1 ...8 9 10 12 13 14 ...20

Simple Start, Essentials, Plus, and Advanced with Payroll

If an end user signs up for QBO Simple Start, Essentials, Plus, or Advanced on his own and creates his own company, he can create the company using the Self Service Payroll option or the Full Service Payroll option, or later, he can sign up for Payroll from within QBO. An accountant also can create the company that uses Self Service Payroll for a client. For details, see the section “ Addressing Payroll Needs” later in this chapter.

The big question: What’s it cost? The price is dependent primarily on the QBO version you choose and whether you start with a trial.

If you are an end user who signs up on your own for a QBO subscription, foregoing the trial, the price per month as of the date this book was written appears in Table 2-1.

TABLE 2-1QBO Subscription Pricing

| QBO Version |

Regular Price |

Sale Price |

| Self-Employed |

$15/month |

$7.50/month |

| Simple Start |

$25/month |

$12.50/month |

| Essentials |

$40/month |

$20/month |

| Plus |

$70/month |

$35/month |

| Advanced |

$150/month |

$75/month |

The prices shown in Table 2-1are monthly subscription prices, and, at the time we wrote this, the sale price was good for three months. In some cases, when you sign up, you’ll be offered the option to pay for an entire year. And, paying for a full year might turn out to be less expensive than paying on a monthly basis.

The prices shown in Table 2-1are monthly subscription prices, and, at the time we wrote this, the sale price was good for three months. In some cases, when you sign up, you’ll be offered the option to pay for an entire year. And, paying for a full year might turn out to be less expensive than paying on a monthly basis.

At the time we wrote this, Intuit offered Simple Start, Essentials, Plus, and Advanced users the ability to add Self Service Payroll for the sale prices of $22.50/month plus $4/employee/month, Payroll Premium for $40/month plus $8/employee/month, or Payroll Elite for $62.50/month plus $10/employee/month.

At the time we wrote this, Intuit offered Simple Start, Essentials, Plus, and Advanced users the ability to add Self Service Payroll for the sale prices of $22.50/month plus $4/employee/month, Payroll Premium for $40/month plus $8/employee/month, or Payroll Elite for $62.50/month plus $10/employee/month.

Each month, your credit card is automatically charged for your subscription. You can opt for a free 30-day trial that includes payroll processing along with the rest of the subscription’s features. If you opt to continue QBO Payroll after the 30-day trial, your subscription fee increases. You also can use the QBO Payments app for free; it gives you the capability to process online and mobile payments at a rate of, at the time we wrote this book, 2.4 percent for swiped transactions, 2.9 percent for eInvoiced transactions, and 3.4 percent for key-entered transactions. In all cases, there’s also a 25 cent per-transaction fee, and ACH costs 1 percent with a maximum fee of $10. QuickBooks Self-Employed users can enable mobile payments and enjoy free bank transfers and accept electronic payments.

If you opt for a 30-day free trial, you won’t get the sale price for the subscription. If you “buy now” you’re on the hook for at least one month at the sale price. In that event, you can cancel your subscription, but Intuit no longer offers refunds for QuickBooks Online. You can of course always try to plead your case with QBO customer support.

If you opt for a 30-day free trial, you won’t get the sale price for the subscription. If you “buy now” you’re on the hook for at least one month at the sale price. In that event, you can cancel your subscription, but Intuit no longer offers refunds for QuickBooks Online. You can of course always try to plead your case with QBO customer support.

If you are an accounting professional, you can sign up for the Wholesale Pricing program and use QBOA for free. If you create a client’s company as part of the Wholesale Pricing program and you manage the client’s subscription, your credit card is charged automatically for each client subscription. It is your responsibility to bill the client for the QBO subscription. The bill you receive from Intuit is a single consolidated bill for all the QBO subscriptions you manage. For a little more information on the Wholesale Pricing program, see Chapter 11. But, for the complete skinny on the Wholesale Pricing program, contact Intuit. Note that accounting professionals might be able to get QBO for their clients at a reduced price.

If an accounting professional creates a company through QBOA, the company does not come with a 30-day free trial. Instead, at the time the accounting professional creates the company, he must provide a payment method to ensure uninterrupted service.

If an accounting professional creates a company through QBOA, the company does not come with a 30-day free trial. Instead, at the time the accounting professional creates the company, he must provide a payment method to ensure uninterrupted service.

If your client initially sets up QBO with his or her own subscription, you can move that existing QBO subscription to your consolidated bill at the discounted rate. And, if your arrangement with your client doesn’t work out, you can remove the client from your consolidated bill, and the client can begin paying for his own subscription.

QBO can handle payroll regardless of whether an end user or an accountant creates the QBO company.

