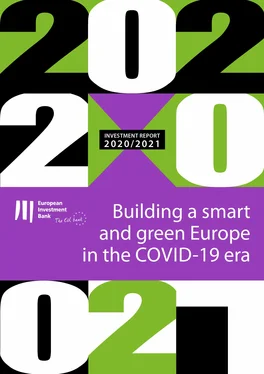

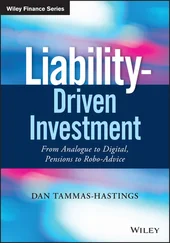

Figure 11

Change in investment in 2020(% of all firms)

Source: EIBIS 2020.

Base: All firms (excluding don’t knows/refusals to respond).

Note: The figure shows the 10 th, 25 th, 50 th, 75 thand 90 thpercentiles and the average (diamonds) of firm-level total factor productivity.

Question: For the current financial year, do you expect your investment to be more than last year, around the same or less than last year (panels a, b and c); How many people did your company employ three years ago (panel b).

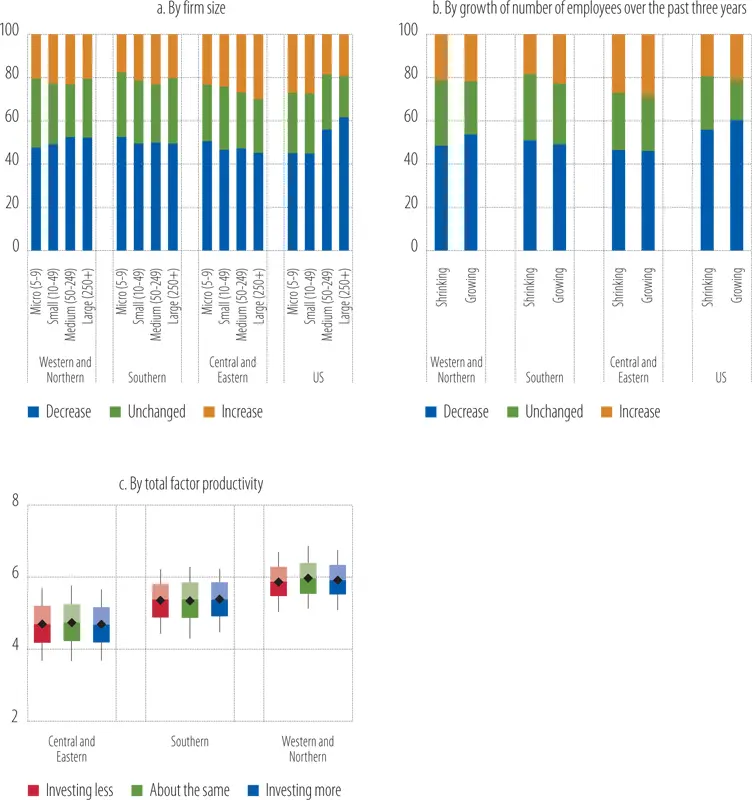

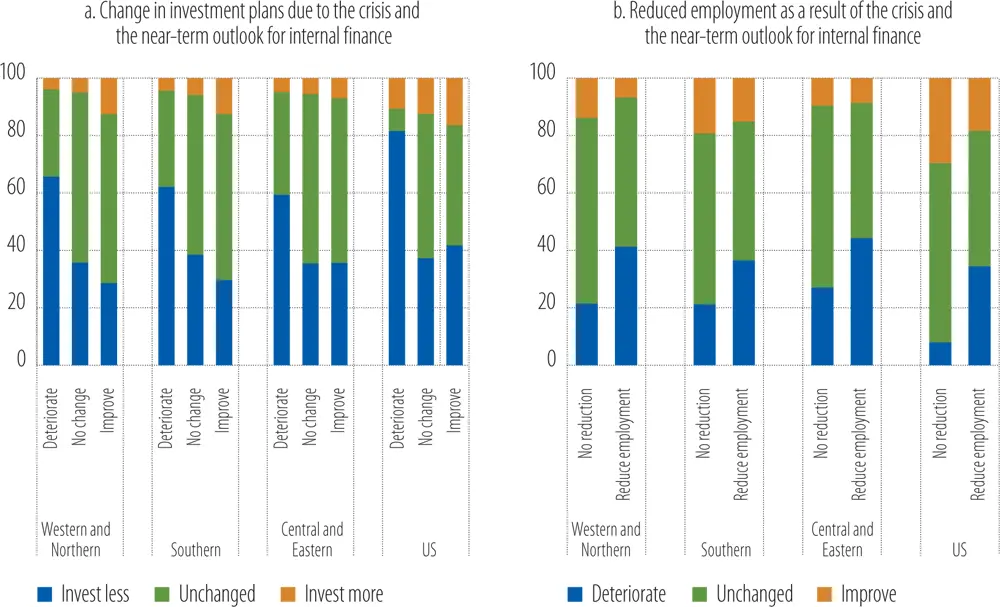

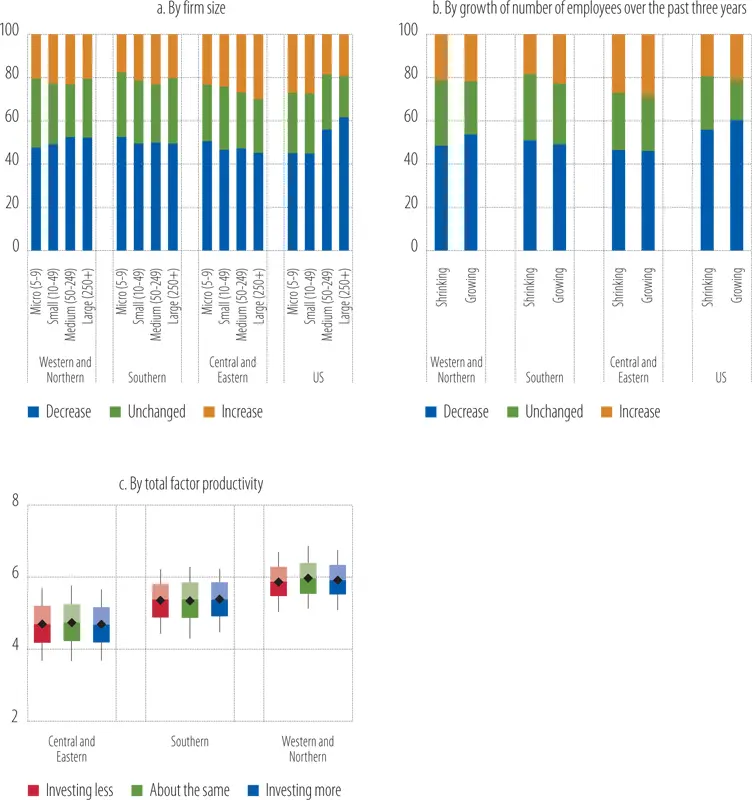

The impact of COVID-19 on firms’ investment plans varied by sector (Figure 12b).The bars on Figure 12bplot the share of firms in each sector that reduced employment due to the pandemic. Each bar is further split according to the pandemic’s impact on investment plans. For the hospitality sector (accommodation), for instance, 89.6% of firms took measures to reduce their labour input, and 53% of these firms also reduced investment plans as a result of the coronavirus. In contrast, slightly more than 40% of firms in the water sector took steps to reduce their labour force, while only 14% of these firms reduced their investment plans because of the pandemic. The ranking in Figure 12bis not surprising, given that the operations of these businesses, especially in the first four sectors, were the most affected by government restrictions and social distancing measures. At the opposite end of the spectrum, utility companies were the least affected by the measures to contain the pandemic and, accordingly, their investment plans were less affected.

