In 2020-2021, a substantial increase in capital transfers will appear on many public sector balance sheets.Capital spending, which includes investment and capital transfers, is projected to show a massive increase in 2020. Many governments have allocated considerable resources to shore up firms. Examples include the hardest-hit sectors, such as air transport, along with innovative firms or start-ups, firms in the utilities sector or, in general, “strategic” companies as shown in Table 3. Not all of these funds will necessarily be used and, even if they are, the equity injections by governments will likely be only temporary as the shareholdings will be sold to private investors at a later date.

Table 3

Programmes providing equity support for large, strategic firms or small businesses/startups

|

Large or strategic firms |

Small businesses |

| Germany |

100 |

2 |

| France |

20 |

3.9 |

| Spain |

10 |

|

| Denmark |

1.3 |

|

| Ireland |

2 |

|

| Italy |

45 |

2 |

Source: Bruegel, Bank of Spain, IMF Policy Tracker[16].

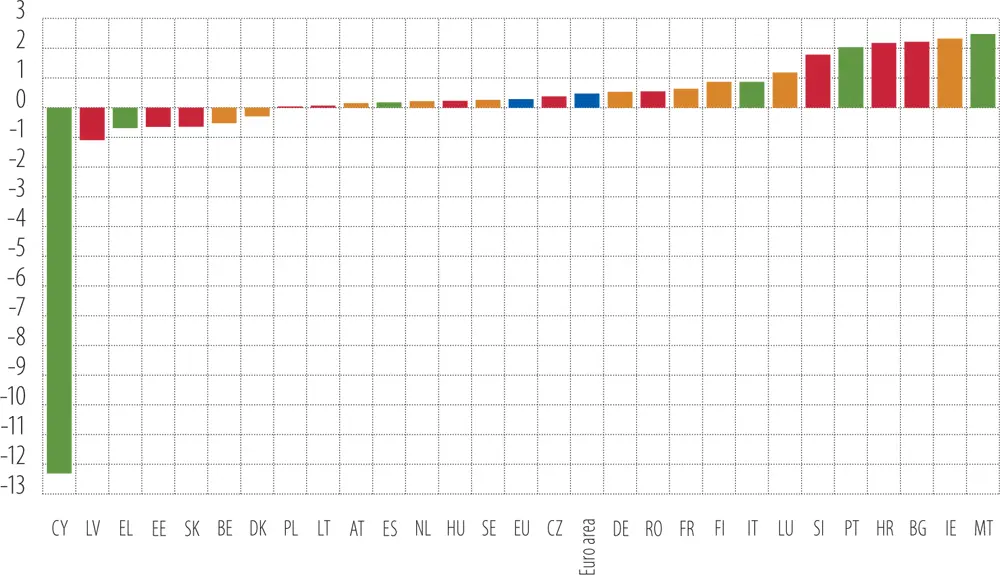

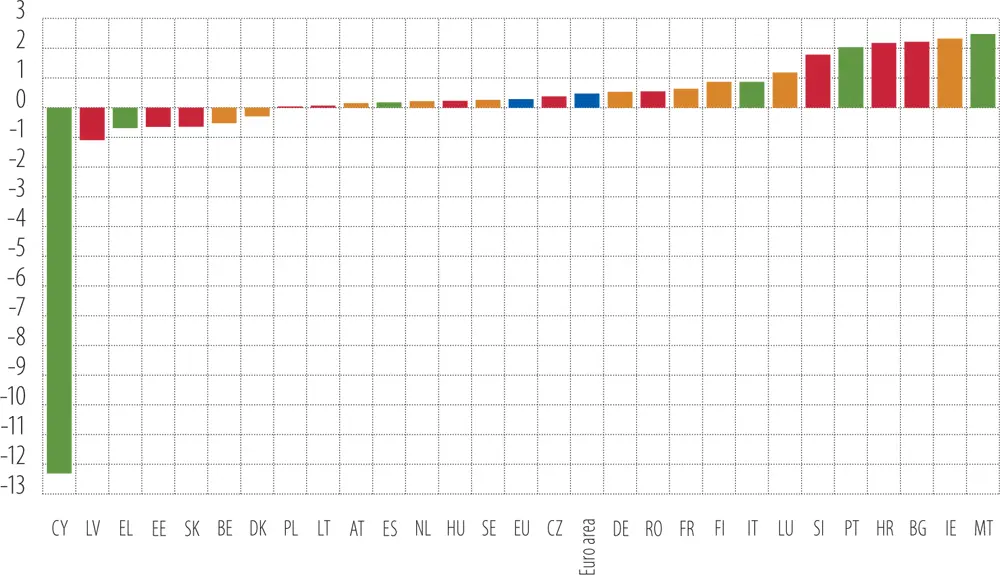

Figure 26

Capital expenditure as a share of primary current expenditure, 2020-2021 change relative to 2017-2019(percentage points)

Source: European Commission’s AMECO database and EIB staff calculations.

Policymakers should keep in mind that historically, government investment has tended to decline substantially following a surprise contraction in GDP (Box A).We argue that this time, the outcome should be different. As a share of GDP, government investment has approached a 25-year low following several years of fiscal consolidation in the wake of the global financial crisis. Infrastructure needs in many European regions have been increasing after years of underinvestment (EIB, 2017; EIB, 2018). Furthermore, the biggest challenges for the future of the European Union – climate change and digitalisation – require even more government investment. At the same time, current ultra-low interest rates are allowing many governments to borrow very cheaply, easing fiscal constraints. Recent high estimates of the impact of government investment on GDP lend further support for an increase (International Monetary Fund (IMF), 2020).

Fiscal sustainability issues, however, require a careful balance between taking on new debt and re-orienting government spending from current to capital expenditure.Low borrowing costs could quickly increase and force fiscal consolidation (Lian, Presbitero and Wiriadinata, 2020). That said, sovereign borrowing costs are historically very low as a result of central-bank purchases of sovereign debt in most EU countries. Theoretically, governments could lock in low interest rates for their bonds if they extended the maturity of their borrowing. However, investor demand for very long-term securities may be low.[17] In addition, debt management offices tend to caution against varying long-established issuance patterns.[18]

