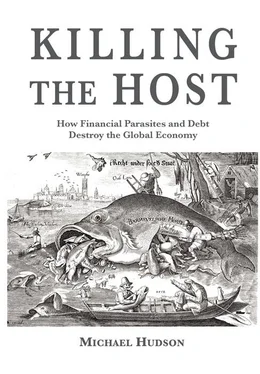

Thomas Picketty’s Capital in the 21 stCentury has quantified what nearly everyone knew intuitively: The One Percent have doubled their share of wealth over the past generation. Less attention has been paid to how they amassed this wealth. It has not been by investing in capital goods and hiring labor in the way textbooks describe industrial capitalists as doing. Most fortunes are made by rent seeking and debt pyramiding, financializing real estate and corporate industry, and creating or privatizing monopolies.

The most pressing political struggle of our time is how to cope with financial centers in control of central banks and governments, plunging economies deeper into austerity, leaving the industrial economy by the wayside. “Banks no longer ‘lend’ to the non-bank business sector,” writes UMKC professor Jan Kregel. “If at all they primarily lend to themselves, i.e . to other financial institutions.”

The taproots feeding this financial power are real estate rent, natural resource rent and monopoly rent, which are capitalized into interest-bearing debt and debt-leveraged “capital” gains. This financialization based on rent extraction has transformed the character of wealth. Instead of investing in plant and equipment to hire more labor to produce more output, money is made financially, while the economy shrinks.

Already in the 19 thcentury, economists across the political spectrum, from Marx to Henry George, described financial claims as “fictitious capital.” Frederick Soddy, the great English chemist and polymath, called financial claims “virtual wealth.” But few expected creditor claims in the form of bonds, stocks and bank loans on the “liabilities” side of the balance sheet, to become dominant over the asset side — the material means of production. That would be like a shadow taking over a body. But that is what has occurred.

There was no thought that free-lunch rent would be capitalized into interest-bearing bank loans to become the basis for most bank credit and debt creation. Rent was expected either to be taxed away (if rent-yielding land rent and natural resource rent was left in private hands) or rent-yielding assets would be nationalized and socialized

Financialization of economic rent is mainly responsible for polarizing today’s economies, and then shrinking them by debt deflation. Today’s financial mode of “wealth creation” by arbitrage, derivative gambles and credit pyramiding — capped by foreclosure and privatization — is overpowering the industrial mode of production, making fortunes on a much vaster scale than profits created by industrial capital. These fortunes are made at the economy’s expense. In alliance with other rent-extracting sectors, finance acts from above the industrial economy to indebt it and then rake off debt service, while inflating access prices to housing, education and infrastructure services.

So much of the wage earner’s paycheck must be diverted to pay debt service and rent extraction that the domestic market for goods dries up. Instead of the promised leisure economy, the world is entering a financialized Age of Austerity. Labor may be paid more and more, but its rising wages are stripped to pay the Finance, Insurance and Real Estate (FIRE) sector.

Unproductive fortune building, free lunches and their apologists

No one likes freeloaders. Children of the rich are especially prone to worry about being unproductive. “Inheritors of wealth,” a psychologist on the Wells Fargo wealth team observes, “‘feel they don’t deserve money and have shame and guilt. They feel isolated and closeted.’ Even the language we use to describe such people is mocking… ‘There are so many negative words attached to inheritors: trust-fund baby, silver spoon, spoiled brat — there’s no positive associations.’”

In contrast to this negative but realistic self-image, lobbyists for rentiers provide their clients with a productive mask. For banks, the trick is to convince borrowers that debt leveraging will help borrowers obtain wealth — and to accept their losses when their dreams turn into a living nightmare, blaming themselves instead of the system. The public relations aim is to numb popular awareness of the fact that running into debt historically has meant losing the homestead and the public Commons of entire nations. Claiming that there is no free lunch, they depict the One Percent as productive helpers in a symbiosis for mutual gain. Indoctrinating his Harvard students to defend the One Percent who get rich in banking and finance, America’s leading textbook writer Greg Mankiw attributes their wealth to their “service” of allocating society’s resources:

Those who work in banking, venture capital and other financial firms are in charge of allocating the economy’s investment resources. They decide, in a decentralized and competitive way, which companies and industries will shrink and which will grow. It makes sense that a nation would allocate many of its most talented and thus highly compensated individuals to the task.

Bankers appear as prudent lenders guiding credit to what is most productive. “Right, right,” comments one blogger: “These are the clowns who allocated a shit-ton of capital to building whole counties full of homes with styrofoam pediments during the last housing bubble, which culminated in the largest upward transfer of wealth in world history.” But despite the fact that financial institutions have proven to be a disaster in the way they have allocated savings and credit mainly to indebt the rest of the economy, it has been a calamity for the 99 Percent, not for themselves. Their maneuverings have made them rich.

Most fortunes grow simply by inertia, accruing interest and rent charges “in the recipient’s sleep,” to paraphrase John Stuart Mill’s description of landlords. The winning strategy is to extend credit to indebt the rest of society. The debt overhead that makes most of the money for the One Percent is paid for by the 99 Percent, leaving less and less for investment or living standards. So today’s main political issue is how to save economies from the financial sector’s alliance with rent extractors — and the rentiers ’ coordinated attack on the government’s power to tax wealth or allocate resources. To protect their wealth, the super-rich depict their takings as adding to productivity, and fight against democracy, land reform, progressive taxation, socialism, and strong government as potential threats to their takings. Their weapons are deception, force and bribery, backed by control of the courts.

Modes of production vs. modes of appropriation

The financial crisis now plaguing Western economies is age-old. Throughout history the greatest fortunes have been obtained by lending and foreclosing, above all by privatizing the Commons (the public domain) by indebting governments to force sell-offs, or simply via insider dealings and fraud. It would be a travesty of language to say that the resulting privatization rents, financial extraction and “capital” gains are “earned.”

Somebody must lose when debts grow too large to be paid. So bankers and bondholders seek to capture the government to protect themselves from losses — leaving pensioners, mortgage debtors and students to deal with the backwash of debt deflation. For the public sector, debt-strapped governments from Ireland to Greece are told to obey creditor demands to scale back schooling, health care and infrastructure maintenance, and to privatize the public domain.

Sacrificing the economy on the altar of debt

The financial system has been saved at the economy’s expense. It is a measure of how predatory today’s public policy has become that the huge banking conglomerates that provided credit were kept intact, but not the businesses and households whose balance sheets were being destroyed. Solving the debt problem for the 99 Percent would involve writing down the savings and other financial claims on the opposite side of the balance sheet. But the One Percent has placed its representatives in the Treasury and the Federal Reserve, and backed the election of the leading Congressional Committee figures dealing with banking.

Читать дальше