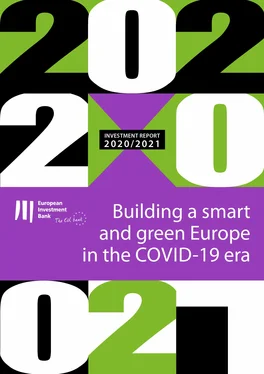

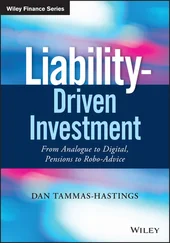

Figure 23

Annual non-PPP project activity by asset share

Source: IJ Global.

Note: Distribution across asset class of the total annual value in euros of non-PPP projects brought to financial close in EU27. 2020 includes deals brought to financial close by 30 June 2020.

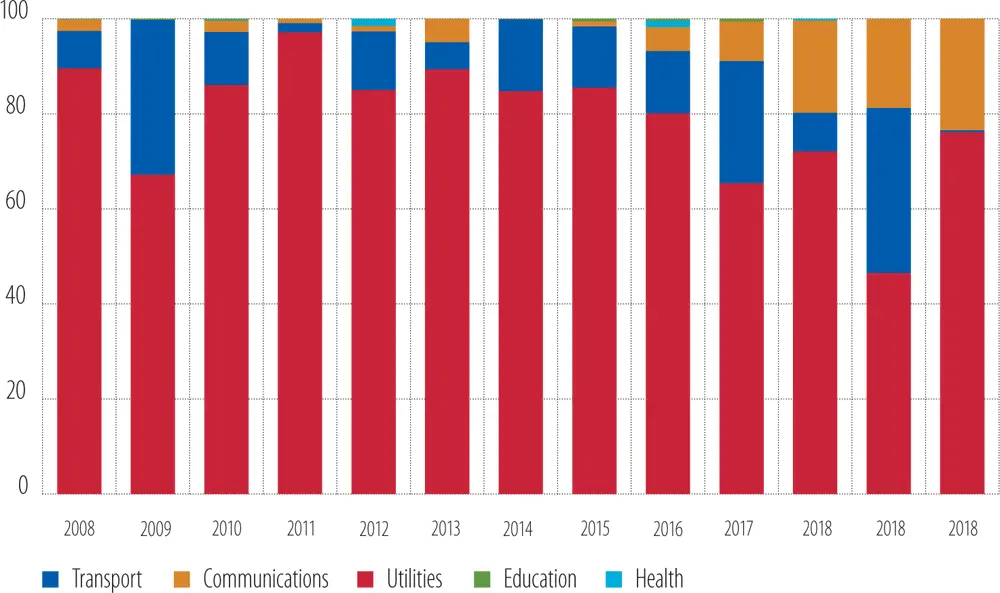

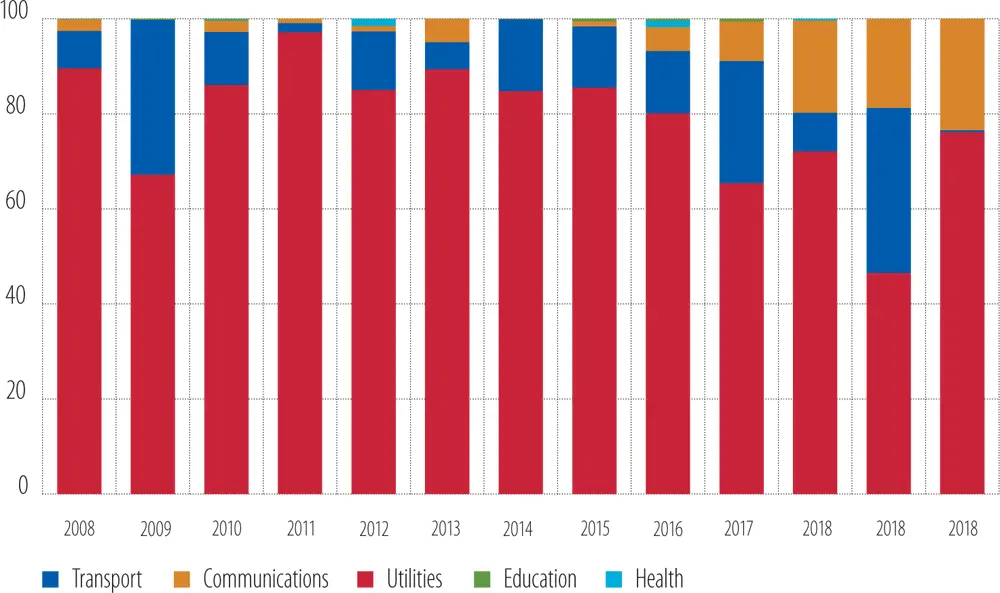

Government investment showed a mild upward trend in the European Union before the coronavirus outbreak.As a share of GDP, government investment reached 3% in 2019 (from 2.8% in 2016, the lowest level in 25 years) compared with an average of 3.2% for 1995 to 2016. It increased in Western and Northern Europe and in Central and Eastern Europe, but continued to decline slightly in Southern Europe. In 2019, investment spending came to 4.2% of GDP in Central and Eastern Europe, 3.1% in Western and Northern Europe and 2.2% in Southern Europe. The low level of investment was fairly consistent across Southern Europe, without major differences between countries, except Malta, which had a much higher share at 3.8%.[13] The differences among countries in the other regions is much greater, ranging from 3.1% in Lithuania to 6% in Hungary in Central and Eastern Europe, and from 2.3% in Ireland to 4.9% in Sweden for Western and Northern Europe.

