John A. Tracy - Accounting For Dummies

Здесь есть возможность читать онлайн «John A. Tracy - Accounting For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Accounting For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

Accounting For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Accounting For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Accounting For Dummies

Accounting For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Accounting For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

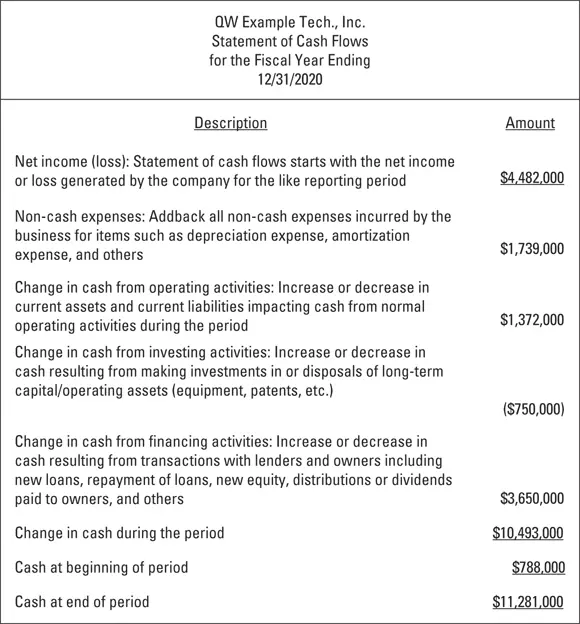

The fourth figure summarizes the company’s investing transactions during the period, or more specifically, what long-term assets the company purchased or invested in.

And finally the fifth figure reports the company’s financing transactions, or more specifically, whether the company raised cash from securing a loan or selling stock or whether the company used cash to repay loans or issue a dividend.

The net increase or decrease in cash from the five types of cash activities during the period is added to or subtracted from the beginning cash balance to get the cash balance at the end of the year.

In the example, the business earned a $4.482 million profit (net income) during the year (see Figure 2-1), which included non-cash expenses of $1.739 million (primarily for depreciation expense) that need to be added back to properly reconcile cash changes during the period. The cash result of its operating activities was to increase its cash by $1.372 million, which you see in the first part of the statement of cash flows (see Figure 2-3). The actual cash inflows from revenues and outflows for expenses run on a different timetable from when the sales revenue and expenses are recorded for determining profit. We give a more comprehensive explanation of the differences between cash flows and sales revenue and expenses in Chapter 8.

The next part of the statement of cash flows sums up the long-term investments the business made during the year, such as constructing a new production plant or replacing machinery and equipment. If the business sold any of its long-term assets, it reports the cash inflows from these divestments in this section of the statement of cash flows. The cash flows of other investment activities (if any) are reported in this part of the statement as well. As you can see in Figure 2-3, the business invested $750,000 in new long-term operating assets (trucks, equipment, tools, and computers).

© John Wiley & Sons, Inc.

FIGURE 2-3:Information components of the statement of cash flows.

The final part of the statement sums up the dealings between the business and its sources of capital during the period — borrowing money from lenders and raising capital from its owners. Cash outflows to pay debt are reported in this section, as are cash distributions from profit paid to the owners of the business. The final part of the example statement shows that the result of these transactions was to increase cash by $3.650 million. (By the way, in this example, the business did make a dividend payment to the shareholders from profit. It probably could have been larger, but it wasn’t — which is an important point that we discuss in the later section “ Why no (or limited) cash distribution from profit?”)

As you see in Figure 2-3, the net result of the five types of cash activities was a $10.493 million increase during the year. The increase is added to the cash balance at the start of the year to get the cash balance at the end of the year, which is $11.281 million. We should make one point clear: The $10.493 cash increase during the year (in this example) is never referred to as a cash flow bottom line or any such thing.

The term bottom line is reserved for the final line of the income statement, which reports net income — the final amount of profit after all expenses are deducted.

