Michael Isichenko - Quantitative Portfolio Management

Здесь есть возможность читать онлайн «Michael Isichenko - Quantitative Portfolio Management» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Quantitative Portfolio Management

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

Quantitative Portfolio Management: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Quantitative Portfolio Management»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

, distinguished physicist-turned-quant Dr. Michael Isichenko delivers a systematic review of the quantitative trading of equities, or statistical arbitrage. The book teaches you how to source financial data, learn patterns of asset returns from historical data, generate and combine multiple forecasts, manage risk, build a stock portfolio optimized for risk and trading costs, and execute trades.

In this important book, you’ll discover:

Machine learning methods of forecasting stock returns in efficient financial markets How to combine multiple forecasts into a single model by using secondary machine learning, dimensionality reduction, and other methods Ways of avoiding the pitfalls of overfitting and the curse of dimensionality, including topics of active research such as “benign overfitting” in machine learning The theoretical and practical aspects of portfolio construction, including multi-factor risk models, multi-period trading costs, and optimal leverage Perfect for investment professionals, like quantitative traders and portfolio managers,

will also earn a place in the libraries of data scientists and students in a variety of statistical and quantitative disciplines. It is an indispensable guide for anyone who hopes to improve their understanding of how to apply data science, machine learning, and optimization to the stock market.

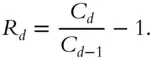

is defined as the relative change in the closing price

is defined as the relative change in the closing price  from previous day

from previous day  to current day

to current day  :

:

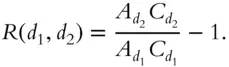

so (1.1)give a correct return on investment after the adjustment. In general, a multi-day return from day

so (1.1)give a correct return on investment after the adjustment. In general, a multi-day return from day  to day

to day  equals

equals

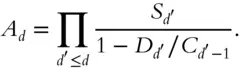

is used only in a ratio across days and is therefore defined up to constant normalizing coefficient. There are two ways of price adjustment: backward and forward. The backward adjustment used, for example, in the Bloomberg terminalis normalized so today's adjustment factor equals one and changes by cax events going back in time. On a new day, all values

is used only in a ratio across days and is therefore defined up to constant normalizing coefficient. There are two ways of price adjustment: backward and forward. The backward adjustment used, for example, in the Bloomberg terminalis normalized so today's adjustment factor equals one and changes by cax events going back in time. On a new day, all values  are recomputed.

are recomputed. starts with one on the first day of the security pricing history and then changes as

starts with one on the first day of the security pricing history and then changes as

or

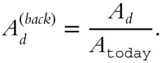

or  . The past history of the forward adjustment is not changed by new entries. Therefore, the forward adjustment factor can be recorded and incrementally maintained along with price-volume data. If backward adjustment factor is desired as of current date, it can be computed as

. The past history of the forward adjustment is not changed by new entries. Therefore, the forward adjustment factor can be recorded and incrementally maintained along with price-volume data. If backward adjustment factor is desired as of current date, it can be computed as

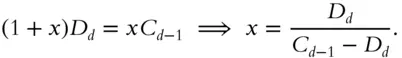

are always known in advance. One perfectly logical, if impractical, way to reinvest a dividend

are always known in advance. One perfectly logical, if impractical, way to reinvest a dividend  (including a monetized spin-off) per share is to borrow cash to buy

(including a monetized spin-off) per share is to borrow cash to buy  additional shares of the same stock at the previous day close and then return the loan the morning after from the dividend proceeds. To stay fully invested, the total dividend amount

additional shares of the same stock at the previous day close and then return the loan the morning after from the dividend proceeds. To stay fully invested, the total dividend amount  must equal the loan amount

must equal the loan amount  , therefore

, therefore

stock split. If there is also a post-dividend split

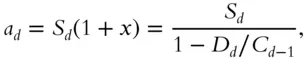

stock split. If there is also a post-dividend split  , one-day adjustment factor equals

, one-day adjustment factor equals

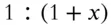

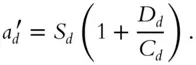

shares of stock at the new closing price

shares of stock at the new closing price  resulting in a somewhat simpler day adjustment factor,

resulting in a somewhat simpler day adjustment factor,

. Intraday forecast features depending on such adjustment factor can generate a wonderful forecast for dividend-paying stocks in simulation, but production trading using such forecasts will likely be disappointing. Formula (1.6)differs from the “simple” Eq. (1.7)by a typically small amount

. Intraday forecast features depending on such adjustment factor can generate a wonderful forecast for dividend-paying stocks in simulation, but production trading using such forecasts will likely be disappointing. Formula (1.6)differs from the “simple” Eq. (1.7)by a typically small amount  but is free from lookahead.

but is free from lookahead. found in actual historical data can occasionally reach or exceed the previous close value

found in actual historical data can occasionally reach or exceed the previous close value  causing trouble in Eq. (1.3). Such conditions are rare and normally due to a datafeed error or a major capital reorganization warranting a termination of the security and starting a new one via a suitable entry in the security master ( Sec. 2.1.2), even if the entity has continued under the same name.

causing trouble in Eq. (1.3). Such conditions are rare and normally due to a datafeed error or a major capital reorganization warranting a termination of the security and starting a new one via a suitable entry in the security master ( Sec. 2.1.2), even if the entity has continued under the same name.