1 ...8 9 10 12 13 14 ...21 The revenue account shows up on the income statement as sales, gross sales, or gross receipts. All three names mean the same thing: revenue before reporting any deductions from revenue. Deductions from revenue can be sales discounts, which reflect any discount a business gives to a good vendor who pays early, or sales returns and allowances, which reflect all products customers return to the company after the sale is complete.

The cost of goods sold (COGS) reflects all costs directly tied to any product a company makes or sells, whether the company is a merchandiser or a manufacturing company.

If a company is a merchandiser (it buys products from a manufacturer and sells them to the general public), the COGS is figured by calculating how much it cost to buy the items the company holds for resale. Keep in mind that to accurately calculate this amount, you have to understand how to value ending inventory, which is the inventory remaining on the retails shop’s shelves at the end of the financial period, a topic I discuss in Chapter 13.

Because a manufacturer makes products, its COGS consists of raw material costs plus the labor costs directly related to making any products that the manufacturer offers for sale to the merchandiser. COGS also includes factory overhead, which consists of all other costs incurred while making the products.

A service company, such as a physician or attorney, will not have a COGS because it does not sell a tangible product.

A service company, such as a physician or attorney, will not have a COGS because it does not sell a tangible product.

Operating expenses are expenses a company incurs that relate to central operations and aren’t directly tied to COGS. Two key categories of operating expenses show up on the income statement:

Selling expenses: Any expenses a company incurs to sell its goods or services to customers. Some examples are salaries and commissions paid to sales staff; advertising expense; store supplies; and depreciation (see Chapter 12) of a retail shop’s furniture, equipment, and store fixtures. Typical retail shop depreciable items include cash registers, display cases, and clothing racks.

General and administrative (G&A) expenses: All expenses a company incurs to keep up the normal business operations. Some examples are office supplies, officer and office payroll, nonfactory rent and utilities, and accounting and legal services. If, after getting an A in your financial accounting class, you’re so bowled over by the subject that you seek employment as a financial accountant, your payroll is lumped into G&A too.

You classify all other income the company brings in peripherally as other revenue or other income; either description is fine. This category includes interest or dividends paid on investments or any gain realized when the company disposes of an asset. For example, the company purchases new computers and sells the old ones; the amount the company makes from the sale of the old ones is included in this category.

Other expenses are expenses the company incurs that aren’t associated with normal operations. Here are two types of expenses you typically see:

Interest expense: The cost of using borrowed funds for business operations, expansion, and cash flow.

Loss on disposal of a fixed asset: If the company loses money on the sale of an asset, you report the loss in this section of the income statement.

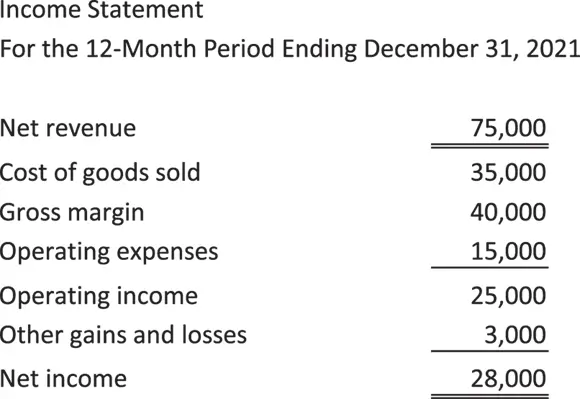

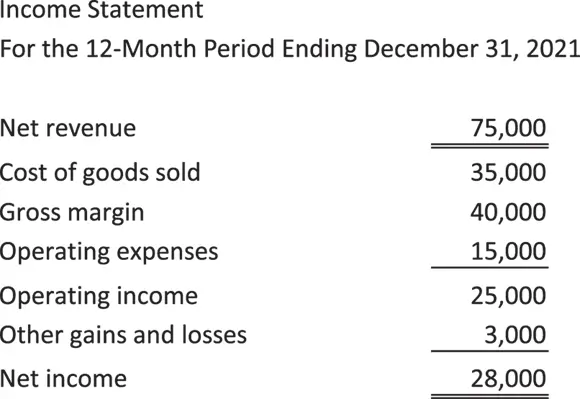

Seeing an example of an income statement

I show you a full-blown income statement prepared in accordance with generally accepted accounting principles (GAAP — see Chapter 4) in Chapter 10. In Figure 2-2, I give you a very abbreviated version of what an income statement looks like.

