Iain Pardoe - Applied Regression Modeling

Здесь есть возможность читать онлайн «Iain Pardoe - Applied Regression Modeling» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Applied Regression Modeling

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:5 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

Applied Regression Modeling: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Applied Regression Modeling»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

delivers a concise but comprehensive treatment of the application of statistical regression analysis for those with little or no background in calculus. Accomplished instructor and author Dr. Iain Pardoe has reworked many of the more challenging topics, included learning outcomes and additional end-of-chapter exercises, and added coverage of several brand-new topics including multiple linear regression using matrices.

The methods described in the text are clearly illustrated with multi-format datasets available on the book's supplementary website. In addition to a fulsome explanation of foundational regression techniques, the book introduces modeling extensions that illustrate advanced regression strategies, including model building, logistic regression, Poisson regression, discrete choice models, multilevel models, Bayesian modeling, and time series forecasting. Illustrations, graphs, and computer software output appear throughout the book to assist readers in understanding and retaining the more complex content.

covers a wide variety of topics, like:

Simple linear regression models, including the least squares criterion, how to evaluate model fit, and estimation/prediction Multiple linear regression, including testing regression parameters, checking model assumptions graphically, and testing model assumptions numerically Regression model building, including predictor and response variable transformations, qualitative predictors, and regression pitfalls Three fully described case studies, including one each on home prices, vehicle fuel efficiency, and pharmaceutical patches Perfect for students of any undergraduate statistics course in which regression analysis is a main focus,

also belongs on the bookshelves of non-statistics graduate students, including MBAs, and for students of vocational, professional, and applied courses like data science and machine learning.

and

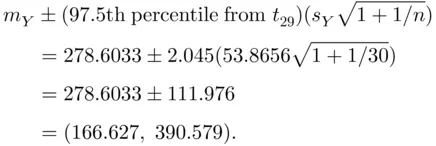

and  .” More precisely, if we were to take a large number of random samples of size 30 from our population of sale prices and calculate a 95% prediction interval for each, then 95% of those prediction intervals would contain the (unknown) sale price for an individual home picked at random from the population.

.” More precisely, if we were to take a large number of random samples of size 30 from our population of sale prices and calculate a 95% prediction interval for each, then 95% of those prediction intervals would contain the (unknown) sale price for an individual home picked at random from the population. ‐value:

‐value: ‐value to be (

‐value to be (  ,

,  ). Then we can say that we are 95% confident that the individual

). Then we can say that we are 95% confident that the individual  ‐value is between

‐value is between  and

and  .

. ,

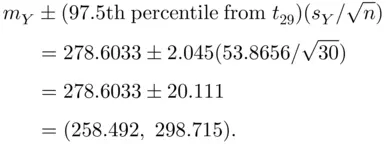

,  , is much wider than the 95% confidence interval for the population mean single‐family home sale price, which was calculated as

, is much wider than the 95% confidence interval for the population mean single‐family home sale price, which was calculated as

‐value. Thus, they have to be calculated by hand using the sample statistics,

‐value. Thus, they have to be calculated by hand using the sample statistics,  and

and  . However, there is a trick that can get around this (although it makes use of simple linear regression, which we cover in Chapter 2). First, create a variable that consists only of the value 1 for all observations. Then, fit a simple linear regression model using this variable as the predictor variable and

. However, there is a trick that can get around this (although it makes use of simple linear regression, which we cover in Chapter 2). First, create a variable that consists only of the value 1 for all observations. Then, fit a simple linear regression model using this variable as the predictor variable and  as the response variable, and restrict the model to fit without an intercept (see computer help #25 in the software information files available from the book website). The estimated regression equation for this model will be a constant value equal to the sample mean of the response variable. Prediction intervals for this model will be the same for each value of the predictor variable (see computer help #30), and will be the same as a prediction interval for an individual

as the response variable, and restrict the model to fit without an intercept (see computer help #25 in the software information files available from the book website). The estimated regression equation for this model will be a constant value equal to the sample mean of the response variable. Prediction intervals for this model will be the same for each value of the predictor variable (see computer help #30), and will be the same as a prediction interval for an individual  ‐value. As further practice, calculate a 90% prediction interval for an individual sale price (see Problem 1.10). Calculate it by hand or using the trick just described. You should find that the interval is (

‐value. As further practice, calculate a 90% prediction interval for an individual sale price (see Problem 1.10). Calculate it by hand or using the trick just described. You should find that the interval is (  ,

,  ).

). ‐values to be normally distributed. However, the formula for a prediction interval for an individual univariate

‐values to be normally distributed. However, the formula for a prediction interval for an individual univariate  ‐value tends to work better for datasets in which the

‐value tends to work better for datasets in which the  ‐values are at least approximately normally distributed—see Problem 1.12.

‐values are at least approximately normally distributed—see Problem 1.12.