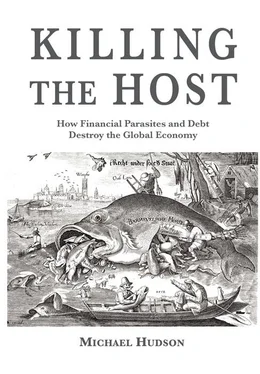

The essence of today’s neoliberal economics is to deny that any income or wealth is unearned, or that market prices may contain an unnecessary excessive rake-off over intrinsic value. If true, it would mean that no public regulation is necessary, or public ownership of infrastructure or basic services. Income at the top is held to trickle down, so that the One Percent serve the 99 Percent, creating rather than destroying jobs and prosperity.

The Labor Theory of Value serves to isolate and measure Economic Rent

Up to medieval times most families produced their own basic needs. Most market trade occurred mainly at the margin, especially for imported goods and luxuries. Not until the 13 thcentury’s revival of trade and urbanization did an analytic effort arise to relate market prices systematically to costs of production.

This adjustment was prompted by the need to define a fair price for bankers, tradesmen and other professionals to charge for their services. At issue was what constituted exploitation that a fair economy should prevent, and what was a necessary cost of doing business. This discussion took place in the first centers of learning: the Church, which founded the earliest universities.

The Churchmen’s theory of Just Price was an incipient labor theory of value: The cost of producing any commodity ultimately consists of the cost of labor, including that needed to produce the raw materials, plant and equipment used up in its production. Thomas Aquinas (122574) wrote that bankers and tradesmen should earn enough to support their families in a manner appropriate for their station, including enough to give to charity and pay taxes.

The problem that he Aquinas and his fellow Scholastics addressed was much like today’s: it was deemed unfair for bankers to earn so much more for the services they performed (such as transferring funds from one currency or realm to another, or lending to business ventures) than what other professionals earned. It resembles today’s arguments over how much Wall Street investment bankers should make.

The logic of Church theorists was that bankers should have a living standard much like professionals of similar station. This required holding down the price of services they could charge ( e.g ., by the usury laws enacted by most of the world prior to the 1980s), by regulating prices for their services, and by taxing high incomes and luxuries.

It took four centuries to extend the concept of Just Price to ground rent paid to the landlord class. Two decades after the Norman Conquest in 1066, for instance, William the Conqueror ordered compilation of the Domesday Book (1086). This tributary tax came to be privatized into ground rent paid to the nobility when it revolted against the greedy King John Lackland (1199–1216). The Magna Carta (1215) and Revolt of the Barons were largely moves by the landed aristocracy to avoid taxes and keep the rent for themselves, shift the fiscal burden onto labor and the towns. The ground rent they imposed thus was a legacy of the military conquest of Europe by warlords who appropriated the land’s crop surplus as tribute.

By the 18 thcentury, attempts to free economies from the rent-extracting privileges and monopoly of political power that originated in conquest inspired criticisms of land rent and the aristocracy’s burdensome role (“the idle rich”). These flowered into a full-blown moral philosophy that became the ideology driving the Industrial Revolution. Its political dimension advocated democratic reform to limit the aristocracy’s power over government. The aim was not to dismantle the state as such, but to mobilize its tax policy, money creation and public regulations to limit predatory rentier levies. That was the essence of John Stuart Mill’s “Ricardian socialist” theory and those of America’s reform era with its anti-trust regulations and public utility regulatory boards.

Tax favoritism for rentiers and the decline of nations

What makes these early discussions relevant today is that economies are in danger of succumbing to a new rentier syndrome. Spain might have used the vast inflows of silver and gold from its New World conquests to become Europe’s leading industrial power. Instead, the bullion it looted from the New World flowed right through its economy like water through a sieve. Spain’s aristocracy of post-feudal landowners monopolized the inflow, dissipating it on luxury, more land acquisition, money lending, and more wars of conquest. The nobility squeezed rent out of the rural population, taxed the urban population so steeply as to impose poverty everywhere, and provided little of the education, science and technology that was flowering in northern European realms more democratic and less stifled by their landed aristocracy.

The “Spanish Syndrome” became an object lesson for what to avoid. It inspired economists to define the various ways in which rentier wealth — and the tax and war policies it supported — blocked progress and led to the decline and fall of nations. Dean Josiah Tucker, a Welsh clergyman and political economist, pointed out in 1774 that it made a great difference whether nations obtained money by employing their population productively, or by piracy or simply looting of silver and gold, as Spain and Portugal had done with such debilitating effects, in which “very few Hands were employed in getting this Mass of Wealth … and fewer still are supposed to retain what is gotten.”

The parallel is still being drawn in modern times. In The Great Reckoning (1991), James Dale Davidson and Lord William Rees-Mogg write with regard to the glory days of Spain’s “century of gold” (1525 to 1625 AD):

Leadership of the Spanish government was totally dominated by tax-consuming interests: the military, the bureaucracy, the church, and the nobility. … Spain’s leaders resisted every effort to cut costs. …Taxes were tripled between 1556 and 1577. Spending went up even faster… By 1600, interest on the national debt took 40 percent of the budget. Spain descended into bankruptcy and never recovered.

Despite its vast stream of gold and silver, Spain became the most debt-ridden country in Europe — with its tax burden shifted entirely onto the least affluent, blocking development of a home market. Yet today’s neoliberal lobbyists are urging similar tax favoritism to un-tax finance and real estate, shift the tax burden onto labor and consumers, cut public infrastructure and social spending, and put rentier managers in charge of government. The main difference from Spain and other post-feudal economies is that interest to the financial sector has replaced the rent paid to feudal landlords. And as far as economic discussion is concerned, there is no singling out of rentier income as such. Nor is there any discussion of the decline and fall of nations. Neoliberal happy talk is all about growth — automatically expanding growth of national income and GDP, seemingly ad infinitum with no checks on the super-rich elites’ self-serving policies.

The main distinction between today’s mode of conquest and that of 16 th-century Spain (and 18 th-century France) is that it is now largely financial, not military. Land, natural resources, public infrastructure and industrial corporations are acquired by borrowing money. The cost of this conquest turns out to be as heavy as overt military warfare. Landlords pay out their net rent as interest to the banks that provide mortgage credit for them to acquire property. Corporate raiders likewise pay their cash flow as interest to the bondholders who finance their takeovers. Even tax revenue is increasingly earmarked to pay creditors (often foreign, as in medieval times), not to invest in infrastructure, pay pensions or spend for economic recovery and social welfare.

Читать дальше