I think technical analysts put too much emphasis on volume. (Consider that for every share sold, one is bought. If institutions are selling massive amounts of shares, then other institutions are buying those shares.)

Table 1.7: Heavy versus light breakout day volume.I compared breakout day volume with the prior month.

Table 1.6 Rising (R) versus Falling (F) Volume

|

Bull Market, Up Breakout |

Bear Market, Up Breakout |

| Winner |

Rising (62%) |

Rising (61%) |

| Performance |

44% R, 42% F |

29% R, 27% F |

|

Bull Market, Down Breakout |

Bear Market, Down Breakout |

| Winner |

Falling (56%) |

Tie (50%) |

| Performance |

–15% R, –15% F |

–22% R, –22% F |

Table 1.7 Heavy (H) versus Light (L) Breakout Day Volume

|

Bull Market, Up Breakout |

Bear Market, Up Breakout |

| Winner |

Heavy (79%) |

Heavy (79%) |

| Performance |

43% H, 41% L |

29% H, 26% L |

|

Bull Market, Down Breakout |

Bear Market, Down Breakout |

| Winner |

Heavy (67%) |

Light (55%) |

| Performance |

–15% H, –15% L |

–22% H, –22% L |

Winner, Performance.The table shows that heavy breakout day volume suggests better performance most of the time. For example, I found that 79% of the time after upward breakouts in bear markets, high volume led to better performance by 29% (for heavy volume) versus gains averaging 26% for patterns with light breakout day volume.

You will notice that the percentage difference is not great, especially after downward breakouts (which show ties). Breakout volume is not as good a predictor of performance as many believe.

Table 1.8: Trend change.This table is different from the others. It shows how often price continues rising or falling more than 20% after the breakout. My thinking is that if a chart pattern shows large post‐breakout moves, then it should be easier to make money trading them. Conversely, a pattern that has lots of small moves may be difficult to trade profitably.

Occurrence.Only in bull markets do the majority (55%) of chart pattern types see price rise more than 20%. The worst performance (28%) comes from chart pattern types with downward breakouts in bull markets. That poor performance makes intuitive sense because the market trend is upward but the breakout is downward. It's like swimming against the current, so you'd expect the swimmer to struggle.

Notice that downward breakouts in bear markets place second (49%). It's another indication that trading with the trend (upward breakouts in bull markets and downward breakouts in bear markets) leads to better performance.

Table 1.8 Trend Change

|

Bull Market, Up Breakout |

Bear Market, Up Breakout |

| Occurrence |

55% |

46% |

|

Bull Market, Down Breakout |

Bear Market, Down Breakout |

| Occurrence |

28% |

49% |

Table 1.9 Single Busted Patterns (S) versus Proxy (P)

|

Bull Market, Up Breakout |

Bear Market, Up Breakout |

| Winner |

Single bust (97%) |

Single bust (75%) |

| Performance |

–22% S, –15% P |

–24% S, –22% P |

| Single bust occurrence |

53% |

76% |

|

Bull Market, Down Breakout |

Bear Market, Down Breakout |

| Winner |

Single bust (94%) |

Single bust (79%) |

| Performance |

53% S, 41% P |

40% S, 28% P |

| Single bust occurrence |

70% |

63% |

Table 1.9: Single busted patterns versus proxy.The final table in this chapter shows how well busted patterns perform against non‐busted ones.

Winner.Single busted patterns outperform their non‐busted counterparts a good portion of the time. That's especially true for chart patterns in bull markets. They win more than 90% of the contests. Bear markets also win contests, but at a more sedate pace.

Performance.I compared the performance of single busted patterns with their proxy (P), the non‐busted pattern. In most cases, the performance difference is quite wide.

For example, in bear markets after downward breakouts, single busted patterns with downward breakouts saw price rise an average of 40% above the top of the chart pattern. The non‐busted patterns saw price climb just 28%, on average.

Occurrence.This line tells how often a single busted pattern happens (versus double or more than two busts). The higher the number, the easier it'll be to trade a busted pattern that wins big. That means you are more likely to trade a single busted pattern than a pattern that double or triple+ busts.

Bull markets with upward breakouts show fewer single busts (53%) than the others. I think that's because when the pattern busts, price will be heading lower and that's going against the bullish current. It invites a double bust.

The chapters that follow look at individual chart patterns. I use statistics to help discover how they behave, and I share my findings with you.

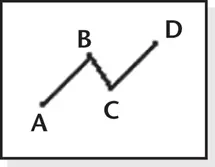

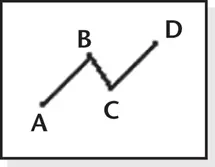

Appearance: A three‐leg zigzag pattern with two turns located by Fibonacci ratios.

|

Bull Market |

Bear Market |

| Performance rank |

5 (worst) out of 5 |

3 out of 5 |

| Breakeven failure rate |

26.3% |

10.2% |

| Average drop |

–12.7% |

–21.6% |

| Volume trend |

Downward |

Downward |

| Point D reversal rate |

32% |

38% |

| How many reach point D? |

95% |

98% |

| See also |

Bearish bat, bearish butterfly, bearish crab, bearish Gartley, measured move up |

You'll need a computer to find this pattern unless you're incredibly fast with a calculator and have lots of time to waste searching for the thing. If you have access to a computer with pattern recognition software, then this pattern is as plentiful as hair on a gorilla. If your software is better than mine or you have special sauce that you can add to the ingredients, then your pattern may behave differently than the ones I studied.

I measured performance of Fibonacci‐based patterns differently than I do other chart pattern types. That's because we're looking for a reversal at the end of the pattern and not an up or down breakout. Therefore, the layout of this chapter is different from most other chapters in this book.

The bearish AB=CD performs in two ways. First, if you know the first three turns (ABC), then you can anticipate at what price the last turn (D) will appear. This works well, with price reaching D nearly all of the time (95% of the time or more). Second, once price reaches D, it's supposed to turn lower. My tests show this doesn't work well (only 32% to 38% of the time). As I mentioned, this could be a flaw with the model I used. Your software may perform differently.

Let's run through the rest of the Results Snapshot for the bull market (you can compare the results with the bear market). I measured the drop from the peak at turn D (the last in the pattern) to the ultimate low. Of the five bearish Fibonacci‐based patterns I studied, this one performs worst in the bull market when price drops just 12.7%. The breakeven failure rate is 26.3%, which is high. That means price fails to drop more than 5% over a quarter of the time. Volume trends downward, but it's close to random.

Читать дальше