Knots and Swing Trading Pullbacks

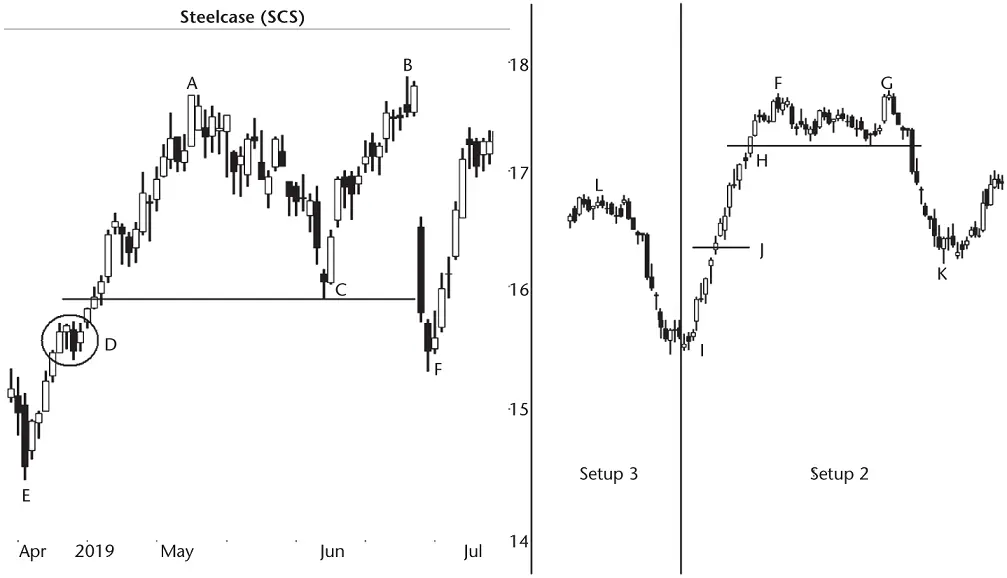

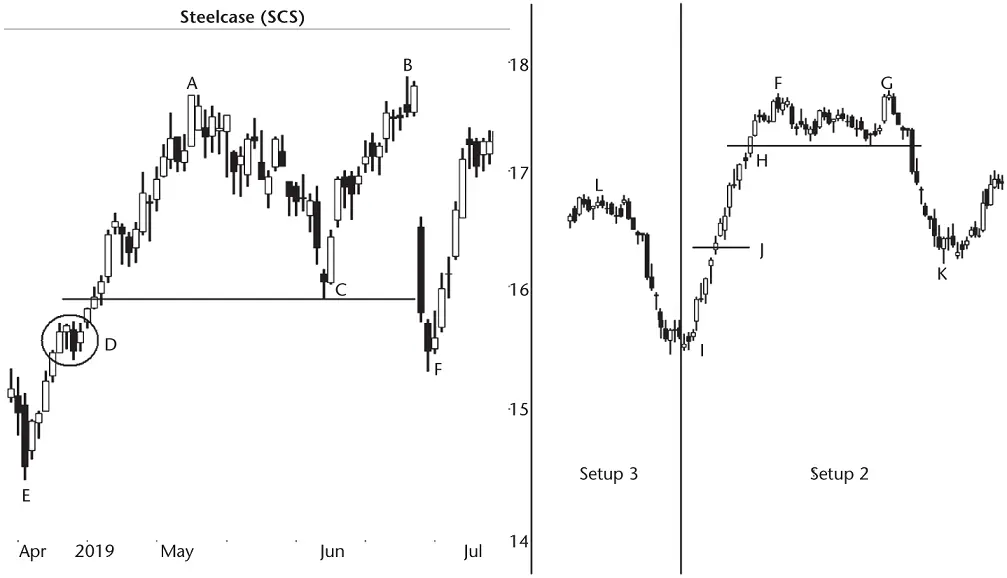

Let's dig in and discuss some swing trading setups. Figure 1.8shows what I call a knot. It's a useful way of detecting when a pullback will start and at what price. It's ideal for swing traders who want to make money when price breaks out downward from a chart pattern in its initial push lower.

Let's look at Steelcase on the left of the figure. A double top forms at AB and confirms at C when price closes below the horizontal line. How low will the stock drop in its initial descent?

