Daniel J. Duffy - Numerical Methods in Computational Finance

Здесь есть возможность читать онлайн «Daniel J. Duffy - Numerical Methods in Computational Finance» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Numerical Methods in Computational Finance

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

Numerical Methods in Computational Finance: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Numerical Methods in Computational Finance»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Part A Mathematical Foundation for One-Factor Problems

Chapters 1 to 7 introduce the mathematical and numerical analysis concepts that are needed to understand the finite difference method and its application to computational finance.

Part B Mathematical Foundation for Two-Factor Problems

Chapters 8 to 13 discuss a number of rigorous mathematical techniques relating to elliptic and parabolic partial differential equations in two space variables. In particular, we develop strategies to preprocess and modify a PDE before we approximate it by the finite difference method, thus avoiding ad-hoc and heuristic tricks.

Part C The Foundations of the Finite Difference Method (FDM)

Chapters 14 to 17 introduce the mathematical background to the finite difference method for initial boundary value problems for parabolic PDEs. It encapsulates all the background information to construct stable and accurate finite difference schemes.

Part D Advanced Finite Difference Schemes for Two-Factor Problems

Chapters 18 to 22 introduce a number of modern finite difference methods to approximate the solution of two factor partial differential equations. This is the only book we know of that discusses these methods in any detail.

Part E Test Cases in Computational Finance

Chapters 23 to 26 are concerned with applications based on previous chapters. We discuss finite difference schemes for a wide range of one-factor and two-factor problems.

This book is suitable as an entry-level introduction as well as a detailed treatment of modern methods as used by industry quants and MSc/MFE students in finance. The topics have applications to numerical analysis, science and engineering.

More on computational finance and the author’s online courses, see www.datasim.nl.

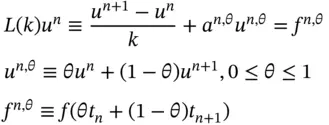

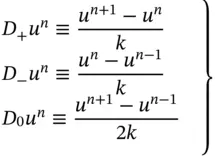

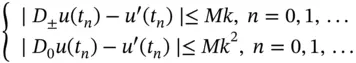

at the mesh point

at the mesh point  ;

;

), we can prove the following:

), we can prove the following:

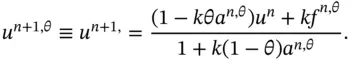

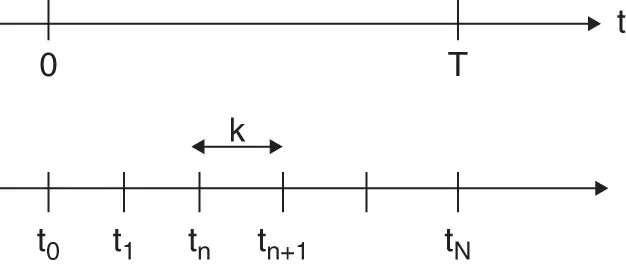

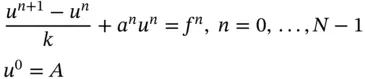

in terms of the solution at time-level

in terms of the solution at time-level  . No information at levels

. No information at levels  ,

,  , or previous levels is needed in order to calculate the solution at level

, or previous levels is needed in order to calculate the solution at level  . A multistep method, on the other hand, is a difference scheme where the solution at level

. A multistep method, on the other hand, is a difference scheme where the solution at level  is determined by values at levels

is determined by values at levels

and possibly previous time levels. Multistep methods are more complicated than one-step methods, and we concentrate solely on the latter methods in this book.

and possibly previous time levels. Multistep methods are more complicated than one-step methods, and we concentrate solely on the latter methods in this book. can be calculated from the information at level

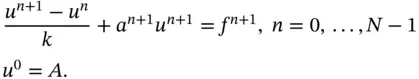

can be calculated from the information at level  directly. No extra arithmetic is needed: for example, using division or matrix inversion. An implicit finite difference scheme is one in which the terms involving the approximate solution at level

directly. No extra arithmetic is needed: for example, using division or matrix inversion. An implicit finite difference scheme is one in which the terms involving the approximate solution at level  are grouped together and only then can the solution at this level be found. Obviously, implicit methods are more difficult to program than explicit methods because we must solve a system of equations at each time step.

are grouped together and only then can the solution at this level be found. Obviously, implicit methods are more difficult to program than explicit methods because we must solve a system of equations at each time step.

can be directly calculated in terms of the solution at level n , while in Equation (2.11)we must rearrange terms in order to calculate the solution at level

can be directly calculated in terms of the solution at level n , while in Equation (2.11)we must rearrange terms in order to calculate the solution at level  .

.

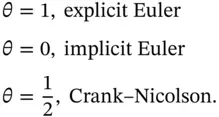

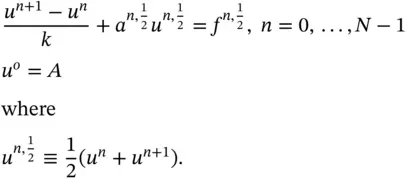

(the scheme is sometimes called the Theta method ):

(the scheme is sometimes called the Theta method ):