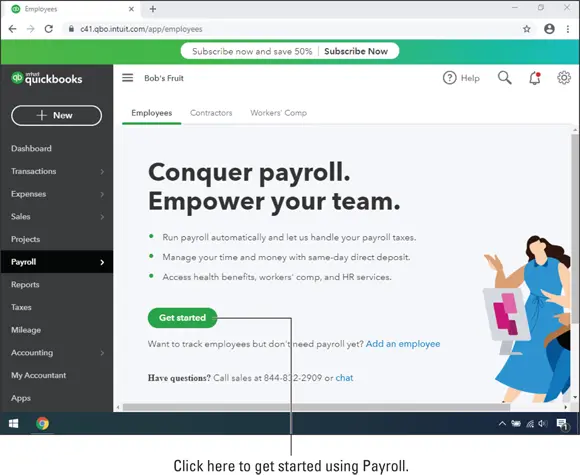

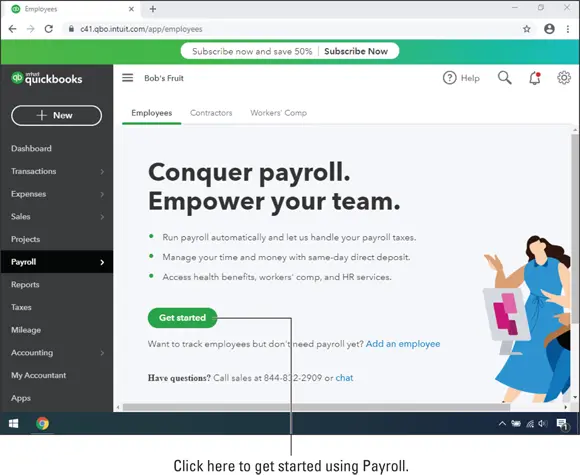

If an end user signs up for QBO Simple Start, Essentials, Plus, or Advanced on his own, he can create his own company using the appropriate “with Payroll” option — Core, Premium, or Elite — or, after the fact, he can sign up for QBO Payroll from the Employees screen (see Figure 2-1).

FIGURE 2-1:If you sign up for QBO on your own, you can turn on Payroll from the Employees screen.

The distinction between the three options, aside from price, is that you choose Self Service Payroll if you want to file payroll forms and pay payroll taxes on your own; for details on preparing payroll in QBO, see Chapter 9. Alternatively, all of the current QBO Payroll plans integrate with QBO, where Intuit pays taxes and files payroll forms for you. For those with an interest in history, Self Service Payroll is the current name for what used to be called Enhanced Payroll. Beginning in February of 2020, all new QBO subscriptions have access to the newest Payroll lineup, Core, Premium, and Elite.

The distinction between the three options, aside from price, is that you choose Self Service Payroll if you want to file payroll forms and pay payroll taxes on your own; for details on preparing payroll in QBO, see Chapter 9. Alternatively, all of the current QBO Payroll plans integrate with QBO, where Intuit pays taxes and files payroll forms for you. For those with an interest in history, Self Service Payroll is the current name for what used to be called Enhanced Payroll. Beginning in February of 2020, all new QBO subscriptions have access to the newest Payroll lineup, Core, Premium, and Elite.

It’s easy to get confused here … we know we were. Intuit also offers another payroll product, Intuit Full Service Payroll, which is a standalone product that doesn’t integrate with QBO.

It’s easy to get confused here … we know we were. Intuit also offers another payroll product, Intuit Full Service Payroll, which is a standalone product that doesn’t integrate with QBO.

All QBO Payroll services sport the following features:

Paying employees with printed checks or by directly depositing paychecks

Automatically calculating tax payments and paying them electronically

Processing federal and state quarterly and annual reports and preparing W-2 forms

Processing payroll for employees working in your company’s state or another state

Keeping payroll tax tables up to date without having to install updates like you do with the QuickBooks Desktop product

Using the QBO Payroll mobile app to pay employees, view past paychecks, electronically pay taxes, and electronically file tax forms

If an accountant who is not enrolled in the Intuit Wholesale Pricing program creates a QBO Essentials, Plus, or Advanced company for a client, the client company can turn on QBO Payroll (QBOP) from the Employees screen in the client’s company (refer to Figure 2-1). Clients can prepare payroll for themselves, or accounting professionals can manage all payroll functions for clients.

Читать дальше

The prices shown in Table 2-1are monthly subscription prices, and, at the time we wrote this, the sale price was good for three months. In some cases, when you sign up, you’ll be offered the option to pay for an entire year. And, paying for a full year might turn out to be less expensive than paying on a monthly basis.

The prices shown in Table 2-1are monthly subscription prices, and, at the time we wrote this, the sale price was good for three months. In some cases, when you sign up, you’ll be offered the option to pay for an entire year. And, paying for a full year might turn out to be less expensive than paying on a monthly basis.