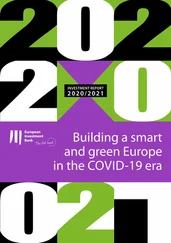

EIB impact report 2020

Climate action, environmental sustainability and innovation for decarbonisation

About the European Investment Bank

The European Investment Bank is the EU bank and the world’s biggest multilateral lender. We finance sustainable investment in small and medium-sized enterprises, innovation, infrastructure, and climate and environment. For six decades, we have financed Europe’s economic growth from start-ups like Skype to massive projects like the Øresund Bridge linking Sweden and Denmark. We are committed to supporting €1 trillion in investment in climate and environmental sustainability to combat climate change by the end of this decade. About 10% of all our investment is outside the European Union, supporting Europe’s neighbours and global development.

Introduction

How the EIB measures its impact

Addressing additionality

Delivering impact

The EIB’s contribution to the UN Sustainable Development Goals

Mapping EIB contributions to the SDGs

EIB impact visualised through the SDGs

Barriers to investment in the European Union

Climate action and environmental sustainability

Research, development and innovation for the decarbonisation of energy-intensive industries

Welcome to the first edition of the European Investment Bank’s new impact report, the successor to the Bank’s annual EIB Operations inside the European Union report.

This new report takes a fresh look at how EIB operations improve lives around the world by measuring the effectiveness of our investments in three key areas:

• Additionality:The EIB’s role is to step in where the market has failed to deliver. The EIB has recently revised its internal procedures to enhance the assessment and measurement of its additionality, ensuring that the Bank’s presence in a project brings a quantifiable improvement over what would have otherwise been possible.

• Impact:The EIB now measures how its investments contribute to the United Nations Sustainable Development Goals (SDG). By doing so, the EIB is signalling its commitment to supporting the United Nations’ Decade of Action to create peace and prosperity for people and the planet. The Bank will continue to report regularly on the impact its global operations have on the SDGs.

• Climate:Because 2020 was the year the EIB assumed its new role as the European Union’s climate bank, this year’s report focuses on barriers to investment in climate action, environmental sustainability and research and development and innovation (RDI) for the decarbonisation of energy-intensive industries. This report takes a closer look at the barriers to investment and innovation, and explores how the EIB’s additionality can help investment in these critical sectors to flourish, making a difference to communities throughout the world.

IN A NUTSHELL

• The EIB delivers additionality and impact all over the world by supporting investment projects that address market failures in a wide variety of economic sectors, improving social welfare across the globe.

• In terms of contributions to the SDGs, the EIB’s reach is most notable in climate action and environmental sustainability, as well as in infrastructure investments.

• The EIB observes and identifies the investment barriers that can hold back projects and slow down economic development. The EIB’s long-time involvement and experience in financing a broad range of investment projects allows it to develop solutions that address some of these investment barriers.

• Fragmented regulation and fragmented markets across Europe, difficulties coordinating public funds and a lack of planning for public sector investments are holding back projects dealing with climate action, environmental sustainability and research and development for the decarbonisation of energy-intensive industries.

• The EIB has been able to improve the viability of projects by blending financing with the European Commission, by focusing on financial intermediaries that cater for small businesses working on climate action and environmental sustainability and by providing advisory services for investment projects.

