1 ...8 9 10 12 13 14 ...37 III

Our first exercise concerns the spatial distribution of investors in urban public debt. Our sample is based on three towns for which an elaborate administration of public debt has been preserved –including the residences of creditors–. The latter information is scarce: towns generally kept a good administration of their public debt, but many usually sufficed with listing the names of their creditors, and the interest they were due. Town accounts of Leiden, Groningen and Nijmegen do provide such information though (map 1).

Leiden was one of the main towns of the county of Holland. It was well known for its textile production, and had a population of c. 10.000-15.000. 29 Leiden stands out as one of the few towns that allows us to investigate the spatial distribution of public debt over a longer period of time. Although the town’s accounts go back to 1390, the first to offer an overview of the residences of creditors is from 1434. By that time the town government had apparently realized that a more thorough recording of public debt was necessary to prevent any errors in annuity payments, which were easily made considering the number of annuities Leiden owed. 30 Apart from the account of 1434, we have sampled accounts from 1449, 1500 and 1548. 31

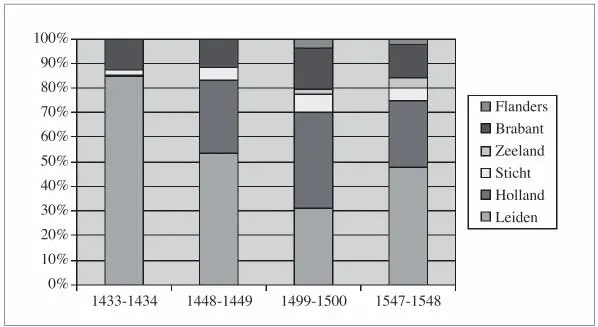

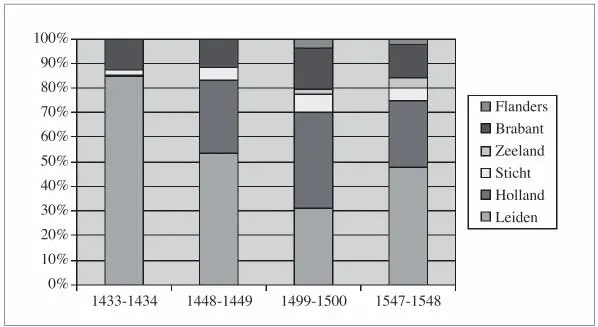

Figure 1 gives the spatial distribution of the town’s public debt. The figure shows that Leiden initially paid out the greatest part of annuities to its inhabitants: in 1434 these were worth no less than 8.541 guilders out of a total of 10.059 guilders (85 %). However, this figure dropped over time, to 54 % in 1449, and 31 % in 1500, when Leiden had come to rely more on funding coming from out of town. By 1548 the proportion of creditors from Leiden had increased again to almost 50 %.

FIGURE 1

Geographic dispersion of creditors of Leiden (15 th -16 th centuries)

Source: J. Zuijderduijn: Medieval capital markets , p. 178.

Several things are worth discussing in depth. Initially the majority of foreign funding came from the Duchy of Brabant, to the Southeast of Holland. In 1434 the value of annuities Leiden was due in Brabant was 1207 guilders (12 %), and this share more or less stayed the same over time, peaking at 18 % in 1500. Foreign funding coming from Brabant is in line with the the prominence of financial markets in the Southern Low Countries. A wealthy area, in Brabant supply of savings was probably much higher than in Holland, and it seems that Leiden had little trouble selling annuities over there. The almost complete absence of creditors from equally wealthy Flanders is a bit puzzling though.