Answer: to the knot at D. I define a knot as a place in a strong trend (E to A in this example) where price moves sideways for at least 3 days. When it's the first knot closest to the double bottom (the first location of support, really, below the pattern's breakout), expect the stock to bottom there and begin a pullback.

In this example, knot D is the first support area below C. Price reaches the area at F and begins to pull back to the price of C.

In my experience with knots, I know to place an order to close out the trade at the top of the knot, not the middle or bottom. Sometimes, price touches the top of the knot and reverses. At other times, the stock drops like we see here at F before reversing.

Let's take the case on the far right of the figure (“Setup 2”). In the rise from I to H, there is no knot of support. The uphill move is fast and long.

The way to trade this is to split the move in half and place an order to close out the trade there. In this example, midway up the run from I to H is J. Place an order to cover a short at J. After the double top FG confirms when price closes below H, price drops to K before beginning a pullback.

Figure 1.8 Shown are three ways to trade a pullback.

You don't see this setup often because there is usually a knot along the uphill run from I to H, but it does happen. Take advantage of it and expect the stock to find support midway in the I to H run like it does here at J.

If the run does show a knot but it looks too far below the chart pattern, then split the run in half like I've explained. In technical terms, if support is too far away, then price will reverse closer to the chart pattern. What is closer? Most pullbacks bottom in the 7% to 8% range. If a knot is 10% or 15% away, then that's too far unless there's a fundamental reason to drive price down hard and fast (bad earnings, bad future outlook, that kind of thing).

If the move from I to H is exceptionally long, you might want to split the run into thirds and place a trading order a third of the way down to I from H. Search for other stocks showing the same pattern and see where they turn. The Patternz simulator can make the search easy.

Another setup is similar to Setup 2 except there's support between J and H, but not in the same upward trend. Let's rewind the tape and start at the beginning.

Imagine that the line separating Setup 3 from Setup 2 is missing. We see a strong move higher from I to H. We could take half that move and assume price is going to drop back to that area, just as we did in Setup 2. However, looking to the left of I, we see peak L. It's a mean‐looking knot of support with price going horizontal for a week or two (but need not be that extensive; a simple well‐defined top can do).

Instead of using Setup 2 to place the exit trade midway at J, it's more likely that the stock will drop to the price of L and reverse there. So L is our target. We place a stop a penny above G, place our order to short a penny below the price of H, and use the top of L as the exit.

