Operating: This section shows items reflecting on the income statement. The three big differences between the cash and accrual methods (see Chapter 6) will be accounts receivable, which is money owed to the company by its customers; accounts payable, which is money the company owes to its vendors; and inventory, which are goods held by the business for resale to customers.

Investing: This section usually shows the sale and purchase of long-term assets. The purchase of long-term assets reflects on the balance sheet (see Chapter 7). The sale of long-term assets reflects both on the balance sheet and income statement (see Chapter 10): It reflects on the balance sheet as a reduction of the amount of assets the company owns, and on the income statement as a gain or loss from disposing of the asset.

Financing: The financing section shows the cash effects of long-term liability items (paying or securing loans beyond a period of 12 months from the balance sheet date) and equity items (the sale of company stock and payment of dividends).

Seeing a short statement of cash flows

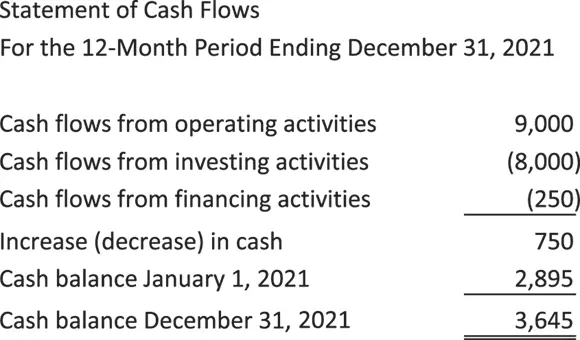

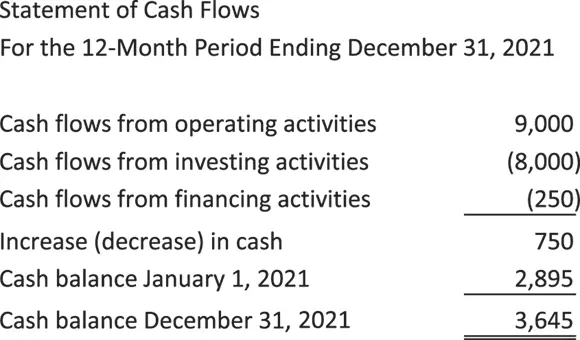

I show you a full-blown statement of cash flows prepared in accordance with generally accepted accounting principles (GAAP — see Chapter 4) in Chapter 11. In Figure 2-3, I give you a very abbreviated version of what a statement of cash flows looks like.

FIGURE 2-3:A very basic statement of cash flows.

There are two different ways to prepare a statement of cash flows: the direct method and the indirect method. I show you how to prepare a statement of cash flows using each method in Chapter 11. For now, here’s what to remember:

There are two different ways to prepare a statement of cash flows: the direct method and the indirect method. I show you how to prepare a statement of cash flows using each method in Chapter 11. For now, here’s what to remember:

The direct method reports cash receipts and disbursements.

The indirect method starts with net income from the income statement and adjusts for noncash items reflecting on the income statement such as depreciation, which is allocating the cost of long-lived assets over their useful life. (See Chapter 12for more info about depreciation.)

Chapter 3

Running the Numbers for Success

IN THIS CHAPTER

Finding out the difference between business entities

Finding out the difference between business entities

Learning about small business reporting

Learning about small business reporting

Managing cash and expenses

Managing cash and expenses

Students approach me every session I teach financial accounting to pick my brains about accounting for a small business. I’ve come to find out that a lot of people have a small gig running on the side to make extra money. Sometimes it’s because they want to completely transition from working for “the man” to self-employment. Other reasons include increasing savings, paying off student debt or planning for a big purchase like a house.

To address this occurrence, in this chapter, you learn the difference between the two most common types of business entities selected by small business owners: sole proprietorships and S corporations. Hint: It’s because both are easy to set up and operate! I also discuss the difference in recording revenue and expenses between the two. To round it all out, I offer a brief introduction to the tax applications of both, which is expanded on in Chapter 18.

