In my experience, it is very difficult to keystone t-shirts. Generally, their cost from the manufacturer or wholesale doesn’t allows for much retail markup wiggle room. Keeping that fact in mind, let’s figure Izzie’s profit margin to see how close she is coming to the keystone margin.

Net Sales = $143,450, and cost of goods sold = $65,180. Following the formula of cost of goods sold/net sales, Izzie’s profit margin is 45 percent. Izzie also has a sales report detailing sales by category. Based on the volume of jeans versus tees sold Izzie is happy with this profit margin.

Trend analysis (see Chapter 14) is a fantastic tool to use to see whether issues exist in operating expenses. Trend analysis looks at accounting results over more than one financial period or year. In the busy hubbub of running your business, without trend analysis, you may not realize an expense, such as insurance, increases unreasonably one year over the next.

Horizontal and vertical analysis (see Chapter 14) are also valuable tools. Horizontal analysis compares accounts over different periods. For example, you compare 2021 salaries to 2020 salaries to see whether the increase or decrease match your assumptions going into 2021.

Vertical analysis compares all other accounts to sales. This gives management a heads up if an expense appears to be too high when compared to sales.

Normally businesses will apply trend, horizontal, and vertical analysis to all income statement accounts. You can see this at work in Chapter 14. When I am preparing analysis for a client, I apply the same analysis to balance sheet accounts (see Part 3) so that I can isolate and discuss fluctuations in asset and liability accounts.

Normally businesses will apply trend, horizontal, and vertical analysis to all income statement accounts. You can see this at work in Chapter 14. When I am preparing analysis for a client, I apply the same analysis to balance sheet accounts (see Part 3) so that I can isolate and discuss fluctuations in asset and liability accounts.

At this point, you may be thinking, okay what assumptions? How do I know what I should be expecting to see? Enter the budget , which is the result of estimating revenue and expenses now for what you expect future periods to bring.

Preparing a budget can be difficult. It may seem like you are merely looking into the future, guessing at projected revenue and expenses. However, using financial and managerial accounting concepts, considering your overall business climate, and factoring in past performance should produce a workable budget.

Getting into the nitty-gritty of preparing all the different types of budgets is outside the scope of this chapter. However, later in this chapter, in the “ Managing Cash”section, I introduce one type, the cash budget.

The topic of budgeting and preparing budgets is typically in the chapter of your financial accounting textbook that covers cost planning. Managerial Accounting For Dummies (Wiley) by Mark P. Holtzman is also a great resource for those budget-minded accounting students and small business owners!

Every business owner should have a budget that is updated at least once a year. Comparing budgeted figures to actual gives the business owner an early warning that there may be potential problems with the way the business is operating. It also forces you to be attentive to all aspects of your business — not just the ones you enjoy.

Every business owner should have a budget that is updated at least once a year. Comparing budgeted figures to actual gives the business owner an early warning that there may be potential problems with the way the business is operating. It also forces you to be attentive to all aspects of your business — not just the ones you enjoy.

For example, at the end of each quarter, you compare your budgeted figures to actual reporting on the income statement, identifying any potential problem areas. After this review, revenue and expenses appear to be performing on track except for shipping costs — they are 25 percent more than budgeted.

So, you put on your detective hat to try to figure out what is going on. Maybe your budgeted figure was just incorrect to begin with. Could be that you are shipping heavier or larger items than expected. Perhaps your preferred carrier raised their rates. In a larger company, you just might see this is the result of employees using the company’s carrier for personal shipment.

While this is somewhat of a simple illustration, the steps taken to resolve can be modified to address many different budget variations. If you screwed up the budget to begin with, passing along the difference — that is, charging your customer more for shipping would be an option. Ditto for any customers without of the norm shipments based on weight or size.

Many vendors will push the fact that they offer free shipping. All this means is that the cost of shipping is built into the purchase price.

Many vendors will push the fact that they offer free shipping. All this means is that the cost of shipping is built into the purchase price.

If your carrier has increased its rates, maybe it’s time to find a different carrier or figure out whether you can raise the purchase price of your products to cover the shipping rate increase. Finally, dealing with employee theft is a thorny issue. However, it is one best nipped in the bud when discovered as inattention on the part of management can lead to bolder employee misappropriations.

Have you ever been waiting in line behind someone in line at the ATM who is repeatedly running through the cycle of inserting the card, punching on the keypad, and having the machine spit the card back out? In my family, we call the process of progressively asking for less and less money until the customer finally gets to the amount the bank will let them withdraw from their account Bank24 Bingo. Not knowing how much money is in the checking account a person uses to pay their rent, buy food, or put gas in their car is a classic example of less than stellar personal cash management.

Wacky economic events that pop up out of nowhere aside, the most prevalent reason why businesses fail within the first few years is poor cash management. For you jokesters out there — yes, you do need to have sufficient cash to begin with to have something to manage!

