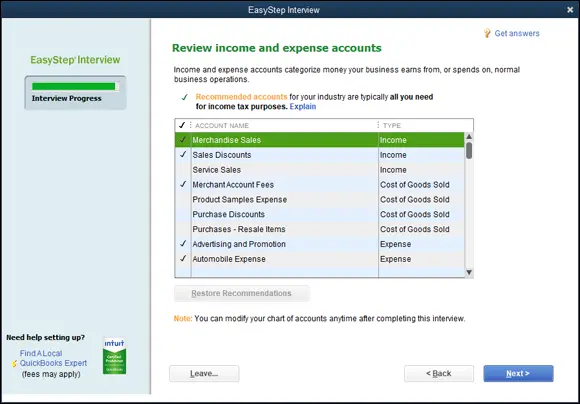

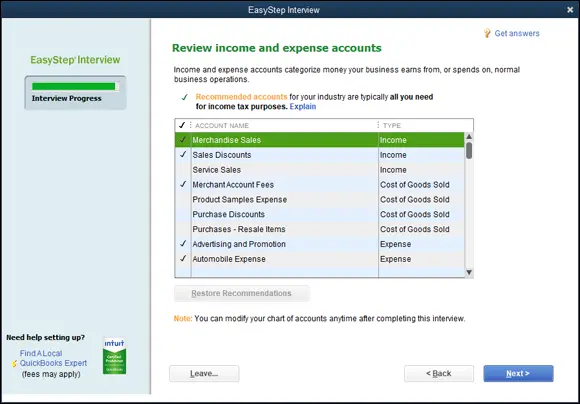

FIGURE 1-5:The EasyStep Interview screen shows you its recommended income and expense accounts.

The accounts that QuickBooks marks with a check, as the screen explains, are the recommended accounts. If you don’t do anything else, these checked accounts are the ones you’ll use (at least to start) within QuickBooks. You can remove a suggested account by clicking the check mark. QuickBooks removes the check mark, which means that the account won’t be part of the final chart of accounts. You can also click an account to add a check mark and have the account included in the starting chart of accounts.

You can click the Restore Recommendations button at the bottom of the list to return to the initial recommended chart of accounts (if you made changes that you later decide you don’t want).

You can click the Restore Recommendations button at the bottom of the list to return to the initial recommended chart of accounts (if you made changes that you later decide you don’t want).

When the suggested chart of accounts looks okay to you, click Next. It’s fine to accept what QuickBooks suggests because you can change the chart of accounts later.

Adding your information to the company file

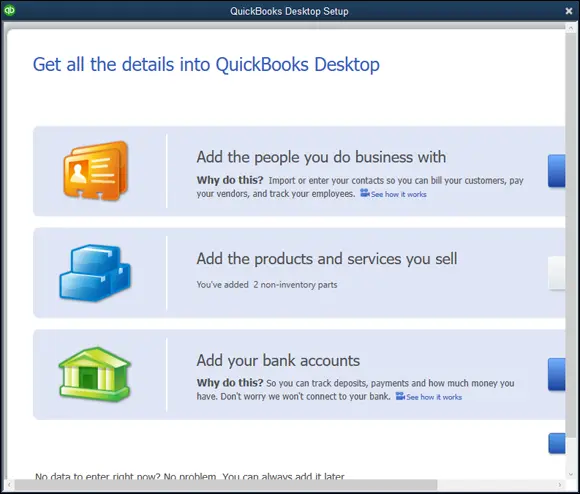

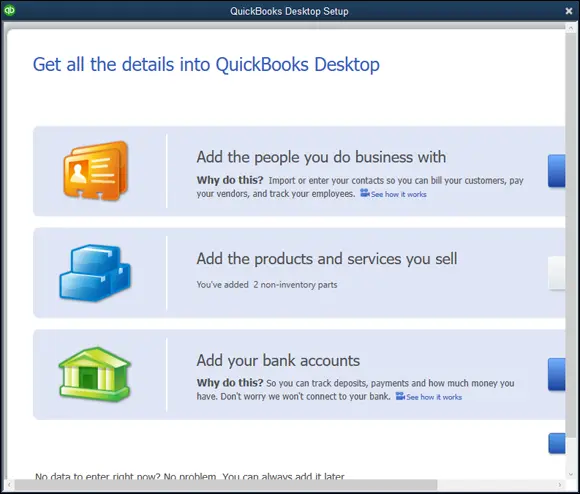

After you and QuickBooks set up the company file, QuickBooks prompts you to enter your own information in the company file (see Figure 1-6).

