A century ago socialists and other Progressive Era reformers advanced an evolutionary theory by which economies would achieve their maximum potential by subordinating the post-feudal rentier classes — landlords and bankers — to serve industry, labor and the common weal. Reforms along these lines have been defeated by intellectual deception and often outright violence by the vested interests Pinochet-Chile-style to prevent the kind of evolution that classical free market economists hoped to see — reforms that would check financial, property and monopoly interests.

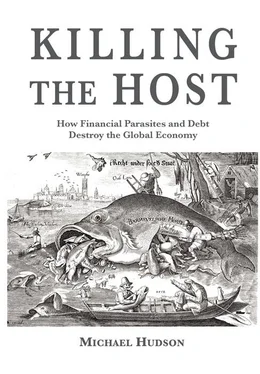

So we are brought back to the fact that in nature, parasites survive best by keeping their host alive and thriving. Acting too selfishly starves the host, putting the free luncher in danger. That is why natural selection favors more positive forms of symbiosis, with mutual gains for host and rider alike. But as the volume of savings mounts up in the form of interest-bearing debt owed by industry and agriculture, households and governments, the financial sector tends to act in an increasingly shortsighted and destructive ways. For all its positive contributions, today’s high (and low) finance rarely leaves the economy enough tangible capital to reproduce, much less to feed the insatiable exponential dynamics of compound interest and predatory asset stripping.

In nature, parasites tend kill hosts that are dying, using their substance as food for the intruder’s own progeny. The economic analogy takes hold when financial managers use depreciation allowances for stock buybacks or to pay out as dividends instead of replenishing and updating their plant and equipment. Tangible capital investment, research and development and employment are cut back to provide purely financial returns. When creditors demand austerity programs to squeeze out “what is owed,” enabling their loans and investments to keep growing exponentially, they starve the industrial economy and create a demographic, economic, political and social crisis.

This is what the world is witnessing today from Ireland to Greece — Ireland with bad real estate debt that has become personal and taxpayer debt, and Greece with government debt. These countries are losing population to accelerating emigration. As wages fall, suicide rates rise, life spans shorten, and marriage and birth rates plunge. Failure to reinvest enough earnings in new means of production shrinks the economy, prompting capital flight to less austerity-ravaged economies.

Who will bear the losses from the financial sector’s over-feeding on its industrial host?

The great political question confronting the remainder of the 21 stcentury is which sector will receive enough income to survive without losses degrading its position: the industrial host economy, or its creditors?

For the economy at large, a real and lasting recovery requires constraining the financial sector from being so shortsighted that its selfishness causes a system-wide collapse. The logic to avoid this a century ago was to make banking a public function. The task is made harder today because banks have become almost impenetrable conglomerates attached Wall Street speculative arbitrage activities and casino-type derivative bets to the checking and saving account services and basic consumer and business lending, creating banks Too Big To Fail (TBTF).

Today’s banks seek to prevent discussion of how over-lending and debt deflation cause austerity and economic shrinkage. Failure to confront the economy’s limits to the ability to pay threatens to plunge labor and industry into chaos.

In 2008, we watched a dress rehearsal for this road show when Wall Street convinced Congress that the economy could not survive without bailing out bankers and bondholders, whose solvency was deemed a precondition for the “real” economy to function. The banks were saved, not the economy. The debt tumor was left in place. Homeowners, pension funds, city and state finances were sacrificed as markets shrank, and investment and employment followed suit. “Saving” since 2008 has taken the form of paying down debts to the financial sector, not to invest to help the economy grow. This kind of “zombie saving” depletes the economy’s circular flow between producers and consumers. It bleeds the economy while claiming to save it, much like medieval doctors.

Extractive finance leaves economies emaciated by monopolizing their income growth and then using its takings in predatory ways to intensify the degree of exploitation, not to pull the economy out of debt deflation. The financial aim is simply to extract income in the form of interest, fees and amortization on debts and unpaid bills. If this financial income is predatory, and if capital gains are not earned by one’s own labor and enterprise, then the One Percent should not be credited with having created the 95 percent of added income they have obtained since 2008. They have taken it from the 99 Percent.

If banking really provides services equal in value to the outsized wealth it has created for the One Percent, why does it need to be bailed out? When the financial sector obtains all the economic growth following bailouts, how does this help industry and employment, whose debts remain on the books? Why weren’t employment and tangible capital investment bailed out by freeing them from their debt overhead?

If income reflects productivity, why have wages stagnated since the 1970s while productivity has soared and the gains extracted by banks and financiers, not labor? Why do today’s National Income and Product Accounts exclude the concept of unearned income (economic rent) that was the main focus of classical value and price theory? If economics is really an exercise in free choice, why have proselytizers for the rentier interests found it necessary to exclude the history of classical economic thought from the curriculum?

The free luncher’s strategy is to sedate the host to block these questions from being posed. This censorial mirage is the essence of post-classical economics, numbed by pro-rentier, anti-government, anti-labor “neoliberals.” Their logic is designed to make it appear that austerity, rent extraction and debt deflation is a step forward, not killing the economy. Future generations may see the degree to which this self-destructive ideology has reversed the Enlightenment and is carving up today’s global economy as one of the great oligarchic takeovers in the history of civilization. As the poet Charles Baudelaire quipped, the devil wins at the point where he is able to convince the world that he doesn’t exist.

The Twelve Themes of this Book

1. A nation’s destiny is shaped by two sets of economic relationships. Most textbooks and mainstream economists focus on the “real” economy of production and consumption, based on the employment of labor, tangible means of production and technological potential.

This tangible Economy #1 is wrapped in a legal and institutional network of credit and debt, property relations and ownership privileges, while Economy #2 is centered on the Finance, Insurance and Real Estate (FIRE) sector. This “debt and ownership” economy transforms its economic gains into political control to enforce payment of debts and to preserve property and natural resource or monopoly rent privileges (typically inherited).

Interest and rents are transfer payments from Economy #1 to Economy #2, but mainstream economics depicts all income as being earned productively, even by absentee landlords and Wall Street speculators receiving rentier overhead and interest. The operative fiction is the assumption that everyone earns in proportion to what they contribute to production. The National Income and Product Accounts (NIPA) treat whatever revenue these individuals are able to extract as a contribution to Gross Domestic Product (GDP), as if their exorbitant incomes reflect high productivity. Their “output” is defined as equal to their revenue, so GDP should really be thought of as Gross National Cost . There seems to be no such thing as economic parasitism or unnecessary costs of living and doing business. No free lunch is recognized, and hence no Economy #2 that does not contribute productively to Economy #1.

Читать дальше