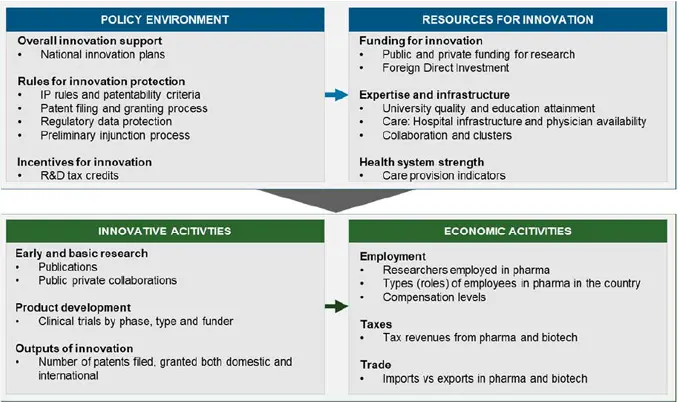

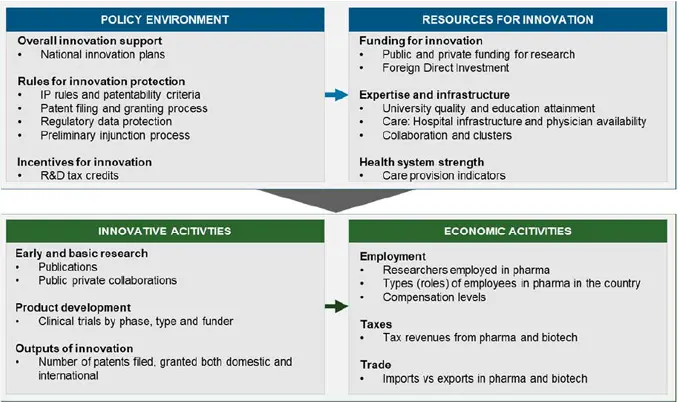

Drawing on this literature we developed an analytical framework that associates the policy environment and the resources in a country to support innovative activity, to metrics of innovative activity, particularly in the biopharmaceutical space, and the wider economy. This is illustrated in Figure 1 below.

Figure 1

The relationship between policy framework

and innovative environment

Source: CRA Analysis

We applied this framework to assess the current policy and resources environment in Argentina as well as the level of innovative and economic activities, with a focus on the pharmaceutical industry, where information for this was available.

3.2. The environment for innovation in Argentina

A number of reports have assessed the relationship between the current IP environment in Argentina and the level of local innovation and performance against indicators of biopharmaceutical activity.31 32 33 34 The most comprehensive review is however over ten years old, in which Thorn (2005) examines the strengths and weaknesses of Argentina’s national innovation system in order to propose policies that will help address these challenges.35 Overall the paper finds that Argentina underinvests in R&D in terms of national spending, but also in terms of private sector involvement in R&D. Collaboration between private companies, universities and government research institutions, which are particularly strong in basic research, is low and there is a lack of R&D personnel with advanced degrees to fill the future demand for researchers. The paper argues that a strong intellectual property rights (IPRs) regime should be in place to complement national policies to provide enterprises with a strong incentive to undertake R&D and commercialise innovations. It further argues that economic growth is to a large extent driven by innovation and that the ability to create knowledge and innovate is essential for gains in productivity and global competitiveness, giving South Korea, Singapore and Taiwan as examples. A more recent assessment of the current innovative environment in Argentina was completed in the Biopharmaceutical Competitiveness Investment Survey (LatAm Special Report) in 2017.36 Argentina is assessed to be amongst the countries less likely to attract foreign investment (through basic research, clinical development, manufacturing or commercialisation efforts), lagging behind Chile, Costa Rica and Mexico, despite having a strong potential due to its local capabilities and available infrastructure, similar to these countries. Key reasons for this are inappropriate leveraging of opportunities for collaborative R&D and technology transfer in biopharmaceuticals, long clinical trial approval delays, red tape and gaps in technical capacity as well as constraints in market access and lack of effective IP protections.