The term bottom line is reserved for the final line of the income statement, which reports net income — the final amount of profit after all expenses are deducted.

Statement of cash flows pointers

When I (coauthor John) started in public accounting, the cash flow statement wasn’t required in financial reports. In 1987, the American rulemaking body for financial accounting standards (the Financial Accounting Standards Board) made it a required statement. Relatively speaking, this financial statement hasn’t been around that long — only about 35 years at the time of this writing. How has it gone? Well, in our humble opinion, this financial statement is a disaster for financial report readers.

Statements of cash flows of most businesses are frustratingly difficult to read and far too technical. The average financial report reader understands the income statement and balance sheet. Certain items may be hard to fathom, but overall, the reader can make sense of the information in the two financial statements. In contrast, trying to follow the information in a statement of cash flows — especially the first section of the statement — can be a challenge even for a CPA. (More about this issue is in Chapter 8.)

Imagine you have a highlighter in your hand and the three basic financial statements of a business in front of you. What are the most important numbers to mark? Bottom-line profit (net income) in the income statement is one number you’d mark for sure. Another key number is cash flow from operating activities in the statement of cash flows. You don’t have to understand the technical steps of how the accountant gets this cash flow number, but pay attention to how it compares with the profit number for the period. (We explain this point in more detail in Chapter 11.)

Imagine you have a highlighter in your hand and the three basic financial statements of a business in front of you. What are the most important numbers to mark? Bottom-line profit (net income) in the income statement is one number you’d mark for sure. Another key number is cash flow from operating activities in the statement of cash flows. You don’t have to understand the technical steps of how the accountant gets this cash flow number, but pay attention to how it compares with the profit number for the period. (We explain this point in more detail in Chapter 11.)

Cash flow is almost always different from net income. The sales revenue reported in the income statement does not equal cash collections from customers during the year, and expenses do not equal cash payments during the year. Cash collections from sales minus cash payments for expenses gives cash flow from a company’s profit-making activities; sales revenue minus expenses gives the net income earned for the year. Sorry, mate, but that’s how the cookie crumbles.

Cash flow is almost always different from net income. The sales revenue reported in the income statement does not equal cash collections from customers during the year, and expenses do not equal cash payments during the year. Cash collections from sales minus cash payments for expenses gives cash flow from a company’s profit-making activities; sales revenue minus expenses gives the net income earned for the year. Sorry, mate, but that’s how the cookie crumbles.

A Note about the Statement of Changes in Shareowners’ Equity

Many business financial reports include a fourth financial statement — or at least it’s called a “statement.” It’s really a summary of the changes in the constituent elements of owners’ equity (stockholders’ equity of a corporation). The corporation is one basic type of legal structure that businesses use. In Chapter 5, we explain the alternative legal structures available for conducting business operations. We don’t show a statement of changes in owners’ equity here. We show an example in Chapter 9, in which we explain the preparation of a financial report for release.

When a business has a complex owner’s equity structure, a separate summary of changes in the components of owners’ equity during the period is useful for the owners, the board of directors, and the top-level managers. On the other hand, in some cases, the only changes in owners’ equity during the period were earning profit and distributing part of the cash flow from profit to owners. In this situation, there isn’t much need for a summary of changes in owners’ equity. The financial statement reader can easily find profit in the income statement and cash distributions from profit (if any) in the statement of cash flows. For details, see the later section “ Why no (or limited) cash distribution from profit?”

Gleaning Important Information from Financial Statements

The whole point of reporting financial statements is to provide important information to people who have a financial interest in the business — mainly its investors and lenders. From that information, investors and lenders are able to answer key questions about the financial performance and condition of the business. We discuss a few of these key questions in this section. In Chapters 11, 12, and 20, we discuss a longer list of questions and explain financial statement analysis, including using ratios to evaluate financial results.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Accounting For Dummies»

Представляем Вашему вниманию похожие книги на «Accounting For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Accounting For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.