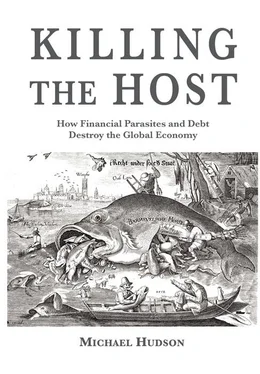

Instead of that future materializing, a financial counter-revolution strives to convince voters that a government strong enough to regulate and tax finance, insurance and real estate (FIRE) is the road to serfdom. That is the parasite’s strategy — to numb the host’s brain so that it doesn’t realize that the free luncher is draining the host’s growth for itself.

There are a number of ways to cut the fortunes of the One Percent back to what used to be deemed normal. Many such policies were suggested in the wake of the 2008 crisis. They involve scaling back debts to market prices in the context of the ability to pay out of current incomes. For the vast category of owner-occupied homes, for example, one way is to assess the market rental value for over-mortgaged properties and make this the monthly payment capitalized into a self-amortizing 30-year mortgage. The bank (and more to the point, its bondholders and uninsured counterparties) would absorb the loss, having over-lent against the property’s value.

Another solution would be to get an honest appraisal of the property’s market price and write down the debt to this level — which was supposed to be what banks lent in the first place. A third approach would be to calculate the occupant’s actual income (not the “liars’ loan” figure filled in by the bank’s mortgage broker) and set the mortgage payment at a specified portion, e.g . the once-traditional 25 percent. Congress established writedowns along such lines as a condition of TARP in October 2008. But as Chapter 11 has described, incoming President Obama’s choice was to leave these debts in place.

In 1931 the world economy recognized a need for a Clean Slate by declaring a moratorium on the dead hand of inter-governmental debts stemming from World War I. A similar act is needed today for today’s sovereign debts in the Eurozone and indeed throughout much of the global economy. The model remains that of Germany’s Economic Miracle. In 1948 the Allies enacted their Currency Reform cancelling all debts except for the wage obligations that businesses owed to their employees, plus modest personal and business savings and checking deposits up to a specified amount for basic transactions. The German economy was made essentially debt-free. That was the miracle, and what made its free market economy viable — a debt-free market.

It was politically easy for the Allies to cancel German debts because nearly all were owed to former Nazi supporters. But today’s banks and bondholders hold the reins of government, their treasuries, central banks, the IMF and ECB. These creditor interests instinctively put their own gains above the aim of economic recovery, to a point that ends up being self-defeating, bringing down the whole financial superstructure.

What if the debts are not cancelled?

One way or another, today’s debts will not be paid. They are too large to be paid off without further impoverishing economies and leading to further waves of default. But in the interim, until the hopelessness is recognized, a steady stream of foreclosures and privatizations will polarize economies between creditors and debtors. Sooner or later, economies will recognize that they must choose between becoming an increasingly polarized financial oligarchy or making a fresh start by clearing away the residue of over-lending and financial malstructuring.

The political problem blocking debt write-downs is that one party’s debts (mainly those of the 99 Percent) are another’s savings (especially those of the One Percent). It is not possible to annul debts on the liabilities side of the balance sheet without wiping out savings on the asset side. As long as “savings” (mainly by the One Percent) takes the form of debt claims on the rest of society, they will grow exponentially to hold the 99 Percent in deepening debt thrall, monopolizing the surplus — in a way that shrinks the economy.

The present course is for governments to support the financial sector, not bring debts within the ability to pay. The one-sided U.S. support for creditors since 2008 has averted a debt writedown. Early in 2013 the Fed announced that it would buy $40 billion of mortgage-backed securities each month — almost half a trillion dollars over the course of a year, while the government’s housing agencies guaranteed some 90 percent of the securitized mortgage packages being written.

Financial Times columnist Gillian Tett described this government activism as a travesty of a free market. Banks stopped writing new mortgages unless the government took all the risk (as also is the case with student loans) by guaranteeing payment out of the public purse in the event that homeowners cannot afford to carry the debt revival. Observing that “state support like this is unprecedented anywhere in the western world,” Tett cited former Treasury Secretary Paulson’s warning: “Today the government is guaranteeing 90 per cent of the mortgages. If the government keeps doing this, and markets aren’t allowed to work, we’ll be right back where we were in 2007 and 2008.”

Today’s government intervention is not socialism. The appropriate word is oligarchy . Debt protests from Iceland to Greece and Spain are rejecting bondholder demands for austerity and privatization sell-offs, voting pro-creditor regimes out of office, and demanding referendums over whether to pay financial tribute to creditors. That is why creditors are shifting their support away from democracies to insist that their designated technocrat lobbyists be assigned control of economic policy.

Bondholders see rising pressure for debt writedowns as an assault on their idea of free markets. But their idea of freedom connotes debt serfdom for the population at large. Their travesty of the classical idea of rent-free markets poses the implicit question: If governments are to intervene to enforce creditor claims and bail out banks while imposing austerity, why not act instead on the side of the indebted majority? Why not choose growth rather than shrinkage ending in bankruptcy? The costs are much less, because financial recklessness would be avoided.

Unthinkable as a broad debt cancellation may seem, once we recognize that it is impossible to pay today’s volume of debt (at least without tearing society apart and imposing financial neofeudalism), what remains practical is that the debts won’t be paid. There ultimately is no revenue to pay. If we acknowledge this fact, then as Sherlock Holmes remarked in The Beryl Coronet : “It is an old maxim of mine that when you have excluded the impossible, whatever remains, however improbable, must be the truth.”

The truth is that today’s debt overhead can’t be paid. Today’s political fight concerns just how they won’t be paid. If government debts to foreign creditors are paid by forced privatization selloffs, the former public domain and infrastructure will be turned into rent-extraction tollbooth opportunities and economies will be impoverished by rentier austerity.

Gretchen Morgenson, “A Slack Lifeline for Drowning Homeowners,” The New York Times, August 2, 2015.