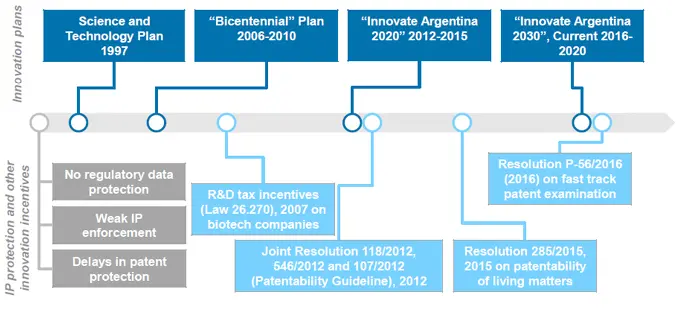

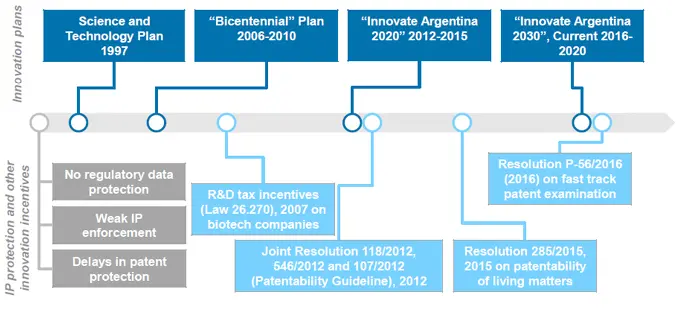

The evolution of innovation

Argentina is characterized by a complex science, technology and innovation system at national government level, which is seen as a potential weakness for the policy environment. Multiple agencies with overlapping responsibilities feed into the Ministry of Education, Science and Technology (Cabinet for Science and Technology, the Federal Council for Science and Technology, and the Interagency Council on Science and Technology).37 38 Despite the complexity, Argentina has historically had a strong focus on innovation. The Argentine government approved the first national multi-year science and technology (S&T) plan in 1997 and since then has shown a strong commitment to encouraging innovation in the country through a series of innovation plans and R&D tax incentives (Figure 2). These aim to expand the scientific and technological capabilities in the country, increase public and private investments in R&D as well as the number of researchers in basic research, to transform Argentina into a knowledge-intensive economy.39 Additionally, Law 26.270 made R&D tax incentives available to biotechnology companies and as of 2007, stipulates that a company may claim further tax relief. The Law also makes available the provision of seed capital and early-stage funding to further incentive R&D.40

Despite these broader innovation policies and the evident prioritisation of the pharmaceutical industry, Argentina shows weaknesses with regards to innovation and as a result has been put on the watch list of countries on the 2017 PhRMA special 301 Submission. The primary drivers of this are a) the lack of Regulatory Data Protection (RDP) for pharmaceuticals,41 b) the weak enforcement of the IP rules by the national agency that has led to a burdensome and lengthy process of seeking preliminary injunction to prevent the sale of an infringing product during a patent litigation, c) the existing backlog of patent applications and d) a series of issued resolutions that implemented restrictive criteria for the patenting of pharmaceutical inventions. The latter include:

Joint Resolutions 118/2012, 546/2012 and 107/2012 (jointly known as “The Guideline on Patentability”) issued in 2012 by the Argentinian government and followed by the Argentinian Patent Office (INPI). The guideline restricts the patentability rules and methodology affecting innovation on existing molecules (e.g. new formulations, combinations, dosage) and the use of existing molecules such as in new indications.42

Resolution 283/2015 passed in 2015, which leads to a more restrictive interpretation and application regarding the prohibition of patentability of every living matter pre-existing in nature (including biologics) set forth in section 6 of the Argentine Patents Law.43

The Argentinian government has taken steps to address some of the current limitations and to improve the current IP framework, particularly relating to the backlog of patent applications. In 2016, the Resolution P-56/2016 (2016), states that patent applications with claims that are the same as for patents granted abroad can be considered through a fast-track process. However, the Guideline on Patentability and the Resolution 2835/2015 take precedence when considering patent applications.

Figure 2

Innovation policies and IP rules in Argentina

Source: CRA Analysis

Updating the assessment of innovative capacity

Compared to other LatAm countries, the total gross domestic expenditure on R&D (GERD) in Argentina, stands at good levels in the region (an average of 0.4% of GDP), representing 0.5% of GDP in 2016(as latest available data) and was only exceeded by Brazil with 1.3% of GDP.44 However, Argentina demonstrates a very high dependence on public R&D funding whereby the levels of private investment in R&D as a percentage of the total were only 21% in 2015, the lowest in LatAm.45 Argentine researchers are underfunded compared to countries in the region in terms of GERD per researcher in 2016, which was only US$55,000 in 2016.46 At the same time, government agencies and public universities accounted for more than two thirds of R&D financing and implementation in 2015.47 Furthermore, the local pharmaceutical industry contributed only 2% of its sales to R&D in 2013.48 In terms of location, R&D spending was heavily concentrated in Buenos Aires (city and region), Córdoba, Río Negro, Santa Fe and Mendoza. CONICET (the National Scientific and Technical Research Council) accounted for 17% of the total R&D spending where R&D activities were conducted.49 In 2016, basic research accounted for 35.9% of R&D activity compared to applied research at 42.7%) and experimental development (21.4%).50As discussed, another source of financial investment in R&D FDI. While data on FDI in the pharmaceutical industry is not publicly available, general FDI inflow in Argentina has been heavily fluctuating in the past 10 years (2010-2017), but overall decreasing from above 2.5% as a percentage of GDP in 2010 to 1.8% in 2017, which is below the average of Brazil, Mexico and Chile of 2.8%.51

Читать дальше