Heather Smith - Xero For Dummies

Здесь есть возможность читать онлайн «Heather Smith - Xero For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Xero For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:5 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 100

- 1

- 2

- 3

- 4

- 5

Xero For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Xero For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Xero For Dummies,

Xero For Dummies

Xero For Dummies

Xero For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Xero For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Once the first lock date has been set by an Adviser, only users with Adviser status in Xero can edit accounts prior to and inclusive of this date. The Xero Adviser can also change the period lock date if required. Once the second lock date has been set by an Adviser, no user can make changes up to and inclusive of the lock date. The Adviser can change either lock date.

Once the first lock date has been set by an Adviser, only users with Adviser status in Xero can edit accounts prior to and inclusive of this date. The Xero Adviser can also change the period lock date if required. Once the second lock date has been set by an Adviser, no user can make changes up to and inclusive of the lock date. The Adviser can change either lock date.

The final field in the Financial Settings window is the Time Zone field, which you set up during the sign-up process. This should already be populated.

When you’re happy with the details you’ve entered, click the green Save button.

ADDING A SECOND LAYER OF SECURITY

Xero Verify is an authenticator app that offers a second layer of security to protect against hackers accessing your Xero data. Using a protocol known as multi-factor authentication (MFA), Xero Verify sends a push notification to your mobile device when you log into Xero. Tap the pop-up message once to authenticate.

Install the Xero Verify app on your smartphone from your Apple or Android app store, and then log in to Xero with your user name and password. Xero opens to an information page on this security feature. Once ready to proceed, click the button labelled Set Up Multi-factor Authentication. You can choose your authenticator app in the next window (either Xero Verify or another authentication app). Next, click the Use Xero Verify button, open the Xero Verify App on your smart device, allow access to your camera by clicking OK, and scan the QR code that appears on the Xero desktop screen. If you are on an Apple device, confirm that it’s OK to receive push notifications. Complete the setup by clicking the blue Continue button on the desktop screen. In case you cannot access your smart device, add a backup email or security question.

The next time you log into Xero, enter your user name and password as usual. Xero will then send a notification to your phone. If it suits you, check the box beside Skip This Step for 30 Days on the desktop screen before grabbing your phone and clicking yes on the pop-up message from Xero. This step confirms that it’s you trying to access Xero. If the pop-up message goes MIA, Xero Verify generates an authentication code every 30 seconds. Next, open up the Xero Verify app and manually enter the authentication code into the Xero desktop.

The push notification method is faster than an authentication code, but it’s handy to know the backup option.

Understanding Bookkeeping Basics

The single most important part of setting up any accounting system is the chart of accounts — think of it as the backbone of the accounting system, because all transactions are coded through these general ledger accounts. Don’t get confused — a bank account is a type of general ledger account, but not all ‘accounts’ are bank accounts. Getting your head around some bookkeeping basics before you set up your chart of accounts in Xero — so you can get them set up correctly from the start — is a good idea. Of course, if you feel you already have a good grasp of these bookkeeping basics, feel free to skip ahead to ‘ Setting Up Your Chart of Accounts’, later in this chapter.

Setting up your chart of accounts to reflect business operations allows you to easily identify the performance of all areas. Let me give you an example. A customer asked me to review their profit and loss statement. On this statement, they had one single line for income: Consultancy, $2 million. Nice! Underneath the lonely income line were many lines of expenses — and expenses had been broken down to such detail I knew they had spent $300 on office flowers that year. Fortunately, the customer’s invoices were very detailed, so it was an easy exercise of defining different types of income accounts, reallocating them to invoices and — ta da! — the owners now had details of the different income streams generated by the business.

Knowing the different ways the business was making money highlighted which streams were the strongest — for example, the owners could now identify that a steady stream of income was being generated from a support contract with a customer who was guaranteed a 48-hour response time. They promoted this support-style contract to other customers and — you guessed it — a few took them up. This generated additional regular income for the business, with minimal extra effort on their behalf.

Working out how account types affect your reports

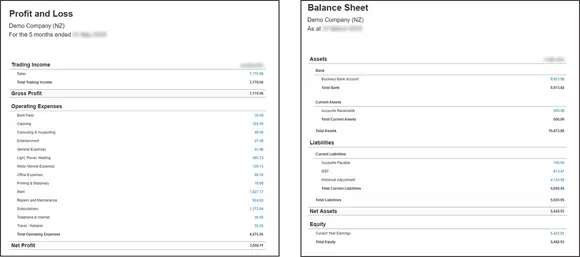

Each element of the chart of accounts, known as a general ledger account , is allocated an account type, and the account type that’s allocated affects how the information is grouped on financial reports. Figure 2-5 shows where the different account types are grouped on two popular reports: The Profit and Loss Statement, and the Balance Sheet.

Source: Xero 2022

FIGURE 2-5:How account types are grouped on your reports.

Depending on how you set up your accounts, not a lot of difference may exist between some of the account types. Fixed Assets and Non-Current Assets, for example, could be deemed the same. Or you could have Fixed Assets defined as representing an asset with a medium life span and Non-Current Assets as an asset with a long life span.

The following sections provide a guide to the different account types. Grab a pad and pencil and, as you read through the lists, jot down how they apply to your own business, decide your interpretation and stay consistent.

Assets

Assets cover the following:

Current Assets: Items owned by the business for fewer than 12 months — for example, accounts receivable, and inventory. If Xero is integrated with an inventory management solution, opt to set up the inventory against a current asset type rather than an inventory-type asset. This gives you more flexibility; for example, it allows you to create a manual journal against the account. Inventory may reflect the value of raw materials, work-in-process goods and completely finished goods.

Inventory: The value of tracked inventory items on hand.

Prepayments: Payments made in advance — for example, rent paid in advance.

Bank Accounts: Accounts held at financial institutions. This includes credit card accounts, which would typically be classified as a current liability; however, in order to activate a bank feed, a credit card account needs to be classified as a bank account in Xero. Using Report Layouts customisation, you can list the credit card account with the Current Liabilities on your balance sheet (see Chapter 9for more on customising your reports).

Fixed Assets: Assets owned by the business for between one and five years — for example, computer equipment.

Non-Current Assets: Owned by the business for over a year — for example, motor vehicles, office equipment, furniture and fittings.

Liabilities

Liabilities cover the following:

Current Liabilities: Monies owed by the business, to be paid back within 12 months — for example, accounts payable.

Liabilities: Monies owed by the business, to be paid back within one to five years — for example, car loans.

Non-Current Liabilities: Monies owed by the business, to be paid back after a year — for example, a mortgage on the building premises.

Equity

Equity covers the net worth of the business to the owner. As seen on the Balance Sheet, this is the assets minus the liabilities.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Xero For Dummies»

Представляем Вашему вниманию похожие книги на «Xero For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Xero For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.