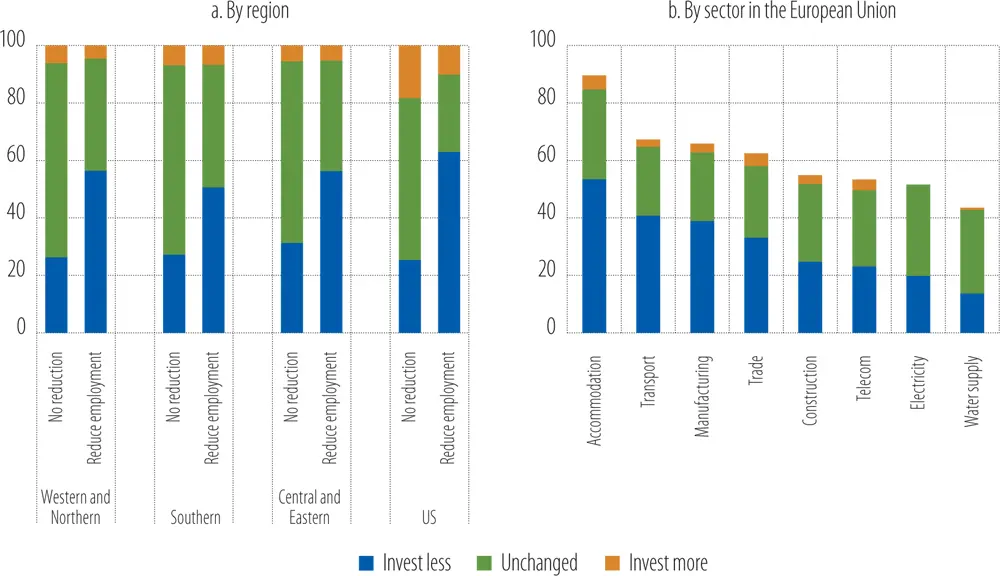

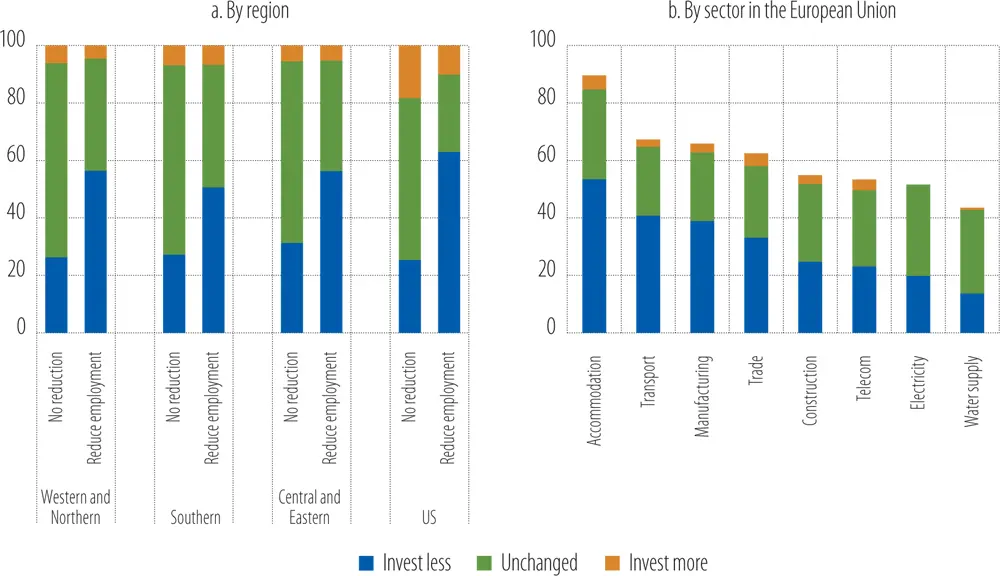

Uncertainty, deteriorating economic sentiment, and the uneven impact of social distancing measures are behind the sector divergence.Many businesses in the hospitality, transport, retail and manufacturing sectors were not able to carry out their investment activities, especially at the beginning of the second quarter of 2020, as they were constrained by social distancing measures. Despite easier conditions in the third quarter, however, it seems that most firms are unwilling to make up the lost ground. Firms are postponing their investment plans amid uncertainty and expectations of a further deterioration in business prospects and the general economic outlook ( Figure 13aand Figure 13b).

Figure 12

COVID-19 impact on use of labour services and on investment plans

Source: EIBIS 2020.

Base: All firms (excluding don’t knows/refusals to respond).

Note: Sectors correspond to the NACE Rev. 2 classification of economic activities in the European Union as follows: manufacturing is section C; electricity is section D (electricity, gas, steam and air conditioning supply); water supply is section E (water supply; sewerage, waste management and remediation activities); construction is section F; trade is section G (wholesale and retail trade; repair of motor vehicles and motorcycles); transport is section H (transportation and storage); accommodation is section I (accommodation and food service activities); and telecoms is section J (information and communication).

Question: Thinking about the impact of coronavirus, have you had to put staff temporarily on leave, make staff redundant or unemployed or reduced the number of hours they work compared to before the coronavirus pandemic? Has your company’s overall investment expectations for 2020 changed due to coronavirus? Will your company invest more, invest less or keep investment broadly the same?