FIGURE 1-6:The QuickBooks Setup screen that prompts you to enter your own information in the company file.

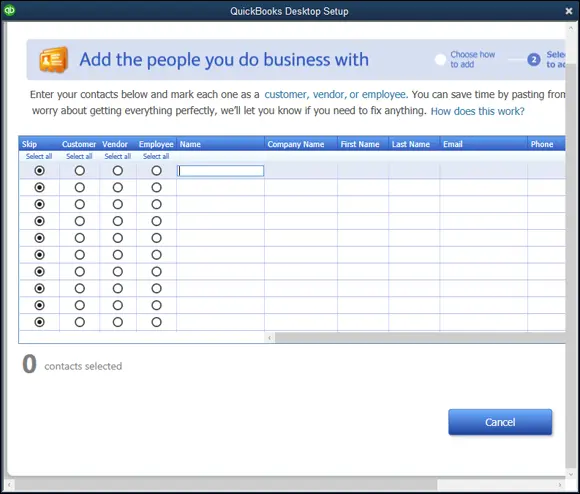

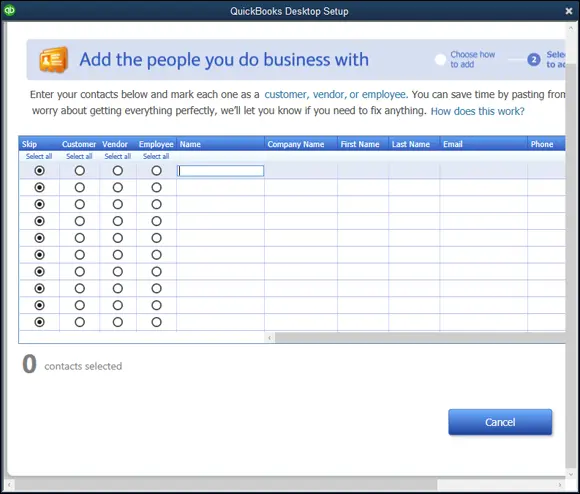

Customers, vendors, and employees

To describe customers, vendors, and employees, click the first Add button. QuickBooks asks whether it’s possible to get this data from someplace else, such as an email program or email service (Outlook, Gmail, and so forth), or whether you want to enter the information into a worksheet manually. You’re probably going to enter the information manually, so click the appropriate button and then click Continue. When QuickBooks displays a worksheet window (see Figure 1-7), enter each customer, vendor, or employee in its own row, and be sure to include both the name and address information. Click Continue (not shown in Figure 1-7) when you finish. Then QuickBooks asks (using a screen I don’t show here) whether you want to enter opening balances — amounts you owe or are owed — for customers and vendors. Indicate that you do by clicking the Enter Opening Balances link and then enter the opening balances in the screen that QuickBooks provides.

FIGURE 1-7:The QuickBooks Setup screen that collects information about the people you do business with.

Services and inventory items you sell

To describe the stuff you sell, click the second Add button in the second box shown in Figure 1-6. QuickBooks asks about the stuff you sell — whether you sell services, whether you sell inventory items, and whether you want to track any such inventory items you sell, for example. Answer these questions by clicking the option button that conforms to your situation and then click Continue. When QuickBooks displays a worksheet window (not shown), describe each item you sell on a separate worksheet row. Also be sure to describe any inventory items you’re holding at the time you convert to QuickBooks. Click Continue when you finish. If you sell more than one type of item, you need to repeat this process for each type of item.

To describe your business bank account (or bank accounts), click the Add button in the third box shown in Figure 1-6. When QuickBooks displays the Add Your Bank Accounts worksheet window (not shown), provide each bank account’s name, account number, and balance on the conversion date. When you finish entering this information, click Continue.