A second thing that stands out is the increasing importance of financial markets outside Leiden, but within the county of Holland. The value of annuities Leiden was due elsewhere in Holland rose from an almost negligable 33 guilders in 1434 to 2528 guilders in 1449. The town entering financial markets elsewhere in Holland went hand in hand with a gradual diversification: in 1449 creditors from Holland lived in main towns Dordrecht, Haarlem, Delft, Amsterdam and Gouda, in The Hague, and also in Noordwijk, a rather large village to the Northwest of Leiden. In 1500 creditors were also to be found in Rotterdam and a number of small towns and villages (map 2). Finally in 1548 the spatial dispersion had again declined, probably due to the fact that Leiden sold fewer annuities in the sixteenth century, due to severe financial problems that resulted in a low credit rating, 32 and also because of the emergence of provincial debt after 1515, causing the representative council ( Staten van Holland ) to start selling annuities on behalf of the towns of Holland. 33

MAP 1

Map of the late-medieval Low Countries

Initially Leiden did not sell many annuities in other provinces of the Northern Low Countries: in 1434 and 1449 the town only owed annuities in the town of Utrecht, in the Nedersticht, located to the East of Holland. Utrecht was the largest town in the Northern Low Countries at the time. In 1500 Leiden had also entered financial markets elsewhere in the Northern Low Countries, having sold annuities in smaller towns and villages in Nedersticht and Oversticht (to the Northeast of Holland). Also, the town owed annuities in Zeeland, to the South. Alltogether the accounts of Leiden suggests that spatial dispersion of public debt increased in the later middle ages: initially most annuities were owed in Leiden, and some in Brabant. Later the share of inhabitants of Leiden decreased, giving way to funding coming from Holland, and eventually also other provinces of the Northern Low Countries. Leiden’s public debt was particularly diversified in 1500 when creditors lived in many towns and villages in Holland and other parts of the Northern Low Countries (see map 2); evidence from other towns in Holland, Haarlem and Gouda, indicates a similarly large spatial dispersion of investors in public debt around 1500. 34

MAP 2

Geographic dispersion of foreign public debt of Leiden (1500)

To get an impression of the integration of capital markets elsewhere in the Northern Low Countries, we have gathered some evidence from two towns, Groningen, in the Northeast, and Nijmegen in the East (map 1). Groningen had about 12.500 inhabitants in the mid-sixteenth-century. Even though its public debt was quite modest compared to that of Leiden, yet it was geographically diversified. In the city accounts the magistrates distinguished annuities they had to pay out in the province of Groningen and outside. For instance, in the account of 1535-1536 the magistrate paid 36 annuities within Groningen and 34 outside. Foreign creditors came from places like Kampen, Hamburg and Cologne and the same goes by and large for the account of 1548 (42 inside and 37 outside). Also, in both years annuities paid outside Groningen were much more valuable than those paid inside. 35

The public debt of Nijmegen, a town of 10.000-12.000 inhabitants in the mid-sixteenth-century, was less spatially diversified: in 1543 the town paid 60 annuities to inhabitants and 16 to foreigners. Once again, foreign annuities were much more valuable than domestic annuities. Creditors lived in Kampen, Cologne, Duisburg and Venlo among others. These two examples indicate that the credit networks of Nijmegen and Groningen may have been less elaborate than those of towns in Holland. Yet, these towns did rely on foreign capital markets, particularly those in the Northwest and West of the German Empire.

IV

The development of the public debt of Leiden, Groningen and Nijmegen suggests that financial markets helped to redistribute money, from savers looking for investment opportunities, to towns looking for foreign funding. They did this on a local, regional, and interregional level. This finding begs the question to what degree late-medieval financial markets contributed to a more or less efficient reallocation of savings. Although difficult to answer, the question of efficiency is crucial for understanding markets, since these are supposed to bring together supply in demand in such a way that prices converge, and «pockets» where prices are either relatively high or low disappear. To get an impression of «efficiency» we will use a dataset based on a large government survey taken in Holland in 1514, inquiring amongst other things into the public debt towns and villages had created.

Читать дальше

![Rafael Gumucio - La edad media [1988-1998]](/books/597614/rafael-gumucio-la-edad-media-1988-1998-thumb.webp)