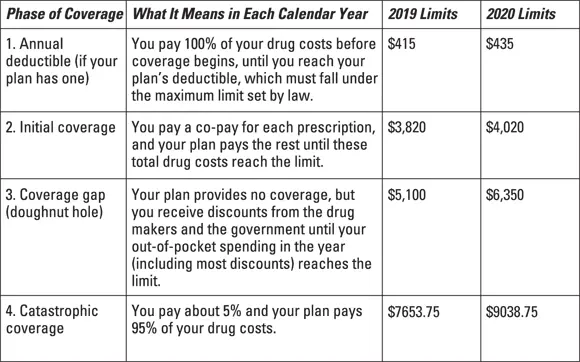

1 ...8 9 10 12 13 14 ...19 Phase 4, catastrophic coverage: If your drug costs are high enough to take you through the gap, coverage kicks in again. At this point, your share of the costs drops sharply. You pay no more than 5 percent of the price of each prescription. Catastrophic coverage ends on December 31. The next day, January 1, you return to Phase 1 (or Phase 2 if your plan has no deductible), and the whole cycle starts over again.

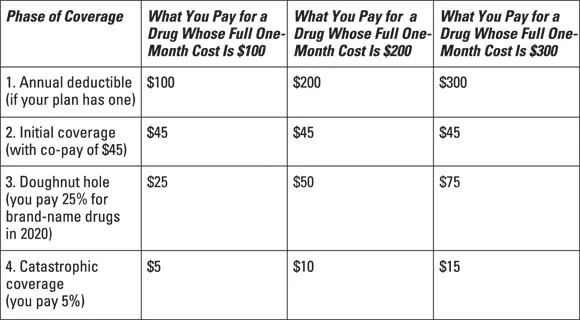

Figure 2-1 is a quick way of looking at the same cycle of coverage.

© John Wiley & Sons, Inc.

FIGURE 2-1:Phases of Part D drug coverage and dollar limits.

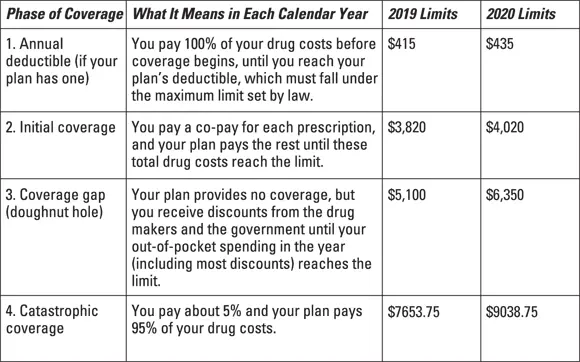

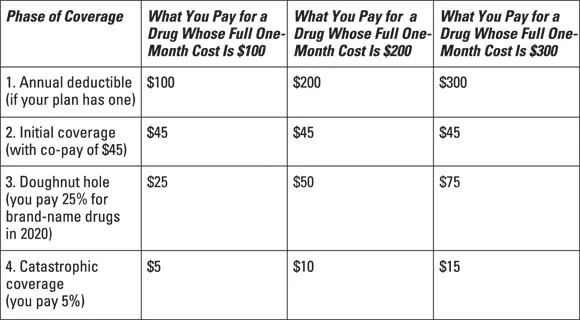

Figure 2-2 shows this information in a different way. Here, you can see examples of brand-name drugs costing (for the sake of simplicity) $100, $200, or $300 per one-month prescription — and what you’d pay for them in each phase of coverage. These examples assume co-pays during the initial coverage period of $45 for each prescription, although co-pays vary widely among Part D plans.

© John Wiley & Sons, Inc.

FIGURE 2-2:Examples of costs through four phases of coverage.

Finding out about formularies

Formulary is jargon that becomes familiar when you’re in Part D because it directly affects what you pay. A formulary is simply the list of drugs that each Part D plan decides to cover. (No national formulary exists.) Here’s why it’s important that your drugs are included on your plan’s formulary:

Formulary is jargon that becomes familiar when you’re in Part D because it directly affects what you pay. A formulary is simply the list of drugs that each Part D plan decides to cover. (No national formulary exists.) Here’s why it’s important that your drugs are included on your plan’s formulary:

You usually have to pay the whole tab for drugs that aren’t covered. Your plan pays its share of the cost during the initial and catastrophic coverage phases (Phases 2 and 4). But for any drug the plan doesn’t cover, you pay full price in all phases of coverage unless you win an exception from the plan. (I explain coverage exceptions in Chapter 14.) The difference in your out-of-pocket expenses between a covered and uncovered drug can be hundreds of dollars a month.

You don’t get doughnut-hole credit for uncovered drugs. If you fall into the doughnut hole (Phase 3), the cost of any drugs not covered by your plan doesn’t count toward the out-of-pocket limit that gets you out of the gap and triggers low-cost catastrophic coverage.

You’re more likely to properly fill and take your medicines. You need the meds you’re prescribed for the sake of your health. If you get coverage for them and don’t have to pay full price, you’re much more likely to fill all your prescriptions and not skip doses.