Identifying the Starting Trial Balance

Whether you use the default Start version or the Detailed Start/EasyStep Interview version of the QuickBooks Setup process, you don’t get a complete trial balance in the QuickBooks company file simply by setting up. Assuming that you follow the instructions and tips provided in the preceding paragraphs, you get only your bank account, accounts receivable, inventory, and accounts payable balances in QuickBooks. Yet you need to enter all the missing trial balance information in QuickBooks, too, to begin getting good reports out of QuickBooks and to use the software for supplying financial data to your tax returns. I end this chapter by talking about how you get the rest of the trial balance data into the QuickBooks company file.

A simple example to start

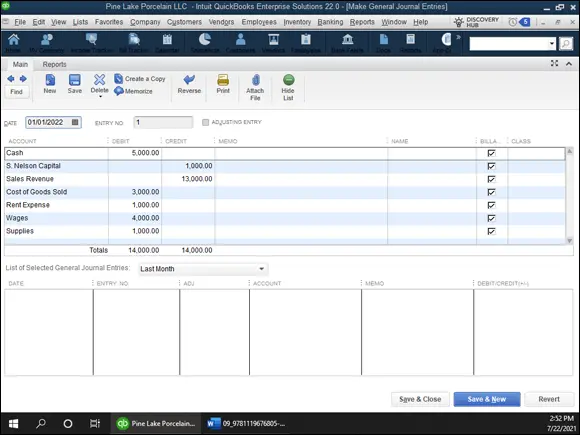

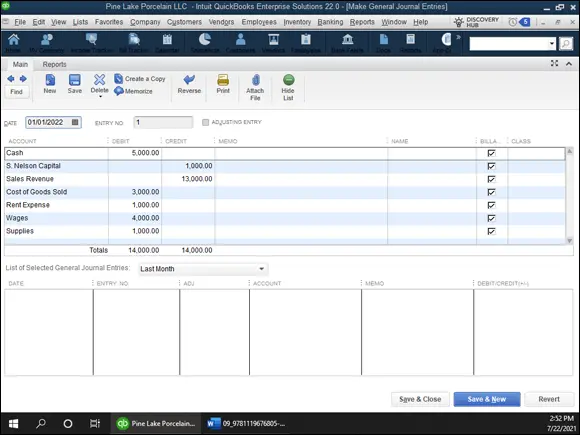

To record the rest of your starting trial balance, you record a journal entry. The journal entry records the remaining trial balance amounts for all your other accounts at the conversion or start date: accounts other than your bank accounts, accounts receivable, accounts payable, and inventory.

To see how this process works, suppose that you have the trial balance shown in Table 1-1. Note that these trial balances are used in the discussion in Book 1, Chapter 2and shown in that chapter’s Table 2-19. Please notice that no balance is recorded for a bank account, no balance is recorded for accounts receivable (because this account doesn’t even show up in the trial balance), and no balances are recorded for inventory or accounts payable (because these accounts have zero balances at the conversion date). For purposes of this example (but not the next example), the cash balance isn’t a bank account but is actually cash: a desk drawer full of low-denomination, used bills with nonsequential serial numbers.

Figure 1-8 shows how the Make General Journal Entries window looks when it records the missing trial balance information from Table 1-1. After this journal entry is recorded, the trial balance is correct as of the start date.

TABLE 1-1A Trial Balance

| Account |

Debit |

Credit |

| Cash |

$5,000 |

|

| Inventory |

0 |

|

| Accounts payable |

|

$0 |

| S. Nelson, Capital |

|

1,000 |

| Sales Revenue |

|

13,000 |

| Cost of Goods Sold |

3,000 |

|

| Rent Expense |

1,000 |

|

| Wages |

4,000 |

|

| Supplies |

1,000 |

|

| Totals |

$14,000 |

$14,000 |

FIGURE 1-8:The Make General Journal Entries window, showing a simple trial balance.

For more information about how to record a journal entry by using the Make General Journal Entries window, see Book 4, Chapter 1. If you want to try this on your own with no further instruction from me, choose the Company ⇒ Make General Journal Entries command. When QuickBooks displays the Make General Journal Entries window, shown in Figure 1-8, use the Account, Debit, and Credit columns to record your journal entry.

Читать дальше

You can click the Restore Recommendations button at the bottom of the list to return to the initial recommended chart of accounts (if you made changes that you later decide you don’t want).

You can click the Restore Recommendations button at the bottom of the list to return to the initial recommended chart of accounts (if you made changes that you later decide you don’t want).