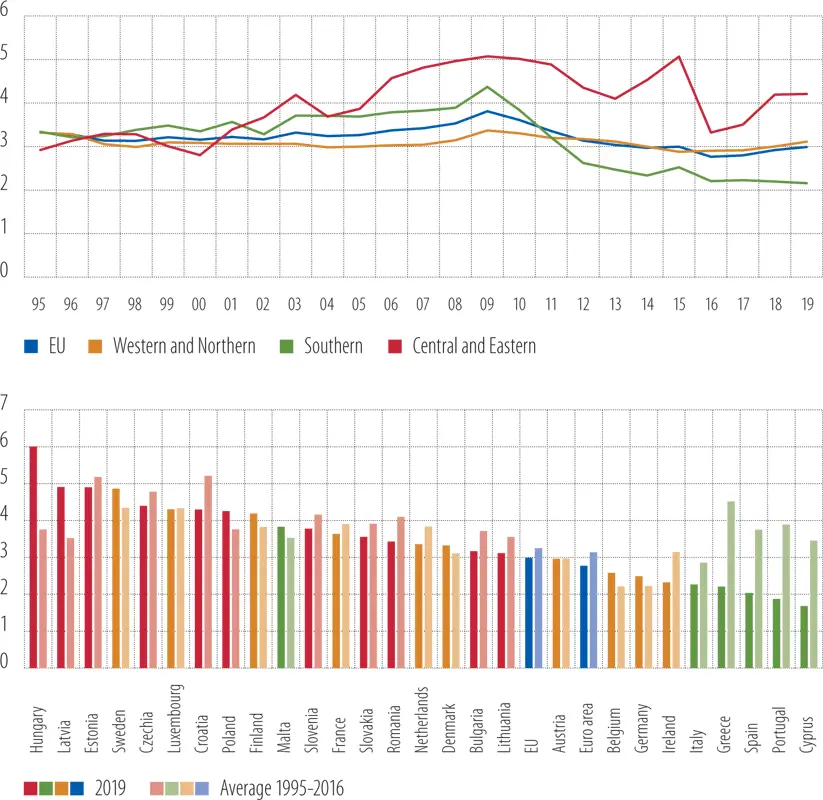

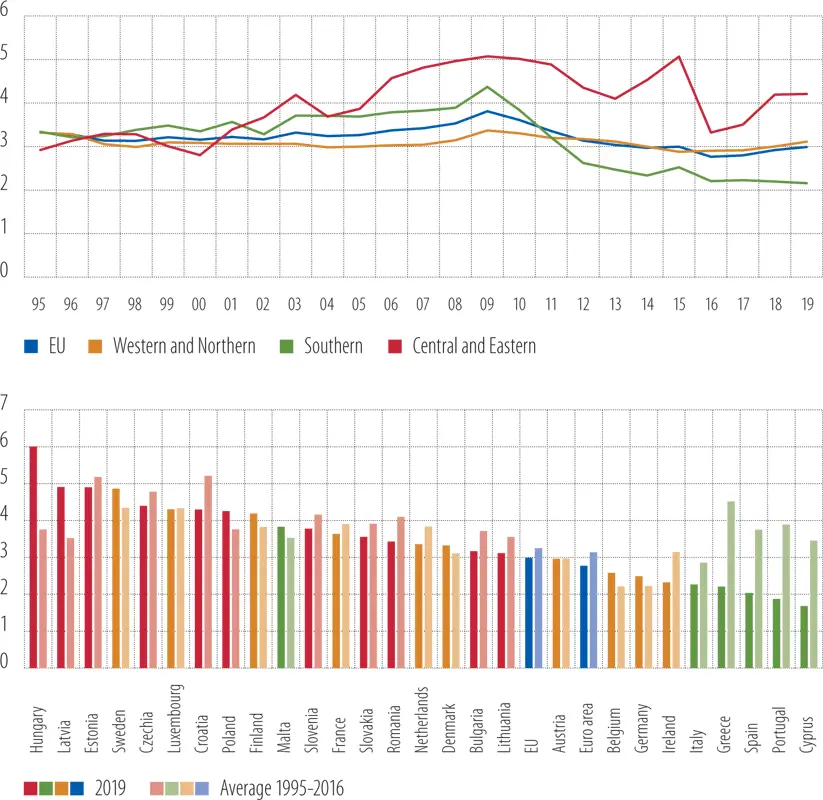

In the last three years, capital transfers and investment have fallen below the average witnessed in 1995-2016.Interest spending registered a larger drop, while primary current expenditure is higher than its historical average. This suggests that the wide reduction in the debt service burden has not translated into support for capital spending. The balance between current and capital expenditure, particularly in Southern Europe, has tilted in favour of current spending.

Figure 24

Government investment as a share of GDP

Source: European Commission’s AMECO database, top panel country groups’ time series, bottom panel 2019 vs. 1995-2016 average.

Figure 25

Capital expenditure, primary current expenditure and interest

Source: European Commission’s AMECO database.

The COVID-19 crisis caused current spending to rise notably, which was reflected in the budget plans of EU Member States.EU members first submitted (at the end of April 2020) streamlined versions of their Stability and Convergence Programmes, including a first assessment of the pandemic’s impact on