No Part D plan covers all prescription drugs, and the number covered varies greatly among plans. In 2019, 63 percent of drugs were covered by Medicare Part D plans, according to an analysis by the health research group Avalere Health. So the goal is to choose a plan that covers all, or at least most, of the specific drugs you take. I describe a strategy for doing so in Chapter 10.

In the following sections, I note the drugs that Part D has to cover and the ones that it doesn’t pay for.

Laying out the drugs Part D plans must cover

Although Medicare law doesn’t require Part D plans to cover every drug, it does require each plan to cover at least two drugs in each class of medications. A class means all the similar drugs that are used to treat the same medical condition. Many plans cover more than two in each class. But every plan must cover “all or substantially all” drugs in each of the following six classes:

Anticancer drugs (used to halt or slow the growth of cancers)

Anticonvulsants (used mainly to prevent epileptic seizures)

Antidepressants (used to counteract depression and anxiety disorders)

Antipsychotics (used to treat mental illnesses such as schizophrenia, mania, bipolar disorder, and other delusional conditions)

HIV/AIDS drugs (used to block or slow HIV infection and treat symptoms and side effects)

Immunosuppressants (used to prevent rejection of transplanted organs and tissues and treat immune system disorders and some inflammatory diseases)

Medicare requires every Part D plan to cover pretty much all drugs in these categories because of the clinical problems that can occur when patients abruptly stop taking such medications or switch to others.

Recognizing the drugs Medicare doesn’t pay for

By law, Medicare doesn’t pay for certain kinds of drugs. Part D plans aren’t prohibited from covering them; Medicare just doesn’t reimburse their cost. So although a few plans may cover some of these drugs, most plans don’t cover any. The types of excluded drugs are:

By law, Medicare doesn’t pay for certain kinds of drugs. Part D plans aren’t prohibited from covering them; Medicare just doesn’t reimburse their cost. So although a few plans may cover some of these drugs, most plans don’t cover any. The types of excluded drugs are:

Medicines sold over the counter (not needing a doctor’s prescription)

Drugs used for anorexia, weight loss, or weight gain

Drugs used for cosmetic reasons and hair growth

Drugs used to promote fertility

Drugs used to treat sexual or erectile dysfunction

Medicines used to treat cough or cold symptoms

Prescription vitamins and mineral products

Sometimes Medicare will pay for medications in these categories if they’re used for a “medically acceptable” purpose — for example, cough medicines when prescribed by a doctor to alleviate medical conditions such as asthma, drugs for impotency when prescribed to treat different medical conditions that affect veins and arteries, or antismoking drugs if prescribed by a doctor rather than bought over the counter.

Until 2013, Medicare also excluded barbiturates (used for anxiety and seizures) and benzodiazepines (used for anxiety and sleeping problems) because these drugs are often abused. But the ban has now been lifted wholly on both types of drugs, allowing Part D plans to cover them for any medically accepted indication.

Determining when drugs are covered by Part A, Part B, or Part D

As confusing as it sounds, some medications may be covered not only under Medicare Part D but also under Part A or Part B. Sometimes an identical drug may be covered by all three but charged under one or another according to different circumstances. That’s because certain drugs were covered under A or B before D came into existence, and that practice continued. Here’s the general rule of thumb:

As confusing as it sounds, some medications may be covered not only under Medicare Part D but also under Part A or Part B. Sometimes an identical drug may be covered by all three but charged under one or another according to different circumstances. That’s because certain drugs were covered under A or B before D came into existence, and that practice continued. Here’s the general rule of thumb:

Part A covers drugs administered when you’re a patient in the hospital or a skilled nursing facility.

Part B covers drugs administered in a doctor’s office (such as injected chemotherapy drugs), hospital outpatient departments, and in some circumstances, by a hospice or home health-care professional.

Part D covers outpatient drugs that you administer to yourself, a caregiver administers to you at your home, or you receive if you live in a nursing home. (These drugs are usually pills but also include self-injected insulin for diabetes, for example.)

These general rules are more complicated in some situations. For example, if your organ transplant was covered by Medicare, the immunosuppressant drugs you need afterward are covered by Part B. But if your transplant surgery wasn’t covered by Medicare (perhaps because you had it before joining the program), the drugs are covered under Part D.

Читать дальше

Formulary is jargon that becomes familiar when you’re in Part D because it directly affects what you pay. A formulary is simply the list of drugs that each Part D plan decides to cover. (No national formulary exists.) Here’s why it’s important that your drugs are included on your plan’s formulary:

Formulary is jargon that becomes familiar when you’re in Part D because it directly affects what you pay. A formulary is simply the list of drugs that each Part D plan decides to cover. (No national formulary exists.) Here’s why it’s important that your drugs are included on your plan’s formulary: By law, Medicare doesn’t pay for certain kinds of drugs. Part D plans aren’t prohibited from covering them; Medicare just doesn’t reimburse their cost. So although a few plans may cover some of these drugs, most plans don’t cover any. The types of excluded drugs are:

By law, Medicare doesn’t pay for certain kinds of drugs. Part D plans aren’t prohibited from covering them; Medicare just doesn’t reimburse their cost. So although a few plans may cover some of these drugs, most plans don’t cover any. The types of excluded drugs are: