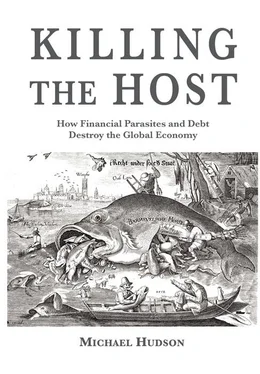

Industrial capitalism or finance capitalism?

Lenin said that capitalists would sell Communists the rope to hang them. But capitalists themselves have produced the rope in the form of predatory finance extracting interest, dividends, fees and various forms of rent from industry, real estate, households and also from governments. “Capital gains” are produced by debt pyramiding, which paves the way for debt deflation of the “real” economy.

The question is whether finance capital can survive simply by lending to speculators in search of interest, rent extraction and asset-price gains or gambles as finance capitalism mutates into casino capitalism. Of course there are many necessary functions provided by banks. But the collapse of today’s financialized economies into negative equity is largely the product of a few giant Wall Street institutions, as economist Randy Wray notes: “We have 4500 honest banks. We have a half dozen huge banks that are run as control frauds. Our financial system’s main problems can be found among those SDIs — systemically dangerous institutions. We will not get back our economy or our government until we close them.”

Fiscally, today’s problem is akin to that of 16 th-century Spain, whose landed aristocracy taxed labor and incipient industry in the towns while living tax-free in luxury. In 18 th-century France a similar tax shift sparked the Great Revolution. That was the only way to break the rentier stranglehold adding to the cost of labor and its products.

Today’s financial counter-revolution against the reform movement of the 19 thand early 20 thcenturies has shifted taxes off the FIRE sector onto labor and industry, much as did medieval Spain. The Republican administrations of Ronald Reagan and George H. W. Bush cut income taxes on the top brackets and capital gains taxes on real estate and finance, while adding a proliferation of sales and value-added taxes and wage withholding set-asides (and quadrupling the U.S. public debt between 1981 and 1992).

Adding this regressive fiscal burden to the debt overhead has left only one way for the economy to survive without cutting back consumption levels: to borrow from banks to buy what wages and salaries no longer are sustaining. So more debt seems to be the only solution to today’s over-indebtedness. That is the inner financial contradiction of our post-bubble economy.

Financial and debt reform will still leave labor and environmental problems

It is easy to forget how optimistic Marx and other socialists of his day were about the future of industrial capitalism. He expected the industrial mode of production to emerge victorious over all forms of parasitic rentier activities. Enlightened class consciousness and political democracy were expected to usher in a world of rising living standards, better working conditions and less unfair distribution of income.

Like most evolutionary economic forecasters of his day, Marx expected industrial capitalism to free itself from the “excrescences” of landlordism, monopolies and other forms of exploitation. But the banking and landlord class that were mutual enemies in Ricardo’s day have joined forces since World War I. As this has occurred, Social Democratic and Labour parties abandoned the issue of land rent to the Liberals and Single Taxers (whose ranks dwindled rapidly). And despite an early 20 th-century focus on finance capitalism by Rudolf Hilferding, Lenin and other Marxists, monetary and debt analysis has been left mainly to right wing bank advocates, from followers of Ludwig von Mises to Chicago-type monetarists.

In the early 20 thcentury the fight between employers and labor was expected to be the major tension shaping future politics. But today, Labor is fighting simply for jobs, seeing a harmony of interest with employers in place of the class conflict of a century ago — and imagining that finance helps industrial hiring rather than downsizing and out-sourcing it.

Housing has become more widely distributed, public pensions and health care have at least been promised, and a new world of opportunities has opened up. But the democratization of homeownership has enabled lobbyists for large commercial and rental property owners to make untaxing real estate a seemingly democratic aim. This demagogy reached its pinnacle in California’s notorious Proposition 13, which froze taxes on commercial and rental properties as well as homes.

Coupled with other tax favoritism for real estate and finance, the result has been a sharply regressive tax shift enabling financial power to grow stronger than industrial power. Industry is being financialized more than finance has become industrialized. The remedy is to write down debts and reform the tax system. Our financial problem is like a parasite on a sick body. The host needs to get rid of the intruder before it can heal itself.

Downsizing finance will not, in itself, avert the threatened privatization of the post office, water systems, roads and communication, or cure the high cost of privatized medical insurance and other infrastructure. Once you remove the debt drain and rentier burden from industrial capitalism will still leave the familiar old class tensions between employers and their workers. This will still leave the familiar labor problems of industrial capitalism — the fight to provide fair working conditions and basic necessities to all citizens, as well as to avoid war, environmental pollution and other social strains.

However, the rise of financial power is working against all these objectives, preventing society from healing itself. As Alan Greenspan noted in the passages cited earlier, hooking “traumatized labor” on the debt treadmill is a major factor deterring workers from pressing for wage increases and better workplace conditions. Without resolving the debt overhead and providing a public option for banking services, the other problems are made much worse.

Ancient mythology asked how King Midas could survive with nothing to eat but his gold. This threatens to be a metaphor for today’s finance capitalism — a dream that one can live purely off money, without means of production and living labor. To avoid this fate, the remedy must add financial reform to the 19 thcentury’s unfinished revolution to sweep away the surviving inequities of post-feudal land grabbing, seizure of the Commons and creation of monopoly privileges. These are the vestiges of the past appropriations and insider dealing that underlie rent seeking and endowed a financial system that remains grounded in neofeudal practice instead of investing in industry and human well being.

29. The Fight for the 21 stCentury

If Europe wants the division and the perpetuation of servitude, we will take the plunge and issue a “big no.” We will fight for the dignity of the people and our sovereignty.

— Alex Tsipris, rejecting the eurozone’s bailout terms in June 2015

In 1933, as the wake of World War I’s financial wreckage gave way to the Great Depression, the philosopher H. G. Wells wrote a novel about the conflict he expected to emerge by the last quarter of his century. Reminding his readers of the “perennial struggle of life against the creditor and the dead hand,” he described society’s “forward effort” seeking to break free of past debts and financial claims. Viewing debt as a retarding force, Wells forecast that matters would come to a head in the year 1979 when his fictional character Austin Livewright would publish Bankruptcy Through the Ages . “We need only refer the student to the recorded struggles in the histories of Republican Rome and Judaea between debtor and creditor; to the plebeian Secessions of the former and the year of Jubilee of the latter.” The year 1979 indeed turned out to be precisely when interest rates peaked at a modern-era high of 20 percent.

Читать дальше