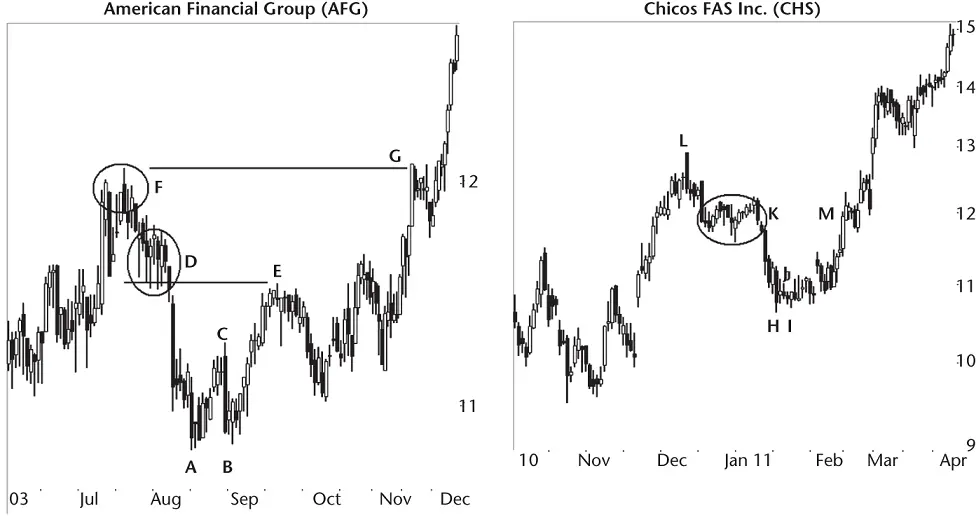

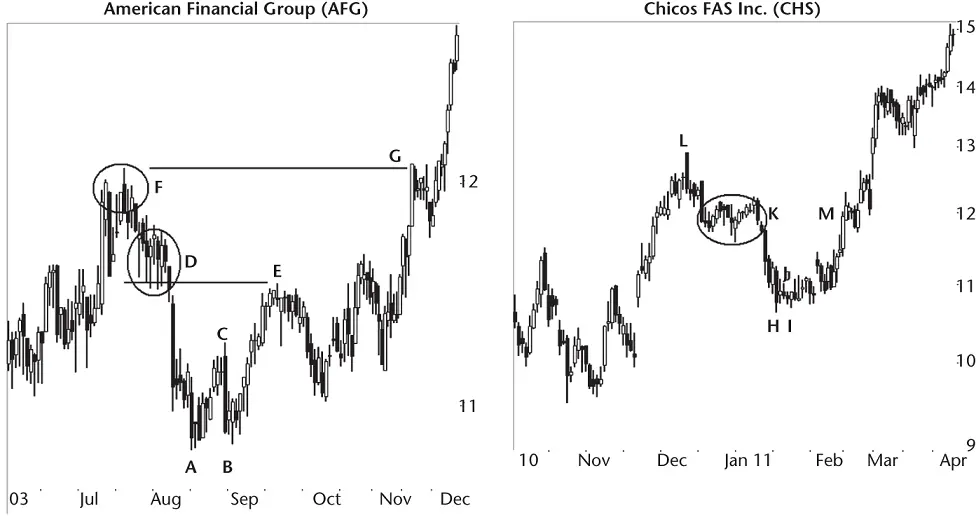

Figure 1.9shows two more scenarios for swing trading the stock. The left panel shows a double bottom at AB, confirmed when price closes above C. As a swing trader, you don't want to wait to buy into this situation, so you place a buy stop a penny above C. That gets you into the trade right on time.

How far will price rise? Answer: to D. That's the first knot. The knot is the closest region to the breakout where price moves horizontally for at least 3 days. That horizontal movement is obvious because it rests in the circle to the left of D.

D is your short‐term swing target. The stock will rise and hit that region and likely turn back to the breakout in a throwback (which it did in this example, after reaching E).

Figure 1.9 Here are two setups that work well for swing trading throwbacks.

You can set a limit order to sell at the top of the knot, but the bottom of the knot works better (less risky). In this case, it did work better when the rise to E triggered the order and sold the position. You don't make a lot of money trading the throwback (7% or 8%), so you might have to increase the position size to make it worthwhile. Do place a stop‐loss order a penny below the lower of the two bottoms (below A in this case).

The prior setup captures the run up to the throwback. What if you want to capture more of an advance? This is a more risky setup, but it also works well. Look for the second higher knot. I show that at F. That's your target.

In this case, the knot is composed of peaks, a ragged top with price spiking upward. Price also moves sideways here for at least 3 days, with lots of overlap, so it's a good area of overhead resistance.

The stock recovers from the throwback and rises to G where it hits resistance setup by the second, higher knot, F. After that, price struggles to push through that resistance but eventually does in this example.

The right half of the figure shows a similar setup. A small double bottom is at HI, confirmed when price closes above J (it's hard to see where that is, though). In this setup, we have a measured move down pattern from L to K (first leg), K is the corrective phase, and KH is the second leg.

We know from studying measured moves that price returns to the corrective phase 77% of the time (see Table 46.5, where 23% remain below the corrective phase and 77% move higher). We know price is going to climb to K. K becomes our target. We use a buy stop a penny above the high at J, a limit order to sell at K, and place a stop a penny below the low at H.

Test these setups in the stocks and markets you trade. Make adjustments accordingly so that they work for your trading style.

Imagine Dave likes to bowl and he plays three games per match. Over a month he competes five times and wins three out of five matches with one tie. If we tally his win/loss record not for the 15 individual games, but for the five matches, we find he wins 75% of the time (three of four contests with one tie). We might conclude that he's a good bowler or those competing against him are not. I built the following tables just like I described with Dave. They show how often an aspect of a chart pattern leads to better or worse performance.

Table 1.1: Reversals versus Continuationsshows the results of the first contest: Which types of patterns perform better, those acting as reversals or continuations? Before I answer that, what is a reversal and a continuation?

A pattern acting as a reversal happens when price enters and exits a chart pattern from different directions (down going into the pattern and exiting out the top, or rising into a pattern and breaking out downward). Patterns acting as continuations see price enter and exit the chart pattern in the same direction (down going into the pattern and breaking out downward, or rising into a pattern and exiting upward).

Читать дальше