Box A

Government investment following recessions and fiscal consolidation

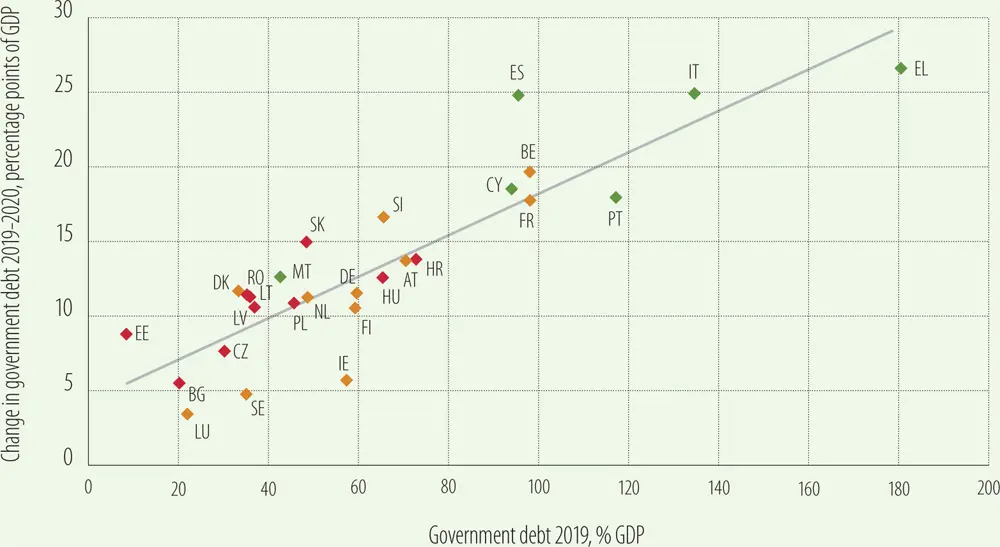

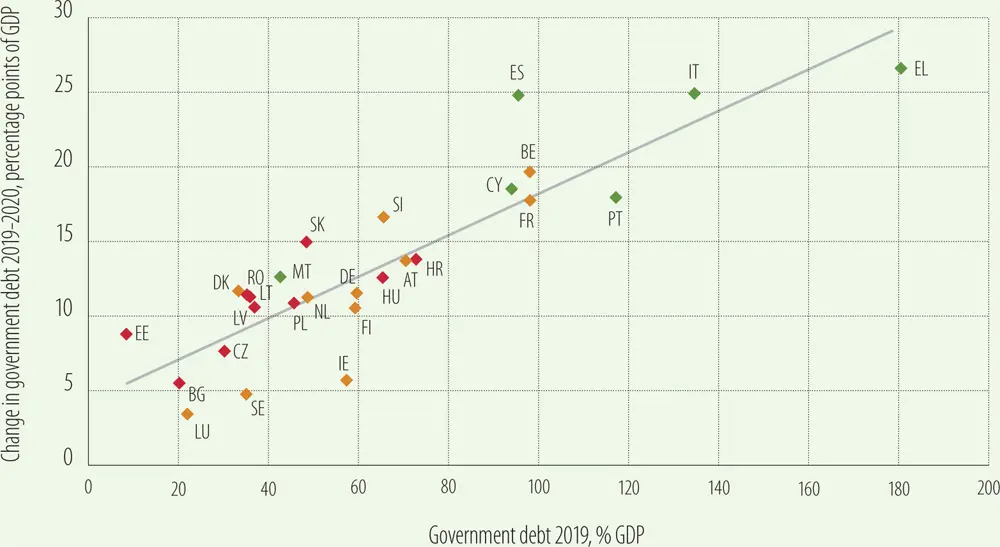

Contingent liabilities and fiscal deficits have climbed rapidly in most EU countries as economic activity collapsed and government support programmes were rolled out. In its 2020 spring forecast, the European Commission estimated that government debt to GDP in the European Union will likely increase by 15 percentage points to 94%. The increase varies substantially across Member States, from 3.4 percentage points in Luxembourg, the country with the third-lowest government debt, to 26.6 percentage points in Greece, the country with the highest ( Figure A.1).

Figure A.1

Increase in government debt, European Union in 2020

Source: AMECO database.

Once the health and economic crises subside, countries will need to rebuild fiscal reserves to deal with future challenges, in particular ageing, structural change, and, in the longer term, climate change (see for instance European Commission, 2020).

Cuts to government investment played an outsized role in previous rounds of fiscal consolidation. Fiscal efforts often entailed a mix in spending cuts and increases in revenues, with increases in revenues playing a bigger part in large-scale consolidations (OECD, 2011). In many countries, belt-tightening involved significant cuts to the largest expenditure items, such as public sector wages and social security spending. However, some expenditures suffered disproportionately. Government investment was sometimes cut vigorously, even though it generally comprises only about 5% of spending. For example, Blöchliger, Song and Sutherland (2012) find that government investment spending as a share of GDP was cut in half, on average, during 13 major rounds of consolidation over 1981-2000. The pressure on investment could be because those cuts encountered less political resistance than reductions in entitlements (for instance, Blöchliger et al., 2012).

