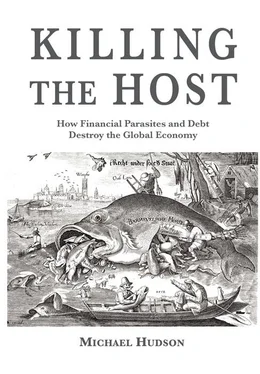

But banks rarely fund new means of production. They prefer to lend for mergers, management buyouts or raids of companies already in place. As for bondholders, they found a new market in the 1980s wave of high-interest “junk-bond” takeovers. Lower interest rates make it easier to borrow and take over companies — and then break them up, bleed them via management fees, and scale back pensions by threatening bankruptcy.

Like other sectors, industry was expected to become more debt-free. Bank lending focused on trade financing, not capital investment. Economists urged industry to rely mainly on equity so as to prevent bondholders and other creditors from taking over management and keeping it on a short leash. But industry has become financialized, “activist shareholders” treat corporate industry as a vehicle to produce financial gains. Managers are paid according to how rapidly they can increase their companies’ stock price, which is done most easily by debt leveraging. This has turned the stock market into an arena for asset stripping, using corporate profits for share buybacks and higher dividend payouts instead of for long-term investment (Chapter 8). These practices are widely denounced in the financial press, but the trend is not being checked (Chapter 9).

Financializing industry thus has changed the character of class warfare from what socialists and labor leaders envisioned in the late 19 thcentury and early 20 thcentury. Then, the great struggle was between employers and labor over wages and benefits. Today’s finance is cannibalizing industrial capital, imposing austerity and shrinking employment while its drive to privatize monopolies increases the cost of living.

The financial takeover of government

Central banks were supposed to free government from having to borrow from private bondholders. But budget deficits have increased the power of financial lobbyists who have pushed politicians to reverse progressive income taxation and cut taxes on capital gains. Instead of central banks monetizing deficit spending to help the economy recover, they create money mainly to lend to banks for the purpose of increasing the economy’s debt overhead. Since 2008 the U.S. Federal Reserve has monetized $4 trillion in Quantitative Easing credit to banks. The aim is to re-inflate asset prices for the real estate, bonds and stocks held as collateral by financial institutions (and the One Percent), not to help the “real” economy recover.

The situation is worst in the Eurozone. The European Central Bank has authorized €1 trillion (“Whatever it takes,” as its head Mario Draghi said) to buy bonds from banks but refuses to lend anything to governments on principle, even though budget deficits are limited to only 3 percent of GDP. This imposes fiscal deflation on top of debt deflation. Governments are forced to rely on bondholders and, increasingly, to sell off the public domain.

All this is contrary to what classical economists urged. Their objective was for governments elected by the population at large to receive and allocate the economic surplus. Presumably this would have been to lower the cost of living and doing business, provide a widening range of public services at subsidized prices or freely, and sponsor a fair society in which nobody would receive special privileges or hereditary rights.

Financial sector advocates have sought to control democracies by shifting tax policy and bank regulation out of the hands of elected representatives to nominees from world’s financial centers. The aim of this planning is not for the classical progressive objectives of mobilizing savings to increase productivity and raise populations out of poverty. The objective of finance capitalism is not capital formation, but acquisition of rent-yielding privileges for real estate, natural resources and monopolies.

These are precisely the forms of revenue that centuries of classical economists sought to tax away or minimize. By allying itself with the rentier sectors and lobbying on their behalf — so as to extract their rent as interest — banking and high finance have become part of the economic overhead from which classical economists sought to free society. The result of moving into a symbiosis with real estate, mining, oil, other natural resources and monopolies has been to financialize these sectors. As this has occurred, bank lobbyists have urged that land be un-taxed so as to leave more rent (and other natural resource rent) “free” to be paid as interest — while forcing governments to tax labor and industry instead.

To promote this tax shift and debt leveraging, financial lobbyists have created a smokescreen of deception that depicts financialization as helping economies grow. They accuse central bank monetizing of budget deficits as being inherently inflationary — despite no evidence of this, and despite the vast inflation of real estate prices and stock prices by predatory bank credit.

Money creation is now monopolized by banks, which use this power to finance the transfer of property — with the source of the quickest and largest fortunes being infrastructure and natural resources pried out of the public domain of debtor countries by a combination of political insider dealing and debt leverage — a merger of kleptocracy with the world’s financial centers.

The financial strategy is capped by creating international financial institutions (the International Monetary Fund, European Central Bank) to bring pressure on debtor economies to take fiscal policy out of the hands of elected parliaments and into those of institutions ruling on behalf of bankers and bondholders. This global power has enabled finance to override potentially debtor-friendly governments.

Financial oligarchy replaces democracy

All this contradicts what the 18 th, 19 thand most of the 20 thcentury fought for in their drive to free economies from landlords, monopolists and “coupon clippers” living off bonds, stocks and real estate (largely inherited). Their income was a technologically and economically unnecessary vestige of past conquests — privileges bequeathed to subsequent generations.

When parliamentary reform dislodged the landed aristocracy’s control of government, the hope was that extending the vote to the population at large would lead to policies that would manage land, natural resources and natural monopolies in the long-term public interest. Yet what Thorstein Veblen called the vested interests have rebuilt their political dominance, led by the financial sector which used its wealth to gain control of the election process to create a neo-rentier society imposing austerity.

A cultural counter-revolution has taken place. If few people have noticed, it is because the financial sector has rewritten history and re-defined the public’s idea of what economic progress and a fair society is all about. The financial alternative to classical economics calls itself “neoliberalism,” but it is the opposite of what the Enlightenment’s original liberal reformers called themselves. Land rent has not ended up in government hands, and more and more public services have been privatized to squeeze out monopoly rent. Banks have gained control of government and their central banks to create money only to bail out creditor losses, not to finance public spending.

The next few chapters review the classical analysis of value, price and rent theory to show how “free lunch” economic rent has been taken away from the public domain by the financial sector. Instead of creating the anticipated symbiosis with industry, as was hoped a century ago, finance has backed the rent-extracting sectors. And instead of central banks creating money to finance their budget deficits, governments are now forced to rely on bondholders, leaving it up to commercial banks and other creditors to provide the credit that economies need to grow.

Читать дальше