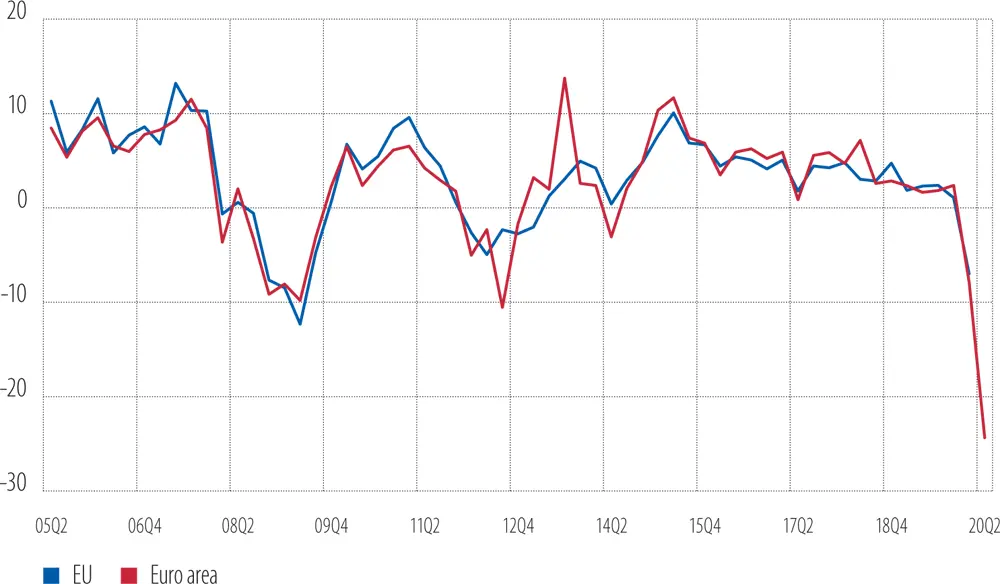

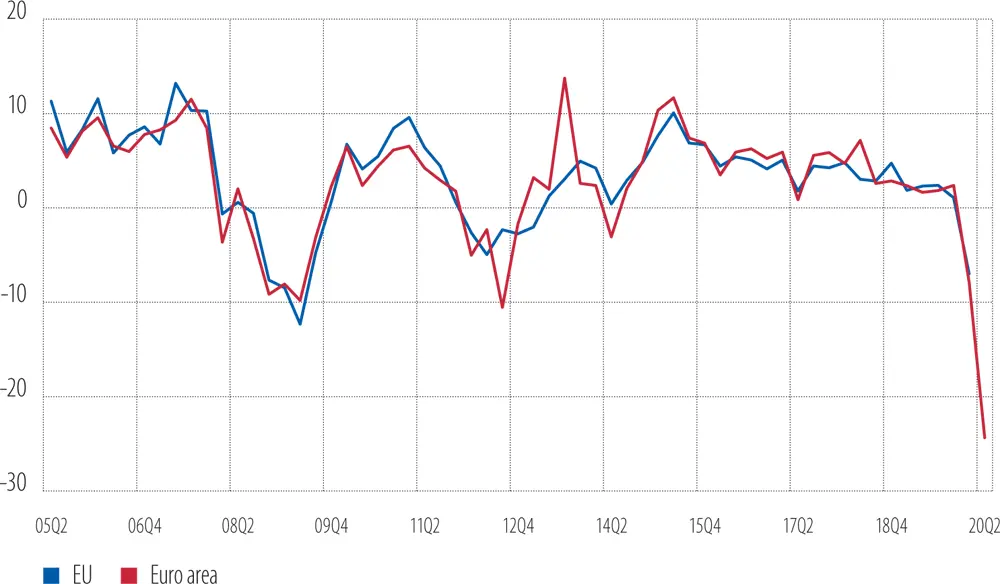

Figure 7

Gross entrepreneurial income of non-financial firms(% change vs. a year ago)

Source: Eurostat.

Corporate investment

Investment cycle and outlook

The near-term outlook for firms deteriorated significantly with the onset of the coronavirus pandemic.Expectations of non-financial corporations about the overall economic climate, as well as the business prospects in their own sectors and the availability of finance, had already deteriorated in 2019, as documented in last year’s edition of the investment report (EIB, 2019). Still, the situation had worsened considerably by this summer with the EIBIS 2020 survey ( Figure 8). A net balance of [6] 57% of firms in the European Union expect the economic climate to deteriorate in the next 12 months. About 25% (in net terms) expect business prospects to deteriorate in their sector or industry. The ability of firms to fund their own investments is expected to deteriorate. The percentage of firms that said they expected a net improvement in their ability internally finance their investments over the following 12 months was 18% in 2019. By 2020, however, 23% (in net terms) of firms said they expected the situation to deteriorate in the next 12 months. Expectations about the availability of external finance are broadly neutral following the massive interventions from the European Central Bank, national governments and the European Union (see Chapters 1and 3).