policies and public accounts. Then, around mid-October, members of the euro area submitted their draft budget plans for 2021. Combining these two sources with the European Commission’s autumn economic forecast allows us to assess the pandemic’s impact on fiscal policy.

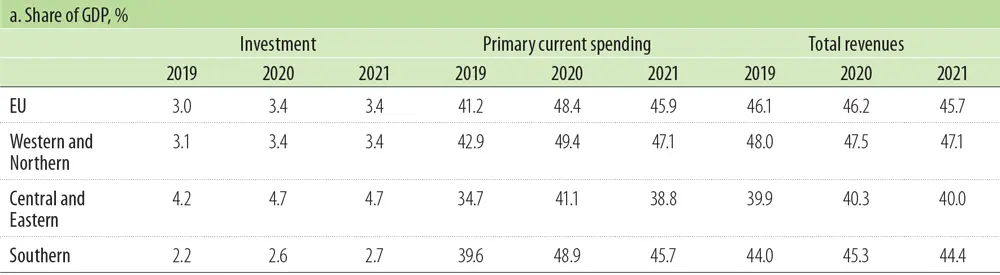

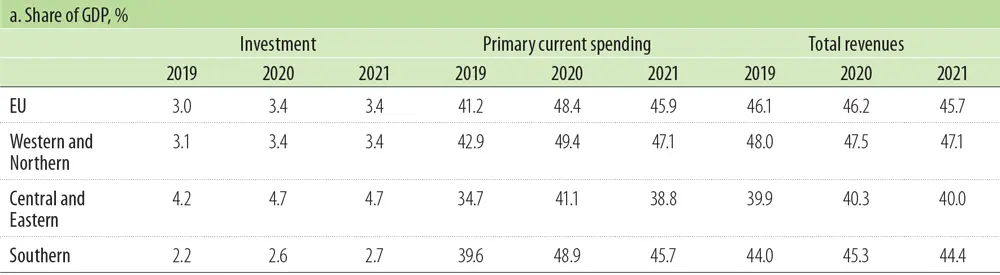

Current expenditure increased substantially in 2020. Table 1ashows that revenues, as a share of GDP, are roughly constant, meaning that they are declining in line with the contraction in GDP. Total expenditure, on the contrary, is increasing as a share of GDP because of the emergency measures taken by Member States, the vast majority of which go under the heading of primary current expenditure.[14] This category of spending is growing significantly as a share of GDP (from 41.2% to 48.4%) and compared with the 2019 level (up 10.8%). The bulk of the spending is for unemployment benefits and subsidies to support incomes. The jump in current expenditure will be partially re-absorbed in 2021, when its share of GDP should decline to 45.9%. Current spending is also expected to dip in 2021, by 0.2%.

