TABLE 2-2A “Right Way” Sample Trial Balance

| Trial Balance Information |

Debit |

Credit |

| Assets |

|

|

| Checking |

$5,000 |

|

| Fixed assets |

$60,000 |

|

| Accumulated depreciation (fixed assets) |

|

$2,000 |

| Liabilities information |

|

|

| Loan payable |

|

$10,000 |

| Owner’s equity and income statement information |

|

|

| Opening balance equity |

|

$53,000 |

| Totals |

$65,000 |

$65,000 |

The mother of all scavenger hunts

Even after you decide when you want to convert to QuickBooks and come up with a trial balance, you still need to collect a bunch of additional information. I list these items in laundry-list fashion. What you want to do is find all this stuff and then pile it up (neatly) in a big stack next to the computer:

Last year’s federal tax return: QuickBooks asks which federal income tax form you use to file your tax return and also asks about your taxpayer identification number. Last year’s federal tax return is the easiest place to find this stuff.

Copies of all your most recent state and federal payroll tax returns: If you prepare payroll for employees, QuickBooks wants to know about the federal and state payroll tax rates that you pay, as well as some other stuff.

Copies of all the unpaid invoices that your customers (or clients or patients or whatever) owe you as of the conversion date: I guess this is probably obvious, but the total accounts receivable balance shown on your trial balance has to match the total of the unpaid customer invoices.ABOUT THOSE DEBITS AND CREDITSDon’t get freaked out about those debits and credits. You just need to keep them straight for a few minutes. Here’s the scoop: For assets and expenses, a debit balance is the same thing as a positive balance. So a cash debit balance of $5,000 means that you have $5,000 in your account, and $20,000 of cost of goods sold means that you incurred $20,000 of costs-of-goods expense. For assets and expenses, a credit balance is the same thing as a negative balance. So if you have a cash balance of –$5,000, your account is overdrawn by $5,000. In the sample trial balance shown in Table 2-1, the accumulated depreciation shows a credit balance of $2,000 — which is in effect a negative account balance.For liabilities, owner’s equity accounts, and income accounts, things are flip-flopped. A credit balance is the same thing as a positive balance. So an accounts payable credit balance of $2,000 means that you owe your creditors $2,000. A bank loan credit balance of $10,000 means that you owe the bank $10,000. And a sales account credit balance of $60,000 means that you’ve enjoyed $60,000 worth of sales.I know that I keep saying this, but do remember that those income and expense account balances are year-to-date figures. They exist only if the conversion date occurs after the start of the financial year.

Copies of all unpaid bills that you owe your vendors as of the conversion date: Again, this is probably obvious, but the total accounts payable balance shown on your trial balance needs to match the total of the unpaid vendor bills.

A detailed listing of any inventory items you’re holding for resale: This list should include not only inventory item descriptions and quantities, but also the initial purchase prices and the anticipated sales prices. In other words, if you sell porcelain wombats, and you have 1,200 of these beauties in inventory, you need to know exactly what you paid for them.

Copies of the previous year’s W-2 statements, W-4 statements for anybody you hired since the beginning of the previous year, detailed information about any payroll tax liabilities you owe as of the conversion date, and detailed information about the payroll tax deposits you made since the beginning of the year: You need the information shown on these forms to adequately and accurately set up the QuickBooks payroll feature. I don’t want to scare you, but collecting this information is probably the most tedious part of setting up QuickBooks.

If you’re converting retroactively as of the beginning of the year, a list of all the transactions that have occurred since the beginning of the year (sales, purchases, payroll transactions, and everything and anything else): If you do the right-way conversion retroactively, you need to reenter each of these transactions into the new system. You actually enter the information after you complete the QuickBooks Setup process, which I describe later in this chapter, but you might as well get all this information together now, while you’re searching for the rest of the items for this scavenger hunt.

If you take the slightly awkward way, you don’t need to find the last item that I describe in the preceding list. You can just use the year-to-date income and expense numbers from the trial balance.

If you take the slightly awkward way, you don’t need to find the last item that I describe in the preceding list. You can just use the year-to-date income and expense numbers from the trial balance.

Stepping through QuickBooks Setup

After you decide when you want to convert, prepare a trial balance as of the conversion date, and collect the additional raw data that you need, you’re ready to step through QuickBooks Setup. You need to start QuickBooks and then walk through the steps.