In this part of the chapter, you learn how to keep a handle on your company’s sales, accounts receivable, and purchases, which is where the cash budget comes into play. I also discuss how to do a bank reconciliation and how to convert accrual numbers to cash (see Chapter 11).

Your financial accounting course gives you the lowdown on different ways to determine areas of improvement in managing your costs. The biggie is keeping a cash budget. A correct beginning cash balance is a must-have part for the cash budget.

Preparing and using a cash budget is your best friend for identifying potential cash shortfalls. Keep in mind that a cash budget doesn’t exist in a vacuum; it flows from many other sources, such as your balance sheet and operating budget.

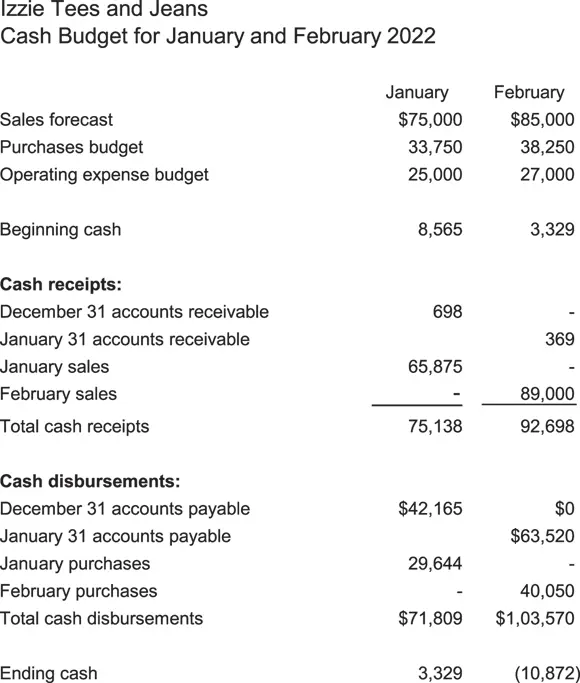

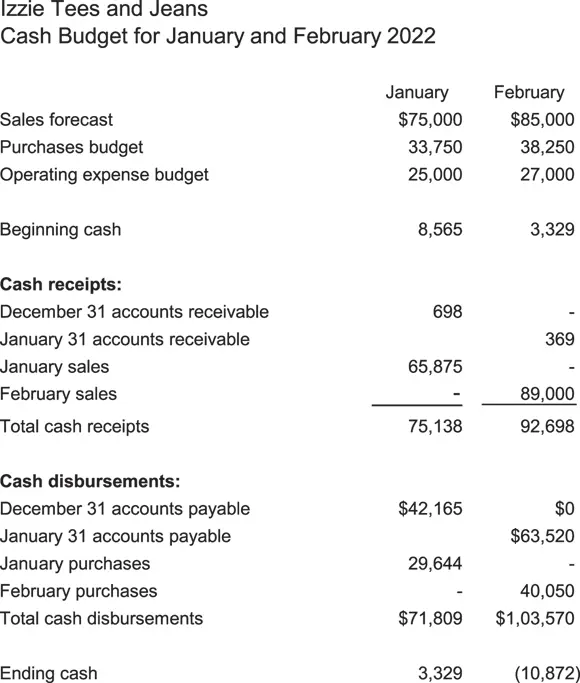

Figure 3-3 is a simple cash budget that Izzie put together for January and February 2022. Depending on the type of retail, fourth quarter, which encompasses the holiday season, usually provides killer revenue.

FIGURE 3-3:Cash budget.

First quarter of the year is usually not all that great sales-wise plus all those pesky returns from holiday gift-giving! So, Izzie wants to make sure that she has enough cash left over from December to cover her expenses in January and February.

Looking at the cash budget, you can see that Izzie’s sales forecast is relatively accurate when smoothed out between the two months. January’s ending cash balance was a squeaker, but her budget shows her still in the green.

Читать дальше

Normally businesses will apply trend, horizontal, and vertical analysis to all income statement accounts. You can see this at work in Chapter 14. When I am preparing analysis for a client, I apply the same analysis to balance sheet accounts (see Part 3) so that I can isolate and discuss fluctuations in asset and liability accounts.

Normally businesses will apply trend, horizontal, and vertical analysis to all income statement accounts. You can see this at work in Chapter 14. When I am preparing analysis for a client, I apply the same analysis to balance sheet accounts (see Part 3) so that I can isolate and discuss fluctuations in asset and liability accounts. Every business owner should have a budget that is updated at least once a year. Comparing budgeted figures to actual gives the business owner an early warning that there may be potential problems with the way the business is operating. It also forces you to be attentive to all aspects of your business — not just the ones you enjoy.

Every business owner should have a budget that is updated at least once a year. Comparing budgeted figures to actual gives the business owner an early warning that there may be potential problems with the way the business is operating. It also forces you to be attentive to all aspects of your business — not just the ones you enjoy.