All the evidence we present in this report shows that Greece not only does not have the ability to pay this debt, but also should not pay this debt, first and foremost because the debt emerging from the Troika’s arrangements is a direct infringement on the fundamental human rights of the residents of Greece. Hence, we came to the conclusion that Greece should not pay this debt because it is illegal, illegitimate, and odious.

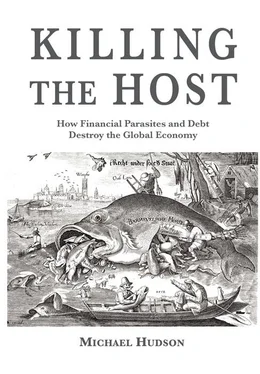

At issue is whether society will save indebted economies or their creditors. Bankers cry havoc at the thought of annulling debts that cannot be paid, as if the thought is unthinkable. But it is less radical than turning economies into the debt-ridden wasteland that was inflicted upon Greece. From a historical point of view, it is more radical to let debt deflation deepen austerity while banks foreclose on property than for governments to protect debtors, whose ranks constitute the vast majority of the population and businesses. Realism and maintenance of viable markets requires recognition that in the end, most debts cannot be paid.

At present we are living in a financial interregnum. If the debt buildup continues, the economy cannot avoid an exponentially deepening debt crisis as it follows an exponential Ponzi-scheme vector. Banks and bondholders will continue as long as they can, until real reforms are made and rules are set to define the conditions under which debts should be cancelled when they become disruptive on an economy-wide scale.

10. Revive classical value and price theory, with special emphasis on debt

As Chapter 3 has described, François Quesnay developed national income accounting to trace how much rent was taken and what landlords did with it. The subsequent value and price theory of Adam Smith and Ricardo served to isolate economic rent, enabling John Stuart Mill and other “Ricardian socialists” to demonstrate that taxing rent re-captures for society the natural resource patrimony and rising site value. This rental valuation is created not by landlord efforts but by society’s overall prosperity and public investment in transportation systems, schools and other infrastructure that define “location, location and location.”

The fight to recover land and natural resource rents for public use, along with making natural monopolies public, including banking, was waged in nearly every industrial nation in the decades leading up to World War I. Taxing rent aimed to lower taxes on consumers and industry, while public infrastructure lowered the prices of key economic needs. The past century has reversed matters, by privatizing the land’s site value, mineral rents and basic infrastructure rents, to be paid mainly to banks as interest.

Seeking to erase memory of classical rent theory, today’s financial power grab pretends that Adam Smith and his followers sought to free such rent-seeking from taxation and regulation, not free economies from rentier elites. Failure to create a more progressive tax system reflects the inability of 19 th-century free market doctrine to achieve the political and lawmaking power needed to liberate economies from the vestiges of feudalism: (1) landlordism stemming from the military conquest of Europe and the regions it colonized; (2) banking in private hands with creditor-oriented laws; and (3) monopolies created by public fiat and sold to pay royal war debts or, more recently, deficits from cutting taxes on rentiers and the rest of the One Percent.

How to manage a debt writedown

Whereas the fight of the 19 thcentury was to nationalize land, natural resources and monopolies, today’s fight is to socialize banking and finance. By becoming the ultimate rent recipients, banks and bondholders have emerged as the major defenders of rent seeking. Having made collateralized rent-extracting privileges the basis of our credit system — mortgage debts and those of oil and privatized monopolies — banks can argue that reviving the classical program of taxing economic rents will bring down the financial system turning these rents into interest and backing the economy’s savings.

These savings are highly concentrated in the hands of the One Percent, to be sure. But the symbiosis between banking, real estate and monopolies has enabled these rentiers to depict their interests as being those of labor and industry — if one leaves out of account the concepts of economic rent and unearned income and its fictive wealth.

The reforms cited above cannot be achieved as long as the debt overhead remains. Even with current rent extraction in place, spurring recovery requires freeing businesses and families from the debt burden. History shows how excessive rent extraction and not forgiving debts reduce economies to debt servitude and collapse. But it also reveals that there always has been a wide the range of alternatives to reverse the spread of indebtedness. If Clean Slates seem so radical as to be nearly unthinkable today, it is mainly because rentier ideology has suppressed awareness of most of civilization’s customary proclamations spanning three thousand years, from Mesopotamia and Egypt to Athens, Sparta and Judea.

Proclaiming Clean Slates to restore economic balance — annulling the accumulation of debts when they grew beyond the ability to be paid — kept pre-Roman civilization financially stables. Mosaic Law placed this principle at the core of Jewish religion ( Leviticus 25). Yet modern Christianity all but ignores the fact that in Jesus’s first sermon ( Luke 4) he unrolled the scroll of Isaiah and announced his mission to proclaim the Year of the Lord, as the Jubilee Year was known.

Restoring the Jubilee Year became the basis for early Christians to break away from Rabbi Hillel, whose prosbul clause was used by creditors to force debtors to waive their rights to a Clean Slate. Jesus’s position — reflected also in the Dead Sea scrolls of the Essenes — prompted the wealthy establishment to fight so strongly against him. By this time it was too late to win the fight against Rome and its increasingly violent creditor class that ended up bequeathing a pro-creditor post-Roman law to Western civilization.

It should not be surprising that the lesson of financial history is that debts that can’t be paid won’t be. The great policy question of our time is how not to pay them: Will nations permit creditors to foreclose and take the public and private assets into their hands, holding populations in bondage? Or will they declare a clean slate and start again?

Something must give: either finance capitalism or the post-rentier industrial capitalism that seemed to be evolving toward socialism a century ago. Merely marginal reforms cannot save a badly warped economy. So much of the economy’s land rent, natural resource rent, monopoly rent, industrial profits, personal income and central bank money creation has been attached to pay bankers and bondholders that the only means of reform is a thorough-going Clean Slate. At the end of today’s dynamic of interest-bearing debt and its dysfunctional financial and tax system is an economic Dark Age and privatization of the commons.

When rentiers insist that There Is No Alternative, they mean that they have attached and interwoven their debt and property claims so tightly throughout the economy that any systemic alternative threatens chaos in the short run. Their aim is to limit any reforms to merely marginal scope, leaving the present financial and rent-extracting system in place.

Banks and bondholders hate classical political economy because its logical conclusion was what was called socialism (before today’s “socialist” parties changed the meaning to endorse neoliberal austerity). Marx became the bête noire of vested rentier interests because he showed how the dynamics of industrial capitalism were radical in striving to subordinate the landed, financial and monopoly interests that survived from feudalism. This required a strong enough government to cope with the rentier interests and break their post-feudal stranglehold.

Читать дальше