Table 1

Government budgets as a share of GDP, nominal growth rates year-on-year

Source: European Commission’s AMECO database, European Commission’s autumn forecasts.

The European Commission’s autumn economic forecast suggests notable growth in public investment in the aftermath of the COVID-19 crisis.Investment’s share of GDP is projected to increase to 3.4% in 2020, up from 3% in 2019. Compared to 2019, the amount spent on government investment will rise by 5.2% in nominal terms. The levels are not homogeneous across regions. In 2020, investment growth will be a little weaker in Western and Northern Europe (4.5% in 2020) and stronger in Southern Europe (7.5%) while in Central and Eastern Europe, public investment will grow by 5.6%. Government investment’s share of GDP will increase in all three regions. In 2021, the share will continue to increase in Southern Europe (2.7%), with nominal growth of 6.8%. The share will stabilise at 3.4% in Western and Northern Europe and at 4.7% in Central and Eastern Europe.

Governments are planning more investment to support the recovery, particularly in 2021.The expenditure targets included in the draft budget plans for 2021 submitted by euro area members suggest a more expansionary path, with a more prominent role for government investment. The largest differences between these plans and the European Commission’s forecasts of the target share of GDP for government investment are for Greece (6.6% vs. 4.1%), Estonia (6.7% vs. 5.9%), Italy (3.4% vs. 2.7%), Slovenia (6.24% vs. 5.8%), Spain (2.8% vs. 2.4%) and France (4.2% vs. 3.9%). If achieved, these targets will imply notably stronger investment growth, particularly in Southern Europe. For example, the Greek draft budget plan foresees an increase in the share of investment in GDP from 2.2% in 2019 to 3.6% in 2020 and 6.6% in 2021. Those increases will bring the share of investment in GDP in Southern Europe almost in line with the EU average (3.3% vs. 3.6%) in 2021.

Table 2

Government investment: Draft budget plans and European Commission’s autumn economic forecast

Source: European Commission’s autumn economic forecast and euro area members’ draft budget plans.

The prospect of activating the Recovery and Resilience Facility and the Multiannual Financial Framework (MFF) for the 2021-2027 budget period is enabling Member States to focus on capital expenditure in their 2021 budgets.The European Union’s recovery programme allows for a longer-term perspective. Without it, the marked increase in public deficits may have reduced governments’ ability to support the recovery by spending on investment. This is particularly evident when comparing the draft budget plan submitted in October with the European Commission’s spring forecasts. Aggregating the numbers shows that the planned increase in investment in 2021 is EUR 40 billion higher, with a share of GDP that is around 0.3% higher than in the forecast.[15] Many draft budget plans include references to the RRF, a central pillar of the NextGenerationEU recovery programme, as a key factor in the medium term.

Some Member States have discussed or already approved plans that aim to support the economy amid the COVID-19 crisis.Early June, Germany approved a large package worth EUR 52.8 billion for 2020-2021 that mainly consists of government investment. Part of the package includes EUR 15 billion supporting e-mobility, EUR 11 billion for artificial intelligence, communication technologies and networks, and EUR 15.3 billion for the digitalisation of public administration and local authorities. Investment in hydrogen technology (EUR 9 billion) and R&D (EUR 2.3 billion) is also planned. France has designed a support package that includes EUR 4.6 billion for the aerospace industry, including military and civil security purchases, along with EUR 8 billion for the automotive sector and its supply chain. The Spanish government set EUR 1 billion aside for strengthening science, technology and innovation and established a regional fund for investments in education (EUR 2 billion) in addition to EUR 9 billion for healthcare spending. As part of their extraordinary measures, many countries allocated funds to shoring up the automotive industry, which remains the easiest way to stimulate demand and activate a large and mainly local production chain. This effort involves incentives for renewing vehicle fleets, favouring low-emission vehicles. The automotive initiative includes the European Union’s largest Member States, namely France, Spain, Germany and Italy.

Читать дальше