There’s more! This chapter provides an overview of how to prepare and analyze financial statement data. You discover the difference between costs and expenses and why the distinction is important. The chapter also provides a walk-through on managing cash and preparing a bank reconciliation, a topic you’ll definitely be tested on in your financial accounting course!

Even if you aren’t interesting in accounting for your own business, this chapter is loaded with information relevant to financial accounting homework and test questions. And since every financial accounting course includes at least one chapter about cost accounting, I also go through the necessary lingo to ace that part of your financial accounting class!

Identifying Accounting Issues and Solutions

Your financial accounting course goes into great detail about classification, interpretation and decision-making. Classification deals with how to properly enter an accounting transaction. Interpretation addresses the assumptions that can be made by viewing that accounting transaction. Decision-making flows from the classification and interpretation.

This chapter discusses how this information is relevant to the internal user of the financial statements, particularly management and owners. It supports the decision to change vendors, add product lines, increase advertising and a myriad number of other forward and backwards actions. The object is usually to increase or maintain steady profits.

If you are hungry for more information about internal users, check out Chapter 6. The flip side of this coin are the external users of the financial statements, a topic covered in Chapter 2. In a nutshell, external users are those not privy to the day-to-day operations of the business.

If you are hungry for more information about internal users, check out Chapter 6. The flip side of this coin are the external users of the financial statements, a topic covered in Chapter 2. In a nutshell, external users are those not privy to the day-to-day operations of the business.

Selecting a Business Entity

In this chapter, I discuss the sole proprietorship and S Corporation, which are the two most popular small business entities. As an owner of the business, how you choose to operate your business directly affects how you classify transactions.

But what about partnerships and regular corporations, as both entities are discussed in your financial accounting course? Chapter 9gives you the scoop on both.

Selecting a type of business entity is not set in stone. If you start out as a sole proprietorship and decide to incorporate, further electing S Corporation status is an easy fix. Some transitions are more difficult. However, this topic isn’t one the average small business owner encounters. As an advanced financial accounting topic, you won’t see it in your basic financial accounting course.

Selecting a type of business entity is not set in stone. If you start out as a sole proprietorship and decide to incorporate, further electing S Corporation status is an easy fix. Some transitions are more difficult. However, this topic isn’t one the average small business owner encounters. As an advanced financial accounting topic, you won’t see it in your basic financial accounting course.

Advantages of the sole proprietorship

A favorite with many of my small business clients, the sole proprietorship is the easiest type of business entity to start and maintain. It also requires the least amount of initial cash outlay. Permitting and licensing issues aside, you are the proud owner of the sole proprietorship the second you make a business purchase or sale.

Small Business For Dummies (Wiley) by Eric Tyson and Jim Schell is a great resource for navigating legal issues, such as securing a business license.

Small Business For Dummies (Wiley) by Eric Tyson and Jim Schell is a great resource for navigating legal issues, such as securing a business license.

Sole proprietorships aren’t required to keep a balance sheet for tax purposes (see Chapter 2), so keeping your accounting books is a snap. This is a plus if you plan to use a spreadsheet program such as Excel to keep track of your sales and costs. Don’t laugh; I still have clients who give me a flash drive with spreadsheet data at year-end for tax return preparation.

Читать дальше

There are two different ways to prepare a statement of cash flows: the direct method and the indirect method. I show you how to prepare a statement of cash flows using each method in Chapter 11. For now, here’s what to remember:

There are two different ways to prepare a statement of cash flows: the direct method and the indirect method. I show you how to prepare a statement of cash flows using each method in Chapter 11. For now, here’s what to remember: Finding out the difference between business entities

Finding out the difference between business entities Selecting a type of business entity is not set in stone. If you start out as a sole proprietorship and decide to incorporate, further electing S Corporation status is an easy fix. Some transitions are more difficult. However, this topic isn’t one the average small business owner encounters. As an advanced financial accounting topic, you won’t see it in your basic financial accounting course.

Selecting a type of business entity is not set in stone. If you start out as a sole proprietorship and decide to incorporate, further electing S Corporation status is an easy fix. Some transitions are more difficult. However, this topic isn’t one the average small business owner encounters. As an advanced financial accounting topic, you won’t see it in your basic financial accounting course.