Figure 8

Investment drivers in the European Union, firms expecting an improvement/deterioration(net balance)

Source: EIBIS 2016, EIBIS 2017, EIBIS 2018, EIBIS 2019 and EIBIS 2020.

Base: All firms (excluding don’t knows/refusals to respond).

Question: Do you think that each of the following will improve, stay the same, or get worse over the next 12 months?

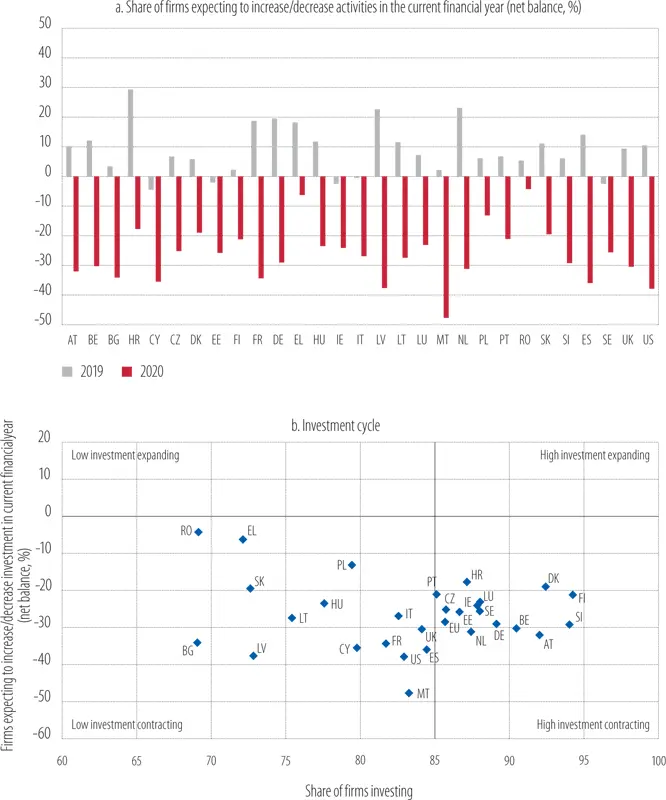

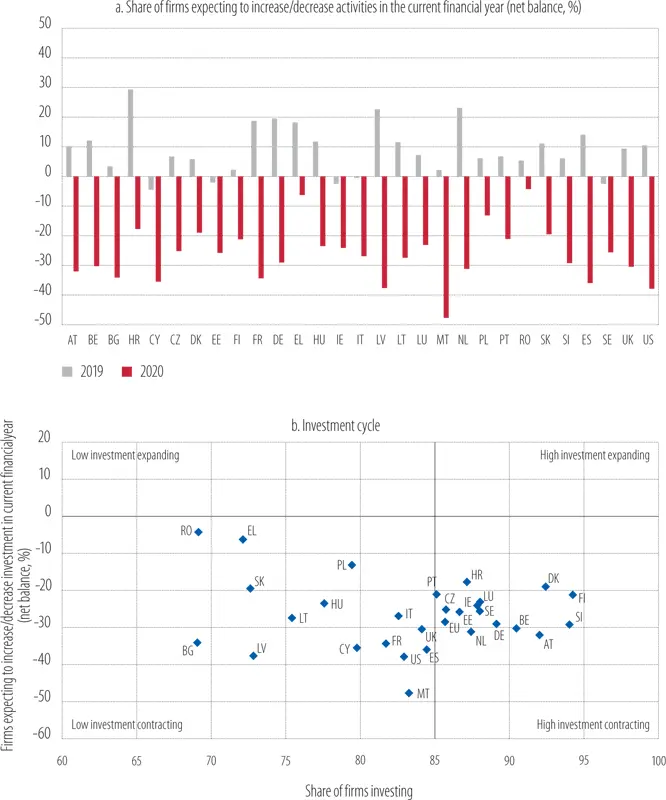

Expected investment for the current year also plummeted, in line with the extraordinary deterioration in economic sentiment (Figure 9).Planned investment changed from an EU average of 13% (in net terms) of firms expecting an increase in 2019 compared to the prior year, to an EU average of 28% (in net terms) of firms expecting a decrease in investment in 2020 compared to the prior year. Country variations are significant ( Figure 9a) – from a 60 percentage point deterioration in Latvia to a 9.6 percentage point contraction in Romania. As discussed above, some of this decline can be explained by the pandemic. While it is still too early to assess the direct impact of government lockdowns and other restrictions on investment, those restrictions are expected to account for only part of the decline, given their relatively short duration. Deteriorating expectations about the economy and substantial uncertainty about the “new normal” will most likely explain a significant portion of the decline in investment in 2020.

Figure 9

Corporate investment dynamics

Source: EIBIS 2019 and EIBIS 2020.

Base: All firms (excluding don’t knows/refusals to respond). Share of firms investing shows the percentage of firms whose investment per employee is greater than EUR 500. The y-axis crosses the x-axis at the EU average in the previous four waves.

