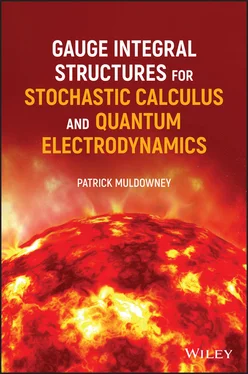

Patrick Muldowney - Gauge Integral Structures for Stochastic Calculus and Quantum Electrodynamics

Здесь есть возможность читать онлайн «Patrick Muldowney - Gauge Integral Structures for Stochastic Calculus and Quantum Electrodynamics» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Gauge Integral Structures for Stochastic Calculus and Quantum Electrodynamics

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

Gauge Integral Structures for Stochastic Calculus and Quantum Electrodynamics: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Gauge Integral Structures for Stochastic Calculus and Quantum Electrodynamics»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

, left off,

introduces readers to particular problems of integration in the probability-like theory of quantum mechanics. Written as a motivational explanation of the key points of the underlying mathematical theory, and including ample illustrations of the calculus, this book relies heavily on the mathematical theory set out in the author’s previous work. That said, this work stands alone and does not require a reading of

in order to be understandable.

Gauge Integral Structures for Stochastic Calculus and Quantum Electrodynamics Stochastic calculus, including discussions of random variation, integration and probability, and stochastic processes. Field theory, including discussions of gauges for product spaces and quantum electrodynamics. Robust and thorough appendices, examples, illustrations, and introductions for each of the concepts discussed within. An introduction to basic gauge integral theory. The methods employed in this book show, for instance, that it is no longer necessary to resort to unreliable «Black Box» theory in financial calculus; that full mathematical rigor can now be combined with clarity and simplicity. Perfect for students and academics with even a passing interest in the application of the gauge integral technique pioneered by R. Henstock and J. Kurzweil,

is an illuminating and insightful exploration of the complex mathematical topics contained within.

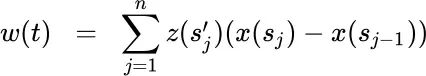

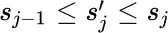

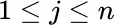

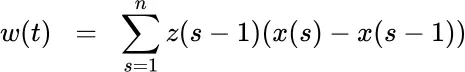

for

for  .

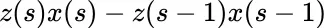

. , not the

, not the  of ( 2.12). The logic of Example 5indicates that only the left hand value

of ( 2.12). The logic of Example 5indicates that only the left hand value  is permitted in the Riemann sum estimates of the stochastic integral

is permitted in the Riemann sum estimates of the stochastic integral  . Why is this?

. Why is this?

is used, but not

is used, but not  or any value intermediate between

or any value intermediate between  and

and  .

. the investor makes a policy decision to purchase a quantity

the investor makes a policy decision to purchase a quantity  of shares whose value from time

of shares whose value from time  up to (but not including) time

up to (but not including) time  is

is  . This number of shares (the portfolio ) is retained up to time

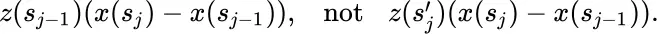

. This number of shares (the portfolio ) is retained up to time  . At that instant of time

. At that instant of time  the decision cycle is repeated, and the investor adjusts the portfolio by taking a position of holding

the decision cycle is repeated, and the investor adjusts the portfolio by taking a position of holding  number of shares, each of which has the new value

number of shares, each of which has the new value  .

. to

to  , the gain in value of the portfolio level chosen at time

, the gain in value of the portfolio level chosen at time  is

is

, since the portfolio quantity

, since the portfolio quantity  operates in the time period

operates in the time period  to

to  (not

(not  to

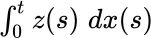

to  ). Reverting to continuous form, this translates to Riemann sum terms of the form

). Reverting to continuous form, this translates to Riemann sum terms of the form

(along with the linked probability measure

(along with the linked probability measure  and family

and family  of measurable subsets of

of measurable subsets of  ). The set of numbers

). The set of numbers