The issue is the $(10,872) February cash shortfall. Looking at the budget, Izzie has to do some planning. One option for conquering the shortfall is being more conservative with January purchases made on account.

To that end, maybe cut down on impulse purchases or not invest in more inventory just because the vendor has markdowns. She could also consider slowing down the payment of accrued expenses or accounts payable (see Part 3) or go to her bank for a short-term loan.

Bank statement reconciliation

Bookkeeping (see Chapter 5) involves recording daily financial transactions in the accounting system, such as entering customer invoices and paying vendor bills. It also involves taking care of routine tasks and calculations, such as doing the bank statement reconciliation, which means you make sure the cash in your personal or business checking account equals the cash you think you have by looking at your checkbook balance.

I know that since many people nowadays rely on online banking services rather than keeping a formal checkbook (I’m also guilty as charged!), they have no idea how to do a bank reconciliation. It’s important to gain this skill, if for no other reason than it will be a financial accounting course homework and test question— and personally, to avoid having to play a game of Bank24 Bingo!

Here’s a little background before I show you how to ace this section of your financial accounting course. Writing checks is an almost daily task that every business must perform. It’s a simple fact that if you own a business, the bills will flow in. What you're really hoping is that payments from your customers will also flow in, but at a greater rate!

If a business doesn’t keep a handle on how much free cash is in the checking account, bouncing a check might happen. Not only is this pretty darn embarrassing, it could be a disaster if a check is for a large amount or written to a valued vendor. Additionally, you’ll probably have to pay a bounced-check bank charge.

What creates the difference between what you might have written in your checkbook and what’s on file with the bank? An easy way to explain this is to remember that until a check or deposit hit your banking system, the bank does not know it exists. Ditto any bank charges, interest, or other debits and credits (see Chapter 5) posted by your bank. Until you get your bank statement, you may not know they exist.

The meaning of a bank debit or credit is different than in financial accounting. On your bank statement a credit is an increase, such as a deposit. And you guessed it, a debit is a decrease such as a bank charge or a cleared check.

The meaning of a bank debit or credit is different than in financial accounting. On your bank statement a credit is an increase, such as a deposit. And you guessed it, a debit is a decrease such as a bank charge or a cleared check.

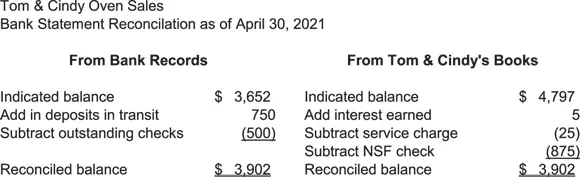

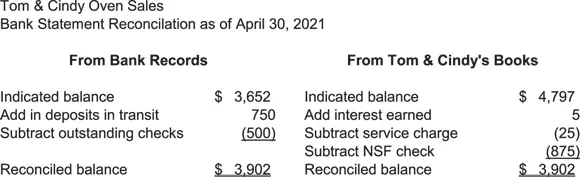

To follow is a typical financial accounting course homework question pertaining to doing an April 30, 2021 bank statement reconciliation for Tom & Cindy Oven Sales:

Tom & Cindy Oven Sales Bank Reconciliation Assumptions:

The balance in the Cash account on April 30, 2021 is $4,797. This is the balance per the checkbook or book.

When you receive the bank statement in May (or access it online), the bank statement shows a balance of $3,652 as of April 31, 2021.

Included with the bank statement are notices the bank deducted a service charge of $25 (bank debit) and added (bank credit) interest for $5 earned on the average daily balance in your account.

One of Tom & Cindy’s customer bounced a check to them in the amount of $875. This transaction is referred to as nonsufficient funds (NSF).

Looking at the deposits on the bank statement, Cindy sees that a deposit for $750 is not showing up. Cindy reckons this is because she made the deposit after the bank cutoff on April 30. This is called a deposit in transit — it’s left your hands, but the bank has yet to record it in your account.

Earlier today, a vendor called asking whether Cindy had issued payment yet. She remembers writing and mailing the check to the vendor. A quick look shows the $500 check is not on the bank statement. Cindy calls the vendor who states it was a mistake. That pesky vendor did receive the check, but just hadn’t gotten around to depositing it yet. This is called an outstanding check — you’ve deducted it from your cash balance, but that news has not yet reached the bank.

Figure 3-4 shows how to prepare the bank statement reconciliation for Tom & Cindy Oven Sales using the preceding assumptions.

Mission accomplished as both the bank and company ending balances are $3,902.

FIGURE 3-4:Bank statement reconciliation.

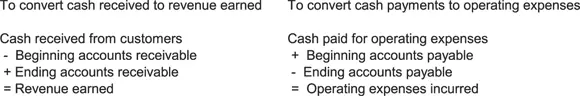

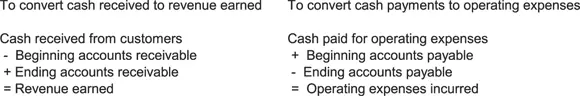

Converting cash accounting to accrual

The last subject in this section of the chapter briefly discusses the underlying factors of the statement of cash flows (see Chapter 11). While concentrating on the accrual method of accounting, your financial accounting course talks about the cash method as well. So, knowing the nuts and bolts of converting cash to accrual revenue and payments will make both the theory and preparation of the statement of cash flows more understandable.

Small business owners will find this helpful as well. You may have just blundered into using a method of accounting without realizing there are two or three if you count the tax method. Or maybe you have a bookkeeper or accountant running your numbers, and they have made the decision for you.

Before I present my handy guide to converting cash to accrual, you may find it helpful to check out Chapter 6, where I expand on cash, accrual, and tax.

Following is a rundown of the cash and accrual methods, with a brief explanation of how the Internal Revenue Code can affect both.

Cash method: Revenue is recorded when it is received, and expenses are recorded when they are paid. The effects of accounts receivable and accounts payable are eliminated.

Accrual method: The opposite of cash, you record all revenue when it is earned and realizable. Expenses are recorded when they are incurred. Accounts receivable and accounts payable are definitely a part of this equation! Costs and expenses are not the same. Financial accounting uses the matching principle (see Chapter 12). The cost of buying something like inventory does not record on the income statement until it can be matched — that is, used to create revenue. Chapter 13give you a good walkabout on the matching principle, too.

Tax: I’m adding this in for you small business owners so that you know what’s going on when your bookkeeper or accountant starts blathering on about GAAP versus tax. In the United States., tax returns are filed using the constraints of Internal Revenue Code.A fantastic example of this at work is entertainment expense. Generally, the cost of taking clients out to dinner is expensed 100 percent, but Internal Revenue Code allows only a 50 percent deduction. That means for a meal costing $75, you are able to deduct only $37.50 on your business tax return.

Ready to go? Figure 3-5 is my handy cash to accrual conversion guide.

FIGURE 3-5:Cash to accrual cheat sheet

Making Figure 3-5 come alive with numbers, in May Tom & Cindy received $5,000 in cash from customers. On May 1, accounts receivable was $1,245. On May 31 accounts receivable was $980. May revenue earned is $4,735 ($5,000 –$1,245 + 980).

Читать дальше

The meaning of a bank debit or credit is different than in financial accounting. On your bank statement a credit is an increase, such as a deposit. And you guessed it, a debit is a decrease such as a bank charge or a cleared check.

The meaning of a bank debit or credit is different than in financial accounting. On your bank statement a credit is an increase, such as a deposit. And you guessed it, a debit is a decrease such as a bank charge or a cleared check.