The advantage of rotary hearth is low demand for area.

6.1.2.3.2.3 Shaft Kiln Calciner

In shaft kiln technology, the coke flows by gravity through multiple vertical shafts with flue wall surrounding it. Residence time is longer compared with rotary kiln (24–36 hours for shaft vs. < 1 hour for rotary kilns), resulting in slower heat up time. Shaft kilns have an advantage when processing coke containing high quantity of fines and high VCM.

6.1.2.4. Uses and Economic Aspects

Worldwide annual consumption of industrial carbon was about 25 × 10 6t/a in 1994, excluding metallurgical coke (see Table 6.1.2.5and Figure 6.1.2.10); main products are carbon anodes and carbon black. Two thirds of this margin is calcinate from petroleum coke [6, 7, 27, 28].

Table 6.1.2.5 World Production of Industrial Carbon 1994.

| Carbon products |

Production (t/a) |

Average product value ($/t) |

Market value (10 9$/a) |

| From petroleum coke |

| Carbon anodes |

9 × 10 6 |

700 |

6.3 |

| Söderberg anodes |

4 × 10 6 |

500 |

2.0 |

| Graphite electrodes |

1.1 × 10 6 |

5500 |

6.05 |

| Reduction medium/TiO 2process |

2 × 10 6 |

600 |

1.2 |

| Partly from petroleum coke |

| Carbon cathodes |

6 × 10 5 |

1300 |

0.78 |

| From other products |

| Carbon black |

8 × 10 6 |

1500 |

12 |

| Activated carbons |

5 × 10 5 |

3000 |

1.5 |

| Carbon construction materials |

1 × 10 5 |

800 |

0.8 |

| Electrographite powder |

8 × 10 4 |

1500 |

0.12 |

| Carbon fibers |

6 × 10 4 |

7 × 10 4 |

4.2 |

| Synthetic diamonds |

50 |

15 × 10 6 |

0.75 |

| Total |

∼24 × 10 6 |

|

∼36 |

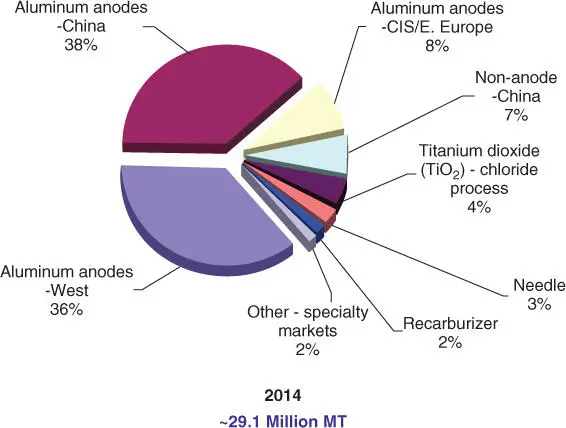

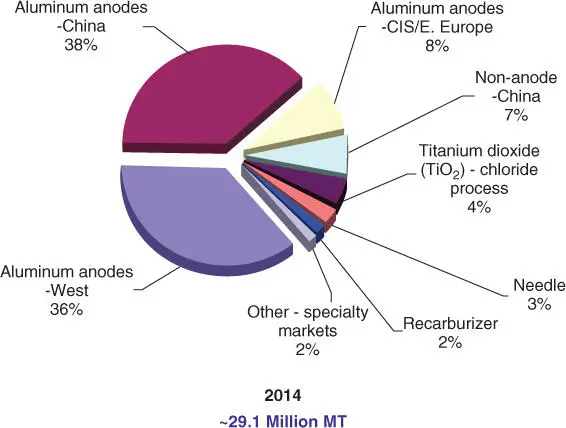

Figure 6.1.2.10 Using of calcined petroleum coke 2014.

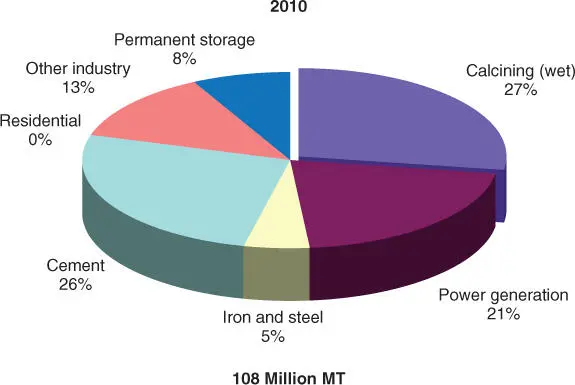

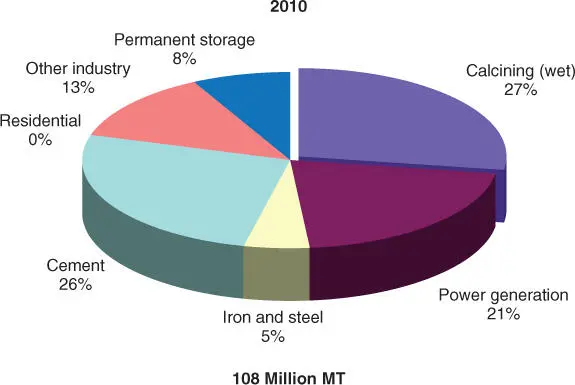

Figure 6.1.2.11 World market profile for petroleum coke 2010.

