Reporting for Small Businesses

Many small businesses are either service or merchandising entities.

A merchandising company buys goods from a manufacturer that are in turn sold to the merchandiser’s customers. This can be wholesale or retail.

For example, say that you went out to buy a new pair of jeans. The clothing store selling the jeans is a retail merchandiser selling to you —the end user or final customer. Looking at this from another angle, maybe the clothing store purchased those jeans from a wholesaler and not directly from the manufacturer.

The wholesaler is a merchandiser, too, because they didn’t make the jeans. Going through the flow, this purchase from the manufacturer is marked up by the wholesaler for sale to the retail shop who further marked them up for sale to you. Suffering from jeans fatigue at this point? Imagine how that pair of traveling jeans feels!

Wholesalers are the middleman between the retail customer and the manufacturer who fabricates the products. Many smaller retailers buy from manufacturer representatives and not directly from the manufacturer. These reps often make sales calls for different companies offering the same or associated product lines.

Wholesalers are the middleman between the retail customer and the manufacturer who fabricates the products. Many smaller retailers buy from manufacturer representatives and not directly from the manufacturer. These reps often make sales calls for different companies offering the same or associated product lines.

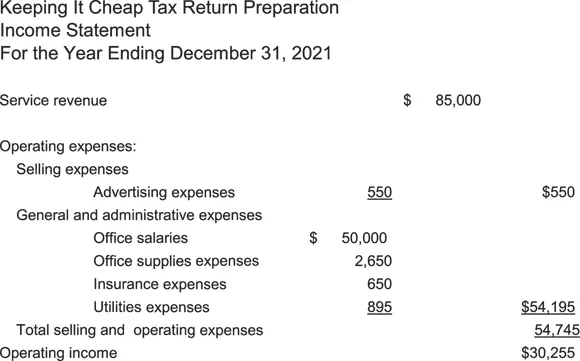

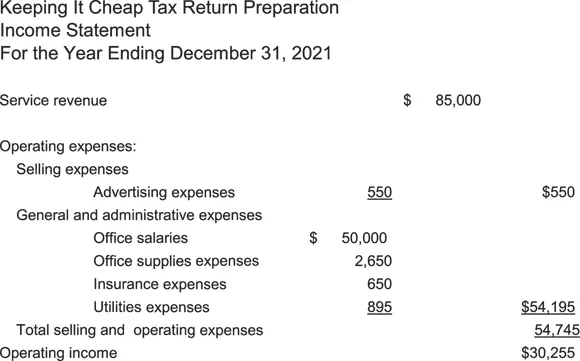

Spotting the difference between the income statement for a service company and a merchandising company is easier if you see both laid out in front of you. Figure 3-1 walks you through a service company income statement. It’s easy-peasy as you just need to report income and general and administrative operating expenses such as payroll, office supplies expense, and insurance expense.

FIGURE 3-1:Service business income statement.

Service business owner Maggie Cheap makes arrangements each year to open a pop-up tax return preparation service from January 31 to April 15. This year, she is operating out of an office-supply store that is not charging her a formal lease payment. She is making a token payment to cover utilities.

The reason behind the lease arrangement is two-fold. Maggie is doing the office-supply tax returns in barter type arrangement; the fair market value of which Maggie includes in her service revenue. Additionally, the office-supply store owner considers the traffic Maggie’s business attracts to his store as a favorable offset to rental income.