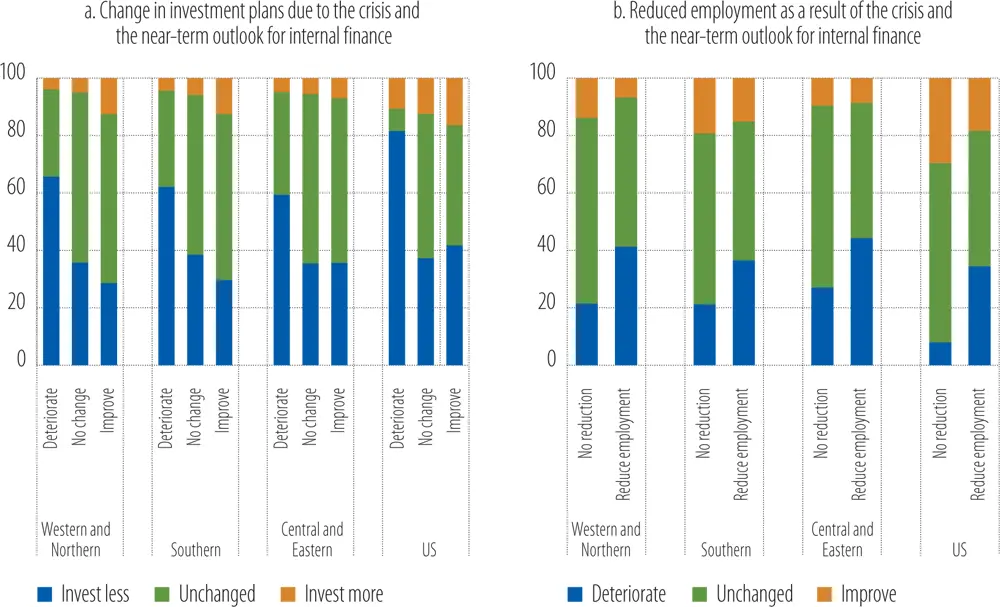

Optimism about a rebound in investment in 2021 may be premature, however.While increased uncertainty and the deterioration in the economy in the first half of 2020 had the strongest impact on investment, firms also said they expected difficulties with finance, especially internal finance. This should come as no surprise as cash flows have retreated well into negative territory, especially in some sectors (see also the analysis in Chapter 3).

Firms that are more affected by the pandemic are significantly more pessimistic about their ability to finance investment internally over the next 12 months (Figure 14).The decline in sales caused by the lockdown resulted in low or negative cash flows for many firms. Some of those firms were obliged to draw down their liquidity as a result, which will affect their overall capital and, ultimately, their net worth ( Chapter 3). These firms have lower internal funds to finance investment and are more likely to face worsening conditions for external finance because of their lower net worth.[8] Furthermore, the firms most affected by the crisis are often small and therefore even more exposed to finance difficulties. Unless these firms receive fresh capital, their investments are very likely to remain low beyond 2020, even in an economic recovery.

Figure 13

Change in investment in 2020(by sector)

Source: EIBIS 2020.

Base: All firms (excluding don’t knows/refusals to respond).

Note: See explanations about sectors in the notes to Figure 12.

Question: Thinking about your investment activities, to what extent is uncertainty about the future an obstacle? Is it a major obstacle, a minor obstacle or not an obstacle at all? Do you think that business prospects specific to your sector or industry will improve, stay the same, or get worse over the next 12 months?

Less competitive firms with small cash holdings plan to invest less in 2020 (Maurin and Pal, 2020).Firms that were not profitable in 2018-2019 are much more likely to have pulled back their investment plans as a result of the pandemic, especially in Western and Northern Europe and in Southern Europe ( Figure 15a). In previous EIBIS waves, these firms were typically less productive than profitable firms[9] and their liquidity was significantly lower. Figure 15bplots the cash-to-total assets ratio as a function of previous-year pre-tax profits, calculated using the matched EIBIS-Orbis database.[10] It shows that less profitable firms hold much less cash, as a share of total assets, than profitable ones. Firms with higher cash buffers can withstand a shock to cash flow much better, and they are better able to survive the shock and to continue to grow and invest (Joseph, Kneer, van Horen and Saleheen, 2020).

Figure 14

Impact of the COVID-19 crisis on internal finance

Source: EIBIS 2020.

Base: All firms (excluding don’t knows/refusals to respond).

Question: Do you think that availability of internal finance will improve, stay the same, or get worse over the next 12 months? Thinking about the impact of the coronavirus, have you had to put staff temporarily on leave, make staff redundant or unemployed or reduce the number of hours they work compared to before the coronavirus pandemic? Has your company’s overall investment expectations for 2020 changed due to coronavirus? Will your company invest more, invest less or keep investment broadly the same?

Figure 15

Читать дальше