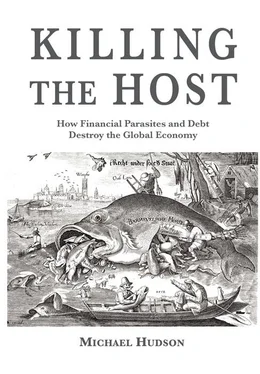

From finance capitalism to neofeudalism

Hiding behind an Orwellian rhetoric that inverts the classical idea of a free market, financial planners are leading the world down the autocratic path that Spain and France took five hundred years ago. Without contributing to production, rentier income is overwhelmingly responsible for the wealthiest One Percent obtaining 73 percent of U.S. income growth since the 2008 crash, while the 99 Percent have seen their net worth decline. Yet in contrast to classical economics, Piketty’s much-applauded neoliberal attempt to explain today’s economic polarization does not single out finance and rent-seeking, so his remedy does not include focusing tax collection on rentier income or de-privatizing infrastructure monopolies by restoring a mixed public/private economy.

The drive to widen political democracy was expected to avoid this fate. Voters were expected to elect politicians who would put in place fiscal and regulatory checks against rentiers, so that industrial capitalism could use its economic surplus to expand markets and, in the process, raise living standards. The idea of asset-price inflation as a financial strategy, extending credit in ways decoupled from helping economies grow, was nowhere on the intellectual horizon. Thorstein Veblen was almost alone in explaining how Wall Street’s financial engineering was undercutting industrial capital formation.

Paying bankers and bondholders at the “real” economy’s expense is antithetical to industrial capitalism. The financial business plan is to turn economies into a set of rent traps, carving out privileges whose purchase and sale is financed by banks and bondholders. Instead of lowering the cost of basic services to make economies more competitive, the effect is to load them down with debt to extract interest, fees and rentier overhead. This destructive policy inflates the economy’s cost structure by building in higher user fees for the privatized monopolies and a rising flow of debt service to bankers, while imposing debt and rent deflation on the core economy.

Replacing government as our epoch’s central planners, the aim of Wall Street, the City of London, Frankfurt and other financial centers is to draw into their own hands all the economy’s net income, followed by the assets that produce it. It is easier to make money by financial manipulation and debt-leveraged bubbles than by the hard work of designing new products, organizing production facilities, hiring and training labor and a marketing and sales force. That is why the shift of economic and social planning into the hands of financial managers has undercut the U.S. and British economies as industrial exporters.

Financializing the income streams from tollbooth privileges is not about earning profits by tangible productive capital investment. It is about appropriating the public domain on credit. This financial mode of expropriation reverses the happy assumption that the momentum of historical progress will, by itself, ensure the primacy of legal systems regulating property and creditor/debtor relationships in the economy’s broad long-term interest. The consequence of real estate, corporate control, monopoly rights and access to education and other basic needs being bought increasingly on credit is to turn nominal ownership into mere stewardship on behalf of the banks and bondholders. This locking of populations into paying financial tribute is now portrayed as a moral and legal right.

The rentier rake-off of revenue is not a necessary cost of production. It makes economies less competitive. Instead of the industrial capitalism envisioned by classical reformers who hoped to free the economy from rent-extracting elites, this rentier mode of exploitation is a regression to feudal-type privileges for elites to charge extortionate prices for basic needs. It is what Hyman Minsky called “money manager capitalism,” allocating savings and credit to serve the One Percent in extractive ways, pushing a widening swath of the population into austerity and negative equity.

Today’s bankers and bondholders are expropriating property owners in ways not anticipated a century ago, when elites worried that socialism might play this role. At that time the financial sector appeared to be the strongest buttress of the security of property, if only because collateral needs to be secure in order to be pledged for a loan. But foreclosure-wielding creditors always have threatened to expropriate indebted owners.

The greatest threat to broad income distribution, economic efficiency and higher living standards thus turns out not to be finance capitalism, not socialism. Families have been pushed, prodded and seduced onto the debt treadmill to pay a rising tribute for what they imagine is to be their economic independence in owning a home. Bank mortgages accounted for 60 percent of the overall value of U.S. housing by 2012. As market prices fell while debts remained in place after 2008, the share of homes actually owned by American homeowners plunged below 40 percent. The price is long-term debt servitude, along with the cost of getting an education these days.

The financial cover story to reverse classical tax and economic reforms

Under classical political economy and socialism (at least of the type expressed after Europe’s 1848 revolutions), governments were to receiving the rental income of land and natural resources. Instead, today’s financial sector is privatizing these rents for itself and its clients. In conjunction with this rent extraction, the essence of debt serfdom is to siphon off disposable personal income by obliging homebuyers, students and consumers to pay all their net earnings above subsistence as interest. For most homebuyers, market equilibrium prices are set at the point where debt service absorbs the full site-rental price. This phenomenon reflects the degree to which the core policy aim of classical economic doctrine has been reversed and, if the financial sector has its way, consigned to oblivion.

A similar predatory financial dynamic has taken over industry. As Chapter 8 has described, creditors finance corporate raiders who pay out profits as interest and cut back capital investment so as to use earnings simply for stock buybacks and quick dividend payouts to raise its price. Financial short-termism is thus the opposite of industrial forward planning and tangible capital formation.

Bankers depict their extraction of debt service as a necessary cost of production, as if the economy would not work without their service of allocating resources to decide who best should receive credit. In reality, banks push debt onto anyone with property to collateralize or earning power to sequester. Their business plan is to maximize financial claims on the means of production, up to the limit at which interest absorbs the total disposable income — leaving debtors to perform the economy’s actual work.

Pro-creditor ideology depicts loans and credit as enriching borrowers along with lenders in a fair bargain that produces gains for everyone. Borrowers acquiesce in the financialization of real estate as long as they believe that buying homes (or academic degrees) on credit may enrich them. They are willing to submit to austerity if they believe it is a necessary interlude to resume economic progress. The reality is that it sinks them deeper into debt, while widening government budget deficits and leading to demands by the One Percent to cut back social services, starting with pensions and Social Security.

Pro-creditor deceptions require censoring the economic history of how financial dynamics actually have evolved, because the lessons are clear enough over the millennia. Little lending has funded new means of production. That is the financial tragedy of our time: Neither the banking system nor the stock market is funding tangible capital formation to increase production, employment and living standards. Instead, exponentially rising debt service creates a chain reaction that weighs down the economy until it collapses into an inert leaden state.

Читать дальше