To start QuickBooks 2021 in Windows 10, click the QuickBooks 2021 icon on the Windows desktop, or click the Windows Start button and then click the menu choice that leads to QuickBooks. (I choose Start ⇒ All Apps ⇒ QuickBooks ⇒ QuickBooks Enterprise Solutions 21.0.)

QuickBooks comes in several flavors. The most common flavors are

QuickBooks comes in several flavors. The most common flavors are

QuickBooks Pro: The Pro version includes the job-costing and time-estimating features, which I briefly describe in Chapter 16. It also includes the capability to share a QuickBooks file over a network, as I describe in Appendix C.

QuickBooks Premier: The Premier version adds features to QuickBooks Pro and also comes in a variety of industry-specific flavors, including an Accountant edition that mimics most of these other flavors.

QuickBooks Enterprise Solutions: This version is nearly identical to QuickBooks Premier but allows for very large QuickBooks files, including much larger customer, vendor, and employee lists.

I use the Accountant edition of QuickBooks Enterprise Solutions, so some of the figures in this book may differ a wee bit from what you see onscreen. But know this: Aside from minor cosmetic differences, all the various versions of QuickBooks work the same way. You can use this book for any of these program versions.

I use the Accountant edition of QuickBooks Enterprise Solutions, so some of the figures in this book may differ a wee bit from what you see onscreen. But know this: Aside from minor cosmetic differences, all the various versions of QuickBooks work the same way. You can use this book for any of these program versions.

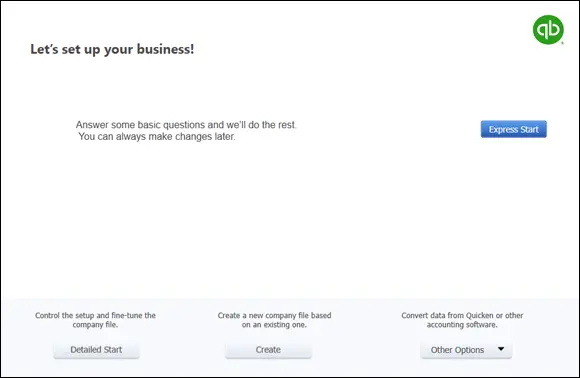

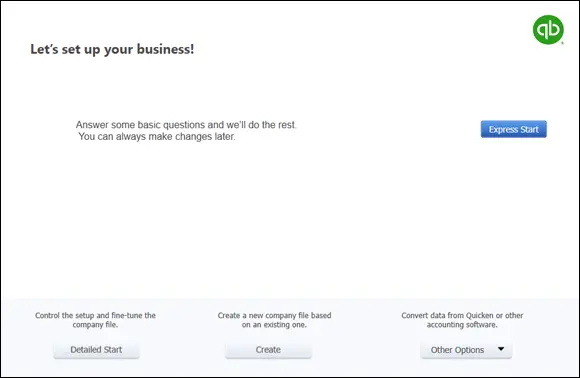

If you’ve started QuickBooks for the first time, QuickBooks tells you how it plans to use your Internet connection to update the QuickBooks software regularly. After you click the button that indicates “Okay, yeah, I’m good with that,” QuickBooks displays the No Company Open dialog box (not shown). Then you click the Create a New Company button so that QuickBooks displays the QuickBooks Setup dialog box with a welcome message (see Figure 2-1).

FIGURE 2-1:The first QuickBooks Setup window.

Читать дальше

If you take the slightly awkward way, you don’t need to find the last item that I describe in the preceding list. You can just use the year-to-date income and expense numbers from the trial balance.

If you take the slightly awkward way, you don’t need to find the last item that I describe in the preceding list. You can just use the year-to-date income and expense numbers from the trial balance. QuickBooks comes in several flavors. The most common flavors are

QuickBooks comes in several flavors. The most common flavors are I use the Accountant edition of QuickBooks Enterprise Solutions, so some of the figures in this book may differ a wee bit from what you see onscreen. But know this: Aside from minor cosmetic differences, all the various versions of QuickBooks work the same way. You can use this book for any of these program versions.

I use the Accountant edition of QuickBooks Enterprise Solutions, so some of the figures in this book may differ a wee bit from what you see onscreen. But know this: Aside from minor cosmetic differences, all the various versions of QuickBooks work the same way. You can use this book for any of these program versions.