Note: Net balances show the differences between firms expecting to increase investment activities in the current financial year and firms expecting to decrease them.

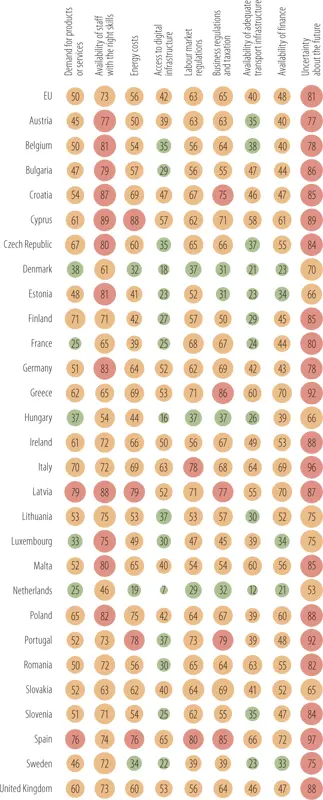

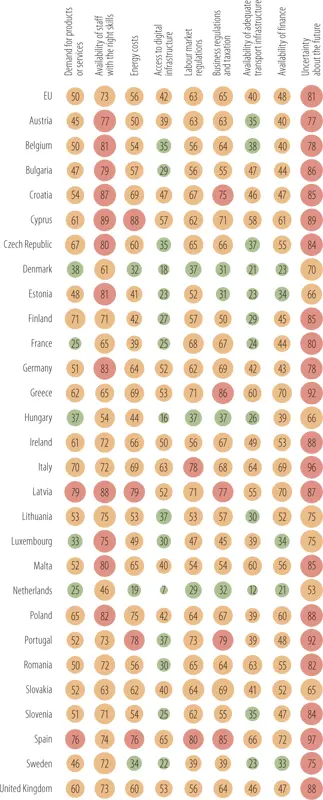

Figure 10

Barriers to investment by country

Source: EIBIS 2019.

Base: All firms (excluding don’t knows/refusals to respond).

Note: A red circle means that the share of mentions of a particular obstacle is in the top quartile; a green circle means that it is in the bottom quartile; an orange circle that it is between the two. The size of the circle and the number inside indicate the share of firms mentioning an area (as either a minor or a major obstacle).

Firms in almost all countries in the EIBIS see uncertainty about the future as the most significant impediment to investment in 2020 (Figure 10).Uncertainty has overtaken the availability of workers with the right skills as firms’ major concern. Firm perceptions vary substantially depending on the country. In Spain, 97% of non-financial firms say uncertainty is an impediment to investing, whereas in the Netherlands, only 53% do. The second largest impediment in almost all countries is the availability of staff with the right skills. In Austria, Cyprus and Lithuania, lack of skills ties with uncertainty as the most reported impediment to investment. In Belgium, Croatia, Estonia, Germany, Latvia and Luxembourg, the availability of staff with the right skills is the top impediment to investment for non-financial firms, unchanged from the past two years.

Short-term impact of the pandemic

In the European Union, 45% of firms have decided to reduce their investments in 2020 because of the COVID-19 crisis.Nearly half of these firms say they will postpone their investments. Another 40% of these firms will change or rescale their pre-pandemic plans and only slightly less than 5% intend to abandon their investment plans altogether.[7] Six percent (net) of firms that did not change their investment because of the pandemic say they will increase investment in 2020, while more than 40% in this group have not changed their investments relative to 2019. Slightly more than half of the firms that have not changed their plans are large, profitable firms for which the availability of finance is not a great concern.

Plans to adjust investment in 2020 vary little across firm size or other characteristics.The share of firms reducing their investments in 2020 is remarkably similar across size classes ( Figure 11a). In previous EIBIS waves, the share of medium and large firms increasing investment was, on average, 10 percentage points higher than for micro and small firms. In the United States and in Western and Northern Europe, a bigger share of medium and large firms are reducing their investments in 2020 compared to smaller firms. Differences in investment plans are likewise small or non-existent across firms with different growth dynamics over the past three years, or different average and median productivity profiles ( Figure 11band Figure 11c).

Firms cut employment radically following the coronavirus outbreak.In EIBIS 2020, the pandemic caused about 55% of firms to reduce to some extent their staff through layoffs, redundancies, unpaid temporary leave and cuts to working hours. The share varies significantly across regions – from 45% in Central and Eastern Europe to slightly more than 60% in Southern Europe. Medium and large firms tend to make smaller adjustments that affect up to a quarter of their employees, whereas smaller firms tend to make larger adjustments that involve half or more of their employees.

Regions where firms are more likely to reduce employment because of the pandemic are likely to see cuts in investment as well.Firms that reduced employment due to the COVID-19 crisis are twice as likely to have also revised downwards their investment plans due to the pandemic ( Figure 12a). This is the case for all three regions within the European Union as well as for the United States.

Читать дальше