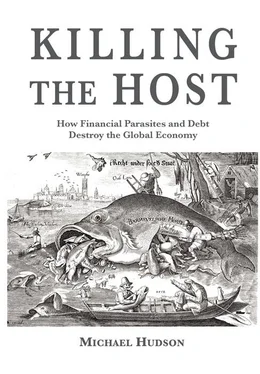

This is the kind of resource grab the IMF and World Bank imposed on Third World debtors for many decades. It is how Carlos Slim obtained Mexico’s telephone monopoly to impose exorbitant charges on business and the population at large. It can be seen most recently in the demands by the European Union, European Central Bank and IMF to force Greece and Cyprus to pay their foreign debts by selling whatever land, oil and gas rights, ports and infrastructure remain in their public domain. What is privatized will become an opportunity to extract monopoly “tollbooth” rents.

This financialization and rent extraction is quite different from what classical economists defined as “profit” made by investing in plant and equipment and employing labor to produce goods and services. The financial sector makes its gains by its privilege of credit creation to obtain interest, fees, and commissions, paid largely out of land rent and monopoly rent. All these forms of revenue are external charges on top of production costs.

The role of debt in the war against labor

As labor’s wages rose above subsistence levels a century ago, economic futurists depicted a post-industrial leisure economy. Left out of account was that the passport to middle-class status involved democratizing property ownership and education on credit, driving labor into debt to buy housing and, more recently, to get an education.

Financial exploitation of labor also occurs when corporate raiders buy out stockholders with high-interest “junk” bonds as their weapon of choice. The effect is to turn industry into a vehicle for bankers to load down with debt. Corporate raiders may pay their creditors by seizing or downgrading employee pension funds from defined benefit plans (in which workers know how much they will receive when they retire) to “defined contribution plans.” In the latter, employees only know how much is to be paid in each month, not what will be left for them after financial managers take their cut. (It’s a big cut.) Pension maneuvering becomes a tactic in class warfare when companies threaten to declare bankruptcy if employees do not renegotiate their pension rights, wage levels and working conditions downward.

The rule of the financial jungle is that big fish eat little fish. Companies use Employee Stock Ownership Plans (ESOPs) to buy up their own stock, enabling managers to cash out their stock options at a higher price. A rule of thumb has long been that about half the ESOPs are wiped out in corporate bankruptcies. After Sam Zell’s leveraged buyout of the Chicago Tribune , the newspaper’s employees were left holding an empty ESOP.

Federal Reserve Chairman Alan Greenspan described the role of rising personal and mortgage debt in today’s evolving class warfare. Under normal conditions unemployment at the relatively low 1997 rate (about 5.4 percent, the same as in the boom years 1967 and 1979) would have led to rising wage levels as employers competed to hire more workers. However, Greenspan explained to the U.S. Senate, a high rate of unemployment no longer was needed to hold down wages. All that was needed was job insecurity:

As I see it, heightened job insecurity explains a significant part of the restraint on compensation and the consequent muted price inflation.

Surveys of workers have highlighted this extraordinary state of affairs. In 1991, at the bottom of the recession, a survey of workers at large firms indicated that 25 percent feared being laid off. In 1996, despite the sharply lower unemployment rate and the demonstrably tighter labor market … 46 percent were fearful of a job layoff.

Despite the increase in labor productivity from fewer strikes and more intensive working conditions), U.S. wages were failing to rise. A major reason, Chairman Greenspan pointed out, was that workers were afraid to go on strike or even to complain about working conditions for fear of losing their paychecks, defaulting on their mortgage and falling behind on their monthly credit card bills and seeing their interest rates explode as their credit ratings declined. In July 1997 testimony he said that a major factor contributing to the “extraordinary” U.S. economic performance was “a heightened sense of job insecurity and, as a consequence, subdued wage gains.” Bob Woodward reported that Greenspan called this the “traumatized worker” effect as attrition spread the same volume of work among fewer employees, squeezing out higher “productivity.”

Median U.S. household income rose by a mere 15 percent during 2001-06 while mortgage credit inflated the cost of housing by 74 percent. Heavy mortgage debt and other housing and living costs have made workers feel one paycheck away from homelessness. As employees became debt ridden, widespread home ownership became a euphemism for a cowed labor force. Austerity’s squeeze on labor is tightened rents and consumer debt rise, along with shifts to part-time or lower-wage jobs and outright unemployment.

Financial appropriation of labor’s disposable personal income

The classical idea of a post-industrial leisure economy was to free nations from rent and interest overhead to bring prices in line with necessary direct costs of production, with governments subsidizing basic services out of progressive taxes or new money creation. By contrast, today’s financialized version of “free markets” obliges families to spend their life working mainly to pay banks for the credit needed to survive in today’s world.

Saddling students and homebuyers with debt has turned their hopes and ambition into a road to insolvency. People can choose which bank to borrow from, which home to buy with a 30-year working-life mortgage, and which college to take out an education loan to attend. But whatever their choice, they are subjected to a financialized version of the Company Store, a deregulated and predatory economy. Something must give way when earnings are unable to cover the stipulated debt service. If banks do not write down their loans, foreclosure time arrives and assets will be forfeited.

Next to home ownership, education is the path to the middle class. Student loans are now the second largest category of personal debt (over $1.3 trillion as of 2015, exceeding the volume of credit-card debt). Carrying charges on this debt absorb over 25 percent of the income for many graduates from lower-income families.

The 2005 U.S. bankruptcy code, written largely by bank and credit-card lobbyists, makes it harder to write off personal debts in general, and nearly impossible for student loans to be cleared. The effect is to turn many graduates into indentured servants, obliged to spend much of their working lives paying off the debt taken on to obtain a degree — or even for failure to complete their studies, most notoriously at for-profit crypto-colleges funded by government guaranteed student debt. The easiest way for many graduates to make ends meet is to live at home with their parents. Inability to save enough for a home of their own slows the rate of marriages and family formation.

By imposing an access fee on the entry point into the middle class job market, privatizing and financializing the educational system raises the cost of living and. This reverses the policy long followed by the United States, Germany and other successful nations that made their economies more competitive by providing education and other basic services freely or at subsidized rates. Creating a need for loans at the educational choke point turns universities into vehicles for banks to earn government-guaranteed interest.

Much as interest charges on home mortgages end up giving banks a larger sum than the sales price received by the sellers, student loan payments often give the bank as much interest income over time as the college or trade school has received as tuition. Consumer credit, home mortgage and education loans thus treat the labor force much as feudal landlords treated the land and its occupants: as a source of tribute.

Читать дальше