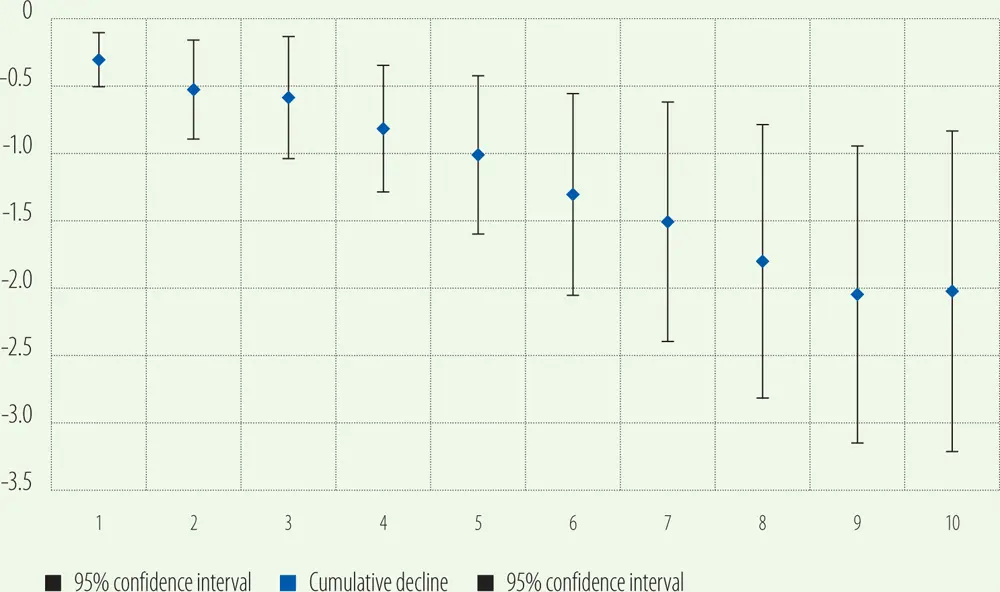

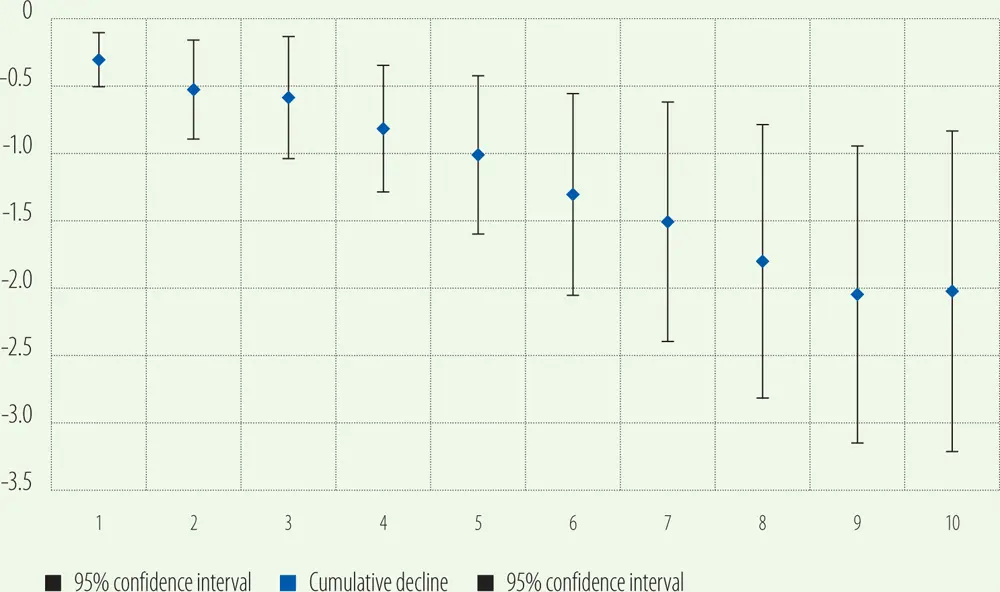

In recent work, we find that the decline in investment following fiscal consolidation was not only large, but also long-lasting. We identify fiscal consolidation, following Alesina and Ardagna (2013), by sustained improvements of the cyclically adjusted primary balance. The estimation strategy is similar to Rioja, Rios-Avila and Valev (2014): the deviation from the trend in the government investment rate is regressed on indicator variables, one for each year since the start of the fiscal consolidation, and a number of relevant controls. The cumulative sum of the coefficients on these indicator variables form the impulse response of government investment to the fiscal consolidation ( Figure A.2). Results illustrate the substantial and persistent effects of fiscal consolidation on government investment. After ten years, the cumulative decline in government investment is about 2 percentage points of GDP. Put differently, ten years after the start of a round of fiscal consolidation, government investment remains, on average, 0.2 percentage points of GDP below the historic trend.

Figure A.2

Deviation of government investment from trend(cumulative percentage points of GDP)

Source: EIB staff calculations.

Government investment also fluctuates significantly more than current expenditure over the business cycle, independently of fiscal consolidation. This suggests that governments find it easier to adjust public investment than current expenditure. To explore the effects of these changes, we have regressed changes in government investment on surprise declines in GDP, using local projections (Jordà, 2005) to estimate the impulse response. The results suggest that a 1% surprise drop in GDP reduces government investment cumulatively by about 3-4% over the following few years ( Figure A.3).

Figure A.3

Cumulative response of government investment after a 1% surprise decline in GDP

Source: EIB staff calculations.

Читать дальше