In 2014, the production of calcined petroleum coke is expected to be 29 × 10 6t/a with 74% about 21.5 × 10 6t/a being used for aluminum anodes.

Figure 6.1.2.11shows the world market profile for petroleum coke in 2010 [6, 7, 29]. The relations are the same as now: more than 70% of petroleum coke is burned as fuel.

6.1.2.4.1 Green Petroleum Coke

More than 70% of the petroleum coke produced is marketed as green coke. This green coke is a cheap fuel used primarily in the cement industry and for power generation. About half of the worldwide produced green coke amount is used for these two utilizations. Normally a mixture of coal and green coke with coal as main component is used, except for the cement industry in Europe, where the green coke dominates.

Due to the use of green coke for cement production, it is of interest to see the application of new quality “green cement” named “Celitement,” which needs only 50% of energy for the cement production [30].

Other green coke utilizations are iron and steel, lime, paper and pulp, and glass production.

Qualities with sulfur content below 1.5% are used as a supplementary substance for hard coke production, if the coal has too high a VCM content. In addition, this green coke is used in the production of carbides too.

There is increasing use of petroleum coke as addition to metallurgical coke [31] primarily used in blast ovens for producing iron.

Green coke is sold worldwide. The biggest transshipment center with some million tons of storage capacity is Rotterdam. For storing green coke it is recommended to spray the surface with water and dust bonding agent (e.g. extract of orange peels that are used in coal mines as well) to avoid dust clouds.

6.1.2.4.2 Calcined Petroleum Coke

6.1.2.4.2.1 Anode‐Grade Coke (Regular Calcinate)

Most calcined petroleum coke is used for production of carbon and Söderberg anodes ( Table 6.1.2.5and Figure 6.1.2.10). Moreover, as aluminum production with Söderberg anodes is declining due to environmental aspects, the requirement will shift more and more to carbon anodes. The coke quality required is called anode‐grade coke or regular calcinate [27].

Worldwide aluminum production was 22.6 × 10 6t in 2004 with a growth up to 52 × 10 6t/a in 2014. 22.5 × 10 6t/a (43%) of the aluminum production capacities in 2014 are located in China. The dominant role held by North America and Western Europe is a thing of the past. 3–5 × 10 6t/a aluminum production is nominated from North America, Western Europe, East Europe, Latin America, Asia, and Middle East. Aluminum production is expected to increase about 9% per year. With an average consumption of about 43 kg regular calcinate per ton of produced aluminum, the worldwide regular calcinate demand in the aluminum industry is approximately 21.5 × 10 6t/a in 2013. This is 74% of the yearly production of calcined petroleum coke.

The recycling rate for aluminum has increased to about 30% [31, 32]. Therefore, the world aluminum consumption is about 70 × 10 6t/a.

The green coke qualities containing relatively low levels of metals like vanadium (typically <200 ppm) and low to moderate levels of sulfur (0.5–2%) are not available in the required amount to make anode‐grade coke. The cause of this is that refineries operate with high sulfur and high metal crudes due to attractive price differential and the demand of anode‐grade coke has increased. Therefore the smelters are increasingly having to adapt to higher sulfur and metal levels [33].

Recent test by companies with “inert” anodes (reduction without carbon) has not been successful due to process economics and aluminum purity [31].

Regular calcinate in the fraction of 0.2–1.0 mm is used for titanium dioxide production. More than 70% of the worldwide TiO 2production is produced using the chloride process. This process needs only about a third compared with the process that is using rutile as reduction medium.

1.2 × 10 6t/a regular calcinate is used for titanium dioxide production. The separation of this fraction improves the regular calcinate quality for anodes as the smaller sized material is removed. Otherwise this fraction has a better price than anode qualities.

3–4% of calcined petroleum coke, which is called needle coke, is used to produce graphite electrodes.

The use of calcined petroleum coke as recarburizer in the steel industry is about 2%.

The rest of the calcined petroleum coke is the basic for other specialty markets (2–7%).

Petroleum coke is also used for the production of graphite electrodes ( Table 6.1.2.5and Figure 6.1.2.10). The quantity employed for this purpose has been stagnant for several years up to 2005. This high‐grade quality calcinate is called needle coke. Although the proportion of electrosteel production in overall steel production is steadily increasing, a series of optimizing steps have continuously reduced the electrode consumption per ton of steel. Whereas in 1985, 7 kg electrode material was needed per ton of steel, modern furnaces can manage with less than 2 kg/t. For this reason the consumption of electrodes worldwide was stagnatedaround 1.100.000 t/a in 2005. By using all process improvements, the needle coke demand has only marginally increased with the growing of electrosteel production. The demand of needle coke in 2014 is 1.5 × 10 6t/a [34–37].

Читать дальше