FIGURE 2-2:A simple income statement.

Showing the Money: The Statement of Cash Flows

This section offers an overview of the statement of cash flows. You prepare the statement of cash flows using certain components of both the income statement and the balance sheet. The purpose of the statement of cash flows is to show cash sources (money coming into the business) and uses (money going out of the business) during a specific period of time. This information is used by investors and potential creditors to gauge whether the business should have sufficient cash flow to pay dividends or repay loans.

The statement of cash flows is very important for financial accounting because generally accepted accounting principles (see Chapter 4) require you to use the accrual method of accounting. This means that you record revenue when it is earned and realizable (regardless of when money changes hands), and you record expenses when they are incurred (regardless of when they are paid). On the flip side, when using the cash method of accounting, a transaction isn’t acknowledged until money changes hands. (A company may use a cash-basis statement for income tax return preparation.)

The statement of cash flows is very important for financial accounting because generally accepted accounting principles (see Chapter 4) require you to use the accrual method of accounting. This means that you record revenue when it is earned and realizable (regardless of when money changes hands), and you record expenses when they are incurred (regardless of when they are paid). On the flip side, when using the cash method of accounting, a transaction isn’t acknowledged until money changes hands. (A company may use a cash-basis statement for income tax return preparation.)

The statement of cash flows gives the financial statement user a basis for understanding how noncash transactions showing up on the balance sheet and income statement affect the amount of cash the company has at its disposal.

Tracking sources and uses of cash

I tell my students that if I could choose only one of the three key financial statements to evaluate a company’s ability to pay dividends and meet fiscal obligations (both of which indicate a healthy business), I would pick the statement of cash flows. That’s because even though the income statement shows eventual sources and uses of cash, the statement of cash flows gives you a better idea of exactly how a business is paying its bills.

Not all cash is created equal. As a general rule, a business presents itself in a more positive position if its costs are being covered by cash it brings in from the day-to-day running of the business rather than from borrowed funds. As a potential investor or lender, I want to see that cash the company brings in through operations exceeds any cash brought in by selling assets or borrowing money. This is because selling assets and borrowing money can never be construed as continuing events the way bringing in cash from selling goods or services can be.

Financial accounting, which is done on the accrual basis (see Chapter 6), does not show the cash ins and outs of business operations. The statement of cash flows gives the user of the financial statements a better idea of cash payments and receipts during the year in two ways:

Financial accounting, which is done on the accrual basis (see Chapter 6), does not show the cash ins and outs of business operations. The statement of cash flows gives the user of the financial statements a better idea of cash payments and receipts during the year in two ways:

By eliminating the effects of accounts receivable and payable

By showing cash brought in by means other than the continuing operations of the business and cash paid out for items outside the scope of continuing operations — for example, for the purchase of fixed assets

Studying sections of the cash flow statement

There are three sections on a statement of cash flows: operating, investing, and financing. Each section addresses cash ins and outs that the business experiences under completely different circumstances:

Читать дальше

A service company, such as a physician or attorney, will not have a COGS because it does not sell a tangible product.

A service company, such as a physician or attorney, will not have a COGS because it does not sell a tangible product.

The statement of cash flows is very important for financial accounting because generally accepted accounting principles (see Chapter 4) require you to use the accrual method of accounting. This means that you record revenue when it is earned and realizable (regardless of when money changes hands), and you record expenses when they are incurred (regardless of when they are paid). On the flip side, when using the cash method of accounting, a transaction isn’t acknowledged until money changes hands. (A company may use a cash-basis statement for income tax return preparation.)

The statement of cash flows is very important for financial accounting because generally accepted accounting principles (see Chapter 4) require you to use the accrual method of accounting. This means that you record revenue when it is earned and realizable (regardless of when money changes hands), and you record expenses when they are incurred (regardless of when they are paid). On the flip side, when using the cash method of accounting, a transaction isn’t acknowledged until money changes hands. (A company may use a cash-basis statement for income tax return preparation.)