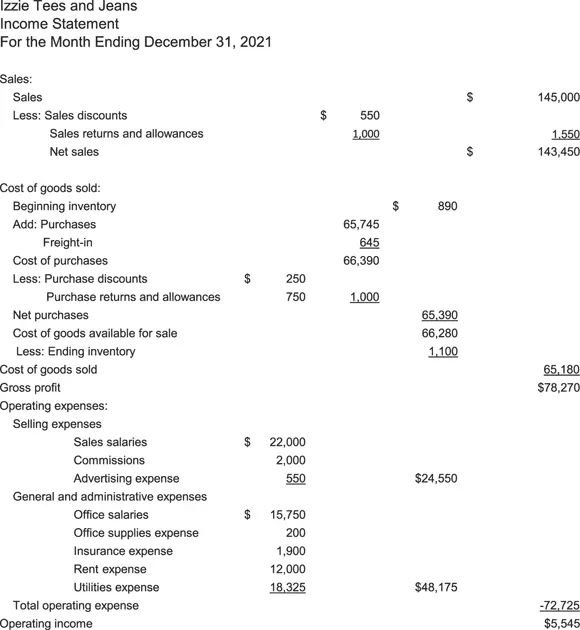

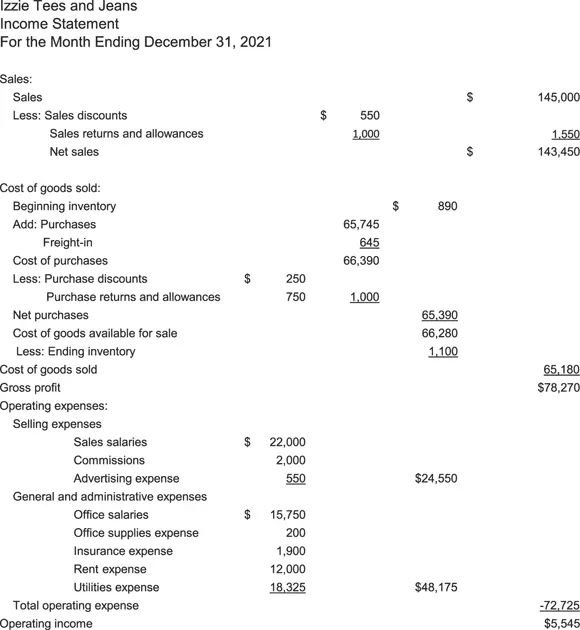

Figure 3-2 tackles the more complex merchandising income statement. Wondering if I completely forgot about manufacturing? I did not! A blown-out income statement for a manufacturing company is the centerpiece of Chapter 10.

Isabella Gabry operates a retail clothing store in downtown Winter Park, Florida. Rollins College is just around the corner from her shop with a built-in market of students looking for jeans and tees.

Chapter 10walks you through most income and expenses shown on this income statement during the manufacturing company discussion. In this chapter, I want to give a quick-and-dirty explanation for a few that may not be intuitive.

Sales discounts and sales returns and allowances: In this example, discounts include markdowns on clothing Izzie wants to move off the racks so that she can put out fresh inventory. The biggest returns and allowances are when a customer changes their mind and returns a purchase.

Cost of goods sold — purchases: This is an important one, which differentiates between service, merchandising, and manufacturing. Izzie matches the cost of jeans and tees purchased from the manufacturer with the jeans and tees sold during the same time (see Chapter 12).

Purchase discounts and purchase returns and allowances: Sometimes, the manufacturer gives Izzie a break on the price of the garments. There are many reasons why this might happen. In this example, Izzie is getting a $250 overstock discount. Purchase returns and allowances generally take place when the retail shop returns garments to the manufacturer that arrived damages, or maybe the wrong items were shipped.

FIGURE 3-2:Merchandising business income statement.

Comparing Figure 3-1 and Figure 3-2, the big difference is that the service business doesn’t have a cost of goods sold, because a service business normally doesn’t sell a tangible product. Makes sense, right?

You are probably a step ahead of me, but a fantastic example of a minor deviation from this would be a hair salon that sells product. While this type of business would have a cost of goods sold associated with the shampoo and conditioner sold to customers, it is still considered a service business because the product sale is subordinate to the income brought by the primary purpose of the salon — that of cutting, coloring, and styling customers’ hair.

In the wonderful world of accounting software programs, the drudgery of manual accounting frees up a small business owner’s time to do some meaningful analysis of revenue and expenses. In Figures 3-1 and 3-2, you can see that the income statement shows financial results for the period it represents; it lets the user know in the short term if a business is making money. More importantly, the relationship between the different accounts on the income statement clues the business owner to areas needing improvement.

For example, looking at the income statement for Keeping It Cheap, salaries are $50,000, and the bottom-line net income is $30,255. While Maggie’s pop-up shop is open for only two and half months (January 31 through April 15), Maggie works at her business year-round.

There is all the prep work before tax season starts. Maggie takes continuing education classes to get up to date on the changes in the tax code. She finds and negotiates the rent on an appropriate location, which may change year-to-year, and sets up an aggressive advertising campaign.

Just because it’s April 16, Maggie’s work is not done. There are always follow up telephone calls with customers about the status of their refund. Or the customer may have gotten a letter from the Internal Revenue Service, which Maggie has to address.

Looking at the $80,255 ($50,000 + $30,255), do you think this is reasonable compensation for working all those long hours during tax return plus the preparation and aftercare? Would your opinion change if you found out that Maggie has an employee to whom $45,000 of the wages was paid, thus reducing the net to Maggie to $35,255 ($80,255 –$45,000)?

Another consideration is how many returns Maggie had to prepare to earn the $80,255. It is easy to reckon you are making money if you have a solid balance in the company checking account. However, you need to see the figures on an income statement to really be able to evaluate how well your service type business is doing.

Moving onto Izzie Tees and Jeans income statement, the No. 1 evaluation is checking cost of goods sold by figuring the gross profit margin , which is cost of goods sold divided by net sales. I know from experience that most retail shops use a keystone approach to pricing goods for sale.

Keystone means the shop applies a 100 percent markup. If you’ve never worked in retail, this is probably confusing. I’ll walk through an example:

Izzie buys 10 pairs of dark blue jeans from the manufacturer for $20/pair or $200 in total. Using a keystone margin, Izzie marks the jeans by the cost of the jeans. The jeans go on the rack for $40 ($20 + $20).

Читать дальше

Wholesalers are the middleman between the retail customer and the manufacturer who fabricates the products. Many smaller retailers buy from manufacturer representatives and not directly from the manufacturer. These reps often make sales calls for different companies offering the same or associated product lines.

Wholesalers are the middleman between the retail customer and the manufacturer who fabricates the products. Many smaller retailers buy from manufacturer representatives and not directly from the manufacturer. These reps often make sales calls for different companies offering the same or associated product lines.