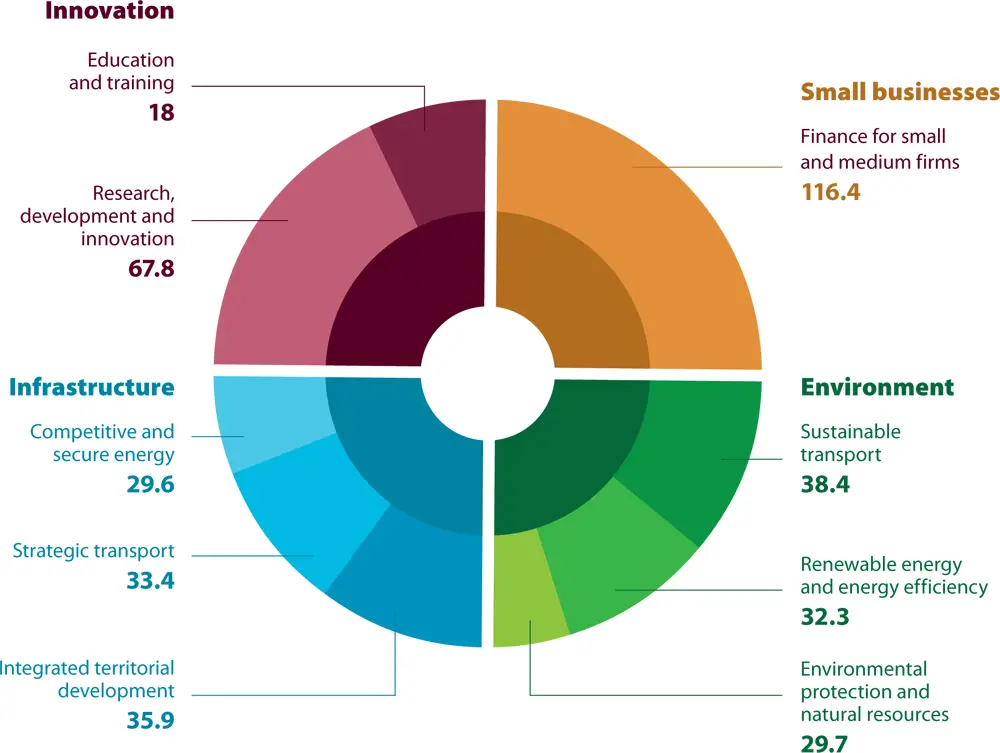

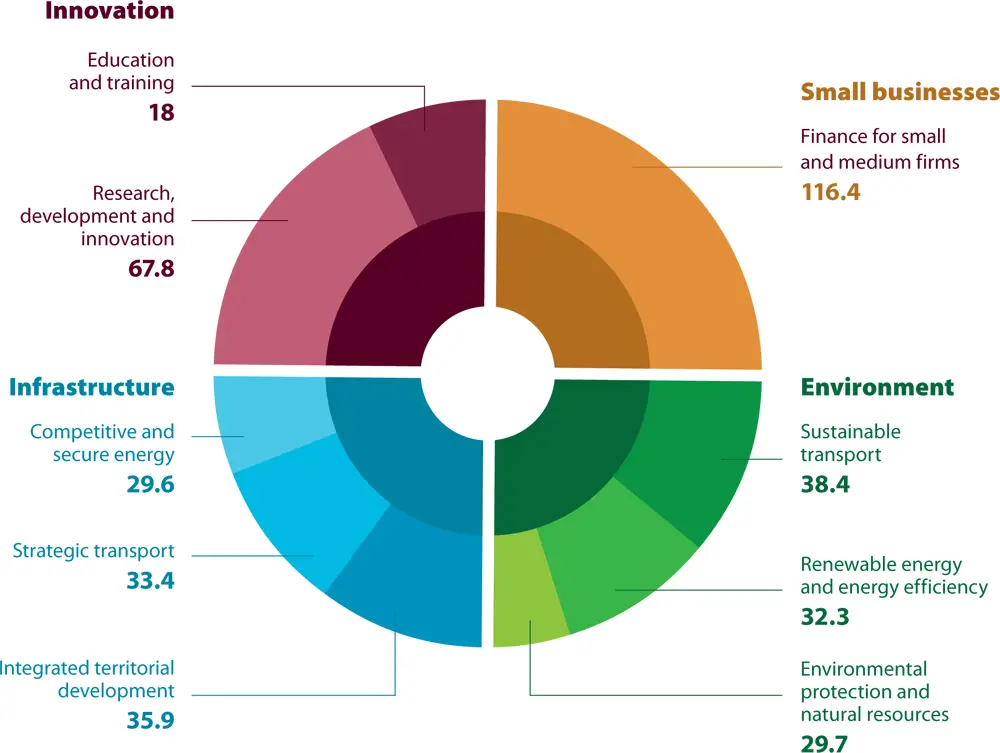

Lastly, the report also provides a more technical assessment of the challenges facing investors in the economic sectors in which the EIB is particularly active. As the following chart illustrates, the Bank’s lending supports projects in a wide range of sectors in the European Union and beyond.

EIB’s lending mix over 2015-2020 (€ billion)

More information relating to EU operations is available on the EIB’s website, in the form of project storiesand data.

How the EIB measures its impact

This report is aimed primarily at readers who already have a certain familiarity with the Bank. It highlights the additionality of the Bank’s involvement in the projects it finances.

As the European Union’s bank, the EIB is charged with implementing public policy. In that role, the Bank ensures that all operations meet its requirements of additionalityand impact, and are eligiblefor its support.

What is additionality? Additionality refers to how the Bank’s intervention can enable or strengthen a project — typically a project that could also benefit public welfare — in a way that the market alone would not achieve. When markets fail to function efficiently, they often do not generate socially desirable outcomes. Market failures can inhibit private sector investors from delivering the optimal level, scope and/or quality of investment for societies, providing room for public banks, such as the European Investment Bank (EIB), to make a difference. If the market failure did not exist, the private sector would likely have made the needed investment.

The Bank’s eligibilityrules ensure that activities are in line with the EIB statutes and EU policy objectives. All projects financed by the Bank must contribute to the EIB’s goals in its main spheres of activity: sustainable cities and regions; sustainable energy and natural resources; innovation, digital and human capital; small and medium-sized enterprises (SMEs) and mid-cap finance; climate action and environmental sustainability; and economic and social cohesion.

An EIB loan will help ArcelorMittal meet its decarbonisation objectives.

Until the end of 2020, the EIB used its Three Pillar Assessment (3PA) to measure additionality and impact for its EU projects, while projects outside the European Union were assessed using the Results Measurement framework (ReM). Both methodologies rated projects according to criteria that fell under three main pillars: the furthering of EU policy objectives; project quality and soundness; and the EIB’s contribution to the project. The charts below illustrate the 2020 performance of the EIB’s different products under each pillar.

Читать дальше