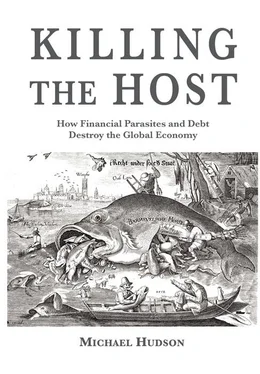

The result is that today’s society is indeed moving toward the central planning that financial lobbyists have long denounced. But the planning has been shifted to financial centers (Wall Street, the City of London or Frankfurt). And its plan is to create a neo-rentier society. Instead of helping the host economy grow, banking, bond markets and even the stock market have become part of a predatory, extractive dynamic.

This destructive scenario would not have been possible if memory of the classical critique of rentiers had remained at the center of political discussion. Chapter 2 therefore reviews how three centuries of Enlightenment reform sought to free industrial capitalism from the rentier overhead bequeathed by feudalism. Only by understanding this legacy can we see how today’s financial counter-Enlightenment is leading us back to a neo-feudal economy.

Marxism diagnosed the main inner contradiction of industrial capitalism to be that its drive to increase profit by paying labor as little as possible would dry up the domestic market. The inner contradiction of finance capitalism is similar: Debt deflation strips away the economy’s land rent, natural resource rent, industrial profits, disposable personal income and tax revenue — leaving economies unable to carry their exponential rise in credit. Austerity leads to default, as we are seeing today in Greece.

The financial sector’s response is to double down and try to lend enough to enable debtors to pay. When this financial bubble bursts, creditors foreclose on the public domain of debtor economies, much as they foreclose on the homes of defaulting mortgage debtors. Central banks flood the economy with credit in an attempt to inflate a new asset-price bubble by lowering interest rates. U.S. Treasury bonds yield less than 1 percent, and the interest rate on German government bonds is actually negative, reflecting the “flight to safety” when debt write-downs look inevitable.

In the end even zero-interest loans cannot be paid. Shylock’s loan to the Merchant of Venice for a pound of flesh was a zero-interest loan. The underlying theme of this book thus can be summarized in a single sentence: Debts that can’t be paid, won’t be.

But trying to pay such debts will plunge economies into prolonged depression.

2. The Long Fight to Free Economies from Feudalism’s Rentier Legacy

If you do not own them, they will in time own you. They will destroy your politics [and] corrupt your institutions.

— Cleveland mayor Tom Johnson (1901-09) speaking of power utilities

Classical economics was part of a reform process to bring Europe out of the feudal era into the industrial age. This required overcoming the power of the landed aristocracy, bankers and monopolies to levy charges that were unfair because they did not reflect actual labor or enterprise. Such revenue was deemed “unearned.”

The original fight for free markets meant freeing them from exploitation by rent extractors: owners of land, natural resources, monopoly rights and money fortunes that provided income without corresponding work — and usually without tax liability. Where hereditary rental and financial revenue supported the richest aristocracies, the tax burden was shifted most heavily onto labor and industry, in addition to their rent and debt burden.

The classical reform program of Adam Smith and his followers was to tax the income deriving from privileges that were the legacy of feudal Europe and its military conquests, and to make land, banking and monopolies publicly regulated functions. Today’s neoliberalism turns the word’s original meaning on its head. Neoliberals have re-defined “free markets” to mean an economy free for rent-seekers, that is, “free” of government regulation or taxation of unearned rentier income (rents and financial returns).

The best way to undo their counter-revolution is to revive the classical distinction between earned and unearned income, and the analysis of financial and debt relations (the “magic of compound interest”) as being predatory on the economy at large. This original critique of landlords, bankers and monopolists has been stripped out of the current political debate in favor of what is best characterized as trickle-down junk economics.

The title of Adam Smith’s chair at the University of Edinburgh was Moral Philosophy. This remained the name for economics courses taught in Britain and America through most of the 19 thcentury. Another name was Political Economy, and 17 th-century writers used the term Political Arithmetic. The common aim was to influence public policy: above all how to finance government, what best to tax, and what rules should govern banking and credit.

The French Physiocrats were the first to call themselves économistes. Their leader François Quesnay (1694–1774) developed the first national income models in the process of explaining why France should shift taxes off labor and industry onto its landed aristocracy. Adam Smith endorsed the view of the Marquis de Mirabeau (father of Honoré, Comte de Mirabeau, an early leader of the French Revolution) that Quesnay’s Tableau Économique was one of the three great inventions of history (along with writing and money) for distinguishing between earned and unearned income. The subsequent debate between David Ricardo and Thomas Malthus over whether to protect agricultural landlords with high tariffs (the Corn Laws) added the concept of land rent to the Physiocratic analysis of how the economic surplus is created, who ends up with it and how they spend their income.

The guiding principle was that everyone deserves to receive the fruits of their own labor, but not that of others. Classical value and price theory provided the analytic tool to define and measure unearned income as overhead classical economics. It aimed to distinguish the necessary costs of production — value — from the unnecessary (and hence, parasitic) excess of price over and above these costs. This monopoly rent, along with land rent or credit over intrinsic worth came to be called economic rent , the source of rentier income. An efficient economy should minimize economic rent in order to prevent dissipation and exploitation by the rentier classes. For the past eight centuries the political aim of value theory has been to liberate nations from the three legacies of feudal Europe’s military and financial conquests: land rent, monopoly pricing and interest.

Land rent is what landlords charge in payment for the ground that someone’s forbears conquered. Monopoly rent is price gouging by businesses with special privileges or market power. These privileges were called patents: rights to charge whatever the market would bear, without regard for the actual cost of doing business. Bankers, for instance, charge more than what really is needed to provide their services.

Bringing prices and incomes into line with the actual costs of production would free economies from in these rents and financial charges. Landlords do not have to work to demand higher rents. Land prices rise as economies become more prosperous, while public agencies build roads, schools and public transportation to increase site values. Likewise, in banking, money does not “work” to pay interest; debtors do the work.

Distinguishing the return to labor from that to special privilege (headed by monopolies) became part of the Enlightenment’s reform program to make economies more fair, and also lower-cost and more industrially competitive. But the rent-receiving classes — rentiers — argue that their charges do not add to the cost of living and doing business. Claiming that their gains are invested productively (not to acquire more assets or luxuries or extend more loans), their supporters seek to distract attention from how excessive charges polarize and impoverish economies.

Читать дальше