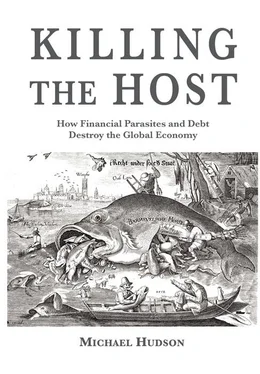

In the workplace, many employees are so deep in debt that they are afraid to complain about working conditions out of fear losing their jobs and thus missing a mortgage payment or utility bill, which would bump their credit-card interest rates up to the penalty range of circa 29 percent. This has been called the debt-traumatized worker effect, and it is a major cause of wage stagnation.

Finance and land rent: How bankers replaced the landed aristocracy

The Norman Conquest of Britain in 1066 and similar conquests of the land in other European realms led to a constant fiscal struggle over who should receive the land’s rent: the king as his tax base, or the nobility to whom the land had been parceled out for them to manage, nominally on behalf of the palace. Increasingly, the hereditary landlord class privatized this rent, obliging kings to tax labor and industry.

This rent grab set the stage for the great fight of classical free market economists, from the French Physiocrats to Adam Smith, John Stuart Mill, Henry George and their contemporaries to tax land and natural resource rents as the fiscal base. Their aim was to replace the vested aristocracy of rent recipients with public taxation or ownership of what was a gift of nature — the sun that the Physiocrats cited as the source of agriculture’s productive powers, inherent soil fertility according to Ricardo, or simply the rent of location as urbanization increased the value of residential and commercial sites.

Classical value and price theory was refined primarily to measure this land rent as not reflecting an expenditure of labor or enterprise (in contrast to buildings and other capital improvements), but as a gift of nature and hence national patrimony.

The main aim of political economy for the past three centuries has been to recover the flow of privatized land and natural resource rent that medieval kings had lost. The political dimension of this effort involved democratic constitutional reform to overpower the rent-levying class. By the late 19 thcentury political pressure was rising to tax landowners in Britain, the United States and other countries. In Britain a constitutional crisis over land taxation in 1910 ended the landed aristocracy’s power in the House of Lords to block House of Commons tax policy. Sun Yat-Sen’s revolution in China in 1911 to overthrow the Qing dynasty was fueled by demands for land taxation as the fiscal base. And when the United States instituted the income tax in 1913, it fell mainly on rentier income from real estate, natural resources and financial gains. Similar democratic tax reform was spreading throughout the world.

By the turn of the 20 thcentury land was passing out of the hands of the nobility to be democratized — on credit. That was the only way for most families to acquire a home. Mortgage credit promises to enable homebuyers to obtain security of their living space — and in the process, buy an asset rising in value. A rising share of personal saving for most of the population took the form of paying down their mortgages, building up their equity in real estate as the major element in their net worth.

Yet no economist anticipated how far-reaching the results would be, or that real estate would become by far the major market for bank lending from North America to Europe. Nor was it expected that real estate prices would be raised not so much by raw population growth (the man/land ratio) as by increasingly leveraged bank credit, and by rising public services increasing site values (“location, location and location”) without recapturing this publicly created value in property taxes, which were cut.

The result of “democratizing” real estate on credit is that most of the rental income hitherto paid to a landlord class is now paid to banks as mortgage interest, not to the government as classical doctrine had urged. Today’s financial sector thus has taken over the role that the landed aristocracy played in feudal Europe. But although rent no longer supports a landed aristocracy, it does not serve as the tax base either. It is paid to the banks as mortgage interest. Homebuyers, commercial investors and property speculators are obliged to pay the rental value to bankers as the price of acquiring it. The buyer who takes out the biggest mortgage to pay the bank the most gets the asset. So real estate ends up being worth whatever banks will lend against it.

Finance as the mother of monopolies

The other form of rent that Adam Smith and other classical economists sought to minimize was that of natural monopolies such as the East India Companies of Britain, France and Holland, and kindred special trade privileges. This was what free trade basically meant. Most European countries kept basic infrastructure in the public domain — roads and railroads, communications, water, education, health care and pensions so as to minimize the economy’s cost of living and doing business by providing basic services at cost, at subsidized rates or even freely.

The financial sector’s aim is not to minimize the cost of roads, electric power, transportation, water or education, but to maximize what can be charged as monopoly rent. Since 1980 the privatization of this infrastructure has been greatly accelerated. Having financialized oil and gas, mining, power utilities, financial centers are now seeking to de-socialize society’s most important infrastructure, largely to provide public revenue to cut taxes on finance, insurance and real estate (FIRE).

The United States was early to privatize railroads, electric and gas utilities, phone systems and other infrastructure monopolies, but regulated them through public service commissions to keep prices for their services in line with the basic costs of production. Yet since the 1980s these natural infrastructure monopolies have been taken out of the public domain and privatized with little regulation. The pretense is that by financing privatization of public enterprises, bank credit and financialized management help make economies more efficient. Thatcherism has been a disaster, most notoriously in the former Soviet economies since 1991, Carlos Slim’s telephone monopoly in Mexico, U.S. pharmaceutical companies and cable TV. The reality is that debt service (interest and dividends), exorbitant management fees, stock options, underwriting fees, mergers and acquisitions add to the cost of doing business.

Property speculators and buyers of price-gouging opportunities for monopoly rent on credit have a similar operating philosophy: “rent is for paying interest.” The steeper the rate of monopoly rent, the more privatizers will pay bankers and bond investors for ownership rights. The financial sector ends up as the main recipient of monopoly rents and land rents, receiving what the landlord class used to obtain.

What is so remarkable is that all this has been done in the name of “free markets,” which financial lobbyists have re-defined as freedom from public ownership or regulation. The financial sector has managed to mobilize anti-government ideology to pry away the public domain and lobby to block regulation legislation. Government planning is accused of being inherently bureaucratic, wasteful and often corrupt, as if the history of privatization deals is not one of corrupt insider dealing and schemes to obtain rights for rent extraction that makes such economies much less competitive.

Financializing industry to turn profits into interest and stock buybacks

Early in the 20 thcentury the wave of the future promised to see banks throughout the world do what they were doing best in Germany and Central Europe: coordinating industrial links with government and acting as forward planners (Chapter 7). Academic textbooks draw appealing pictures of banks financing capital formation. Low interest rates are held to spur industrial investment by making it more profitable to borrow.

Читать дальше