The political problem always comes down to the question of who will bear the losses. The One Percent insist that if the personal, real estate and corporate debts of the 99 Percent are to be written down, the government will bail out creditors. The 99 Percent must pay in another way — in their capacity as taxpayers. when debtors no longer can pay funds. Making the 99 Percent poorer is thus not an accidental byproduct of the behavior of the One Percent. Bank lobbyists have put their own Tim Geithners in place precisely to act as their defenders in such situations. If they succeed in blocking bad debt debts from being written down, bankers and bondholders will kill the economy by plunging it into austerity.

When debts cannot be paid, the choice is between annulling them, or keeping them in place and letting creditors foreclose or bailing them out with public funds. Favoring creditors polarizes economies by siphoning income and transferring assets upward to creditors. This financial conquest must be blocked by resuming the fight to tax unearned income and indeed, to minimize it in the first place, by protecting basic public services (including banking) from being appropriated by rent extractors.

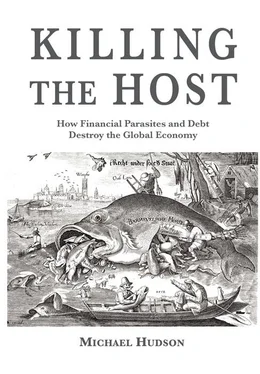

Today’s economies will stagnate unless they are freed from rentier parasitism and debt creation. The financial oligarchy will bring its creditor power to bear against labor and democratic government regulation, worsening poverty and stripping the environment to pay the exponentially expanding debt overhead.

What kind of postindustrial economy will we have?

Today’s most pressing economic fight is not simply between labor and employers. It is being waged by rentier interests against labor, industry and government together. This makes today’s reform task more far-reaching than the social-democratic movement a century ago. Financial and rentier reforms play little role in the party platforms of today’s ostensibly socialist and labor parties. From Britain to Greece and even the United States, they are leading the fight for balanced budgets and fiscal austerity at the Tony Blair, Barack Obama and Papandreou extreme. It is as if recovery depends on the super-rich getting richer, not on rescuing debt-ridden Greece and Cyprus, Ireland, Italy and Spain.

The problem that will occupy the next few generations is how to undo the financial knots into which today’s economies have been tied. Clearing away the overgrowth of debt requires countering the neoliberal junk economics crafted to disable society’s defense mechanisms against financialization and unearned income. There have indeed been courageous U.S. officials, such as Sheila Bair and Neil Barofsky, whose sense of fairness was offended by the giveaways to the large banks and their bondholders. Former Wall Streeters Nomi Prins and Yves Smith, the intellectual force behind the Naked Capitalism website, have explained the financial rip-offs at work. UMKC’s Modern Monetary Theory website New Economic Perspectives provides a commentary on how needless today’s financial austerity is, in light of the power of central banks to fund economic growth. But their voices are all but drowned out by the parroting of pro-bank austerity economics across the political spectrum.

Nobody anticipated that democratic societies would vote for policies that would support the One Percent by impoverishing themselves. Political leaders treat interest and economic rent as secondary concerns while welcoming asset-price inflation and privatization. The economic vocabulary has been corrupted to depict exploitation as wealth creation — which it is for the One Percent under the current system, but at the cost of the 99 Percent.

Latvians have repeatedly voted for neoliberals imposing Europe’s most extreme austerity. Most notoriously, Ireland’s politicians paid foreign bondholders and “hot money” arbitrageurs at the cost of imposing domestic poverty. Voters finally replaced its neoliberal politicians, but the new party coalition did not repudiate the debts that were taken on.

In the United States, Britain and France, no major political party or labor organization has challenged the oligarchic principle that tax rules, financial regulations and the legal system should be run for the benefit of the FIRE sector serving the One Percent. Today’s passivity by the 99 Percent in the face of a rentier counter-Enlightenment reflects the degree to which voters have come to accept the neoliberal financial and tax system as part of the natural environment, as if there indeed is no alternative.

What is needed is a perspective enabling people to see the reforms that would counter today’s corrosive FIRE-sector mode of fortune-creation. The difficulty in promoting this understanding is that its logic and implications are radical — as they were in the 19 thcentury, when they were sponsored by a broad range of reformers, from the “Ricardian socialists” around John Stuart Mill urging nationalization of land rent (by outright purchase or rising land taxation) and Christian socialist ideals of communalism to Marxism, based on nationalizing all means of production, factories as well as public infrastructure. It seemed that the residue of feudalism was being swept away at the very least by land taxation and anti-trust legislation, while banking was becoming industrialized.

But this has not occurred. The leading efforts to free economies from the legacy of feudalism were defeated. After World War I the focus of value and price theory on economic rent was replaced by a more trivialized economics curriculum excluding the concept of unearned income and the distinction between productive labor and overhead.

Will financialized economies self-destruct?

Warning against sacrificing the economy to subsidize the financial sector, chief Financial Times commentator Martin Wolf writes that the key policy guide should be: “First ‘do not’: do not pay too much attention to the financial sector’s self-interested bleating. … The financial sector has put the economy into trouble. If the government is forced to take part of the risk of putting the system back together again, it must protect the public interests first.” As a final “do not,” he urges, “do not bail out mortgage lending via government subsidies. By now it should be evident that the British obsession with speculative home ownership is a snare and a delusion. Let the market deflate, as it should.”

If creditors have their way, they will destroy the economy. Citigroup chief economist (and former advisor to Goldman Sachs) Willem Buiter acknowledged in 2012 that: “The most likely insolvent sovereigns — Greece, Portugal, Ireland, Cyprus and possibly Spain, Italy and Slovenia,” cannot grow without debt restructuring. He saw the risk of sovereign default highest for Ireland’s €63 billion of official debt. “Austerity fatigue in the periphery and growing bailout fatigue in the core mean that the ECB/euro system is the only Santa Claus capable of filling the solvency gaps of sovereigns and banks in the euro area.” But German, Dutch and Finnish finance ministers opposed this.

The financial system had become reckless by joining in a rentier consensus with the One Percent to oppose government powers to tax or regulate any form of wealth — and against labor seeking to improve its working conditions, wages and pensions, even though “winning” the war against labor destroys the domestic market and hence the ability to pay debts owed to the financial sector.

It doesn’t have to be this way. It is now two centuries since the Saint-Simonian proposals to subordinate credit to serve industry. Classical tax policy sought to ward off the rentier economy that the post-World War I century has brought about by un-taxing economic rent, privatizing basic utilities, and failing to socialize banking to prevent bank credit being lent against economic rent. Debts cannot be written down as long as people imagine that keeping them in place is necessary to prevent depression by preserving confidence in the financial system. Such “confidence” helps deepen today’s malaise.

Читать дальше