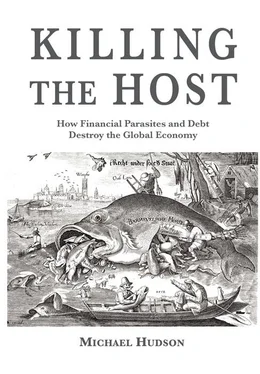

At the root of such parasitism is the idea of rent extraction: taking without producing. Permitting an excess of market price to be charged over intrinsic cost-value lets landlords, monopolists and bankers charge more for access to land, natural resources, monopolies and credit than what their services need to cost. Unreformed economies are obliged to carry what 19 th-century journalists called the idle rich, 20 th-century writers called robber barons and the power elite, and Occupy Wall Street call the One Percenters.

To prevent such socially destructive exploitation, most nations have regulated and taxed rentier activities or kept such potential activities (above all, basic infrastructure) in the public domain. But regulatory oversight has been systematically disabled in recent years. Throwing off the taxes and regulations put in place over the past two centuries, the wealthiest One Percent have captured nearly all the growth in income since the 2008 crash. Holding the rest of society in debt to themselves, they have used their wealth and creditor claims to gain control of the election process and governments by supporting lawmakers who un-tax them, and judges or court systems that refrain from prosecuting them. Obliterating the logic that led society to regulate and tax rentiers in the first place, think tanks and business schools favor economists who portray rentier takings as a contribution to the economy rather than as a subtrahend from it.

History shows a universal tendency for rent-extracting conquerors, colonizers or privileged insiders to take control and siphon off the fruits of labor and industry for themselves. Bankers and bondholders demand interest, landlords and resource appropriators levy rents, and monopolists engage in price gouging. The result is a rentier-controlled economy that imposes austerity on the population. It is the worst of all worlds: Even while starving economies, economic rent charges render them high-cost by widening the margin of prices over intrinsic, socially necessary costs of production and distribution.

Reversing classical reforms since World War II, and especially since 1980

The great reversal of classical Industrial Era reform ideology to regulate or tax away rentier income occurred after World War I. Bankers came to see their major market to be real estate, mineral rights, and monopolies. Lending mainly to finance the purchase and sale of rent-extracting opportunities in these sectors, banks lent against what buyers of land, mines and monopolies could squeeze out of their rent-extracting “tollbooth” opportunities. The effect was to pry away the land rent and natural resource rent that classical economists expected to serve as the natural tax base. In industry, Wall Street became the “mother of trusts,” creating mergers into monopolies as vehicles to extract monopoly rent.

Precisely because a “free lunch” (rent) was free — if governments did not tax it away — speculators and other buyers sought to borrow to buy such rent-extracting privileges. Instead of a classical free market ideal in which rent was paid as taxes, the free lunch was financialized — that is, capitalized into bank loans, to be paid out as interest or dividends.

Banks gained at the expense of the tax collector. By 2012, over 60 percent of the value of today’s homes in the United States is owed to creditors, so that most rental value is paid as interest to banks, not to the community. Home ownership has been democratized on credit. Yet banks have succeeded in promoting the illusion that the government is the predator, not bankers. The rising proportion of owner-occupied housing has made the real estate tax the most unpopular of all taxes, as if property tax cuts do not simply leave more rental income available to pay mortgage lenders.

The result of a tax shift off of property is a rising mortgage debt by homebuyers paying access prices bid up on bank credit. Popular morality blames victims for going into debt — not only individuals, but also national governments. The trick in this ideological war is to convince debtors to imagine that general prosperity depends on paying bankers and making bondholders rich — a veritable Stockholm Syndrome in which debtors identify with their financial captors.

Today’s policy fight is largely over the illusion of who bears the burden of taxes and bank credit. The underlying issue is whether the economy’s prosperity flows from the financial sector’s credit and debt creation, or is being bled by increasingly predatory finance. The pro-creditor doctrine views interest as reflecting a choice by “impatient” individuals to pay a premium to “patient” savers in order to consume in the present rather than in the future. This free-choice approach remains mute about the need to take on rising levels of personal debt to obtain home ownership, an education and simply to cover basic break-even expenses. It also neglects the fact that debt service to bankers leaves less to spend on goods and services.

Less and less of today’s paychecks provide what the national accounts label as “disposable income.” After subtracting FICA withholding for taxes and “forced saving” for Social Security and Medicare, most of what remains is earmarked for mortgages or residential rent, health care and other insurance, bank and credit card charges, car loans and other personal credit, sales taxes, and the financialized charges built into the goods and services that consumers buy.

Biological nature provides a helpful analogy for the banking sector’s ideological ploys. A parasite’s toolkit includes behavior-modifying enzymes to make the host protect and nurture it. Financial intruders into a host economy use Junk Economics to rationalize rentier parasitism as if it makes a productive contribution, as if the tumor they create is part of the host’s own body, not an overgrowth living off the economy. A harmony of interests is depicted between finance and industry, Wall Street and Main Street, and even between creditors and debtors, monopolists and their customers. Nowhere in the National Income and Product Accounts is there a category for unearned income or exploitation.

The classical concept of economic rent has been censored by calling finance, real estate and monopolies “industries.” The result is that about half of what the media report as “industrial profits” are FIRE-sector rents, that is, finance, insurance and real estate rents — and most of the remaining “profits” are monopoly rents for patents (headed by pharmaceuticals and information technology) and other legal privileges. Rents are conflated with profit. This is the terminology of financial intruders and rentier s seeking to erase the language and concepts of Adam Smith, Ricardo and their contemporaries depicting rents as parasitic.

The financial sector’s strategy to dominate labor, industry and government involves disabling the economy’s “brain” — the government — and behind it, democratic reforms to regulate banks and bondholders. Financial lobbyists mount attacks on public planning, accusing public investment and taxes of being a deadweight burden, not as steering economies to maximize prosperity, competitiveness, rising productivity and living standards. Banks become the economy’s central planners, and their plan is for industry and labor to serve finance, not the other way around.

Even without so conscious an aim, the mathematics of compound interest turns the financial sector into a wedge to push large sectors of the population into distress. The buildup of savings accruing through interest that is recycled into new lending seeks out ever-new fields for indebtedness, far beyond the ability of productive industrial investment to absorb (as Chapter 4 describes).

Creditors claim to create wealth financially, simply by asset-price inflation, stock buybacks, asset stripping and debt leveraging. Lost from sight in this exercise in deception is how the financial mode of wealth creation engorges the body of the financial intruder, at odds with the classical aim of rising output at higher living standards. The Marginalist Revolution looks nearsightedly at small changes, taking the existing environment for granted and depicting any adverse “disturbance” as being self-correcting, not a structural defect leading economies to fall further out of balance. Any given development crisis is said to be a natural product of market forces, so that there is no need to regulate and tax the rentiers. Debt is not seen as intrusive, only as being helpful, not as capturing and transforming the economy’s institutional policy structure.

Читать дальше