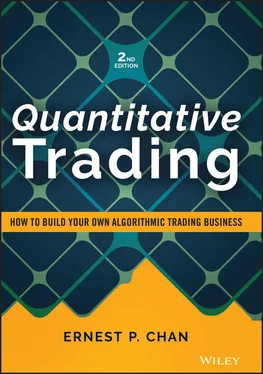

1 Cover

2 Title Page Quantitative Trading How to Build Your Own Algorithmic Trading Business Second Edition ERNEST P. CHAN

3 Copyright Copyright © 2021 by Ernest P. Chan. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions . Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages. For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002. Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com . Library of Congress Cataloging-in-Publication Data is Available: ISBN 9781119800064 (hardback) ISBN 9781119800088 (ePDF) ISBN 9781119800071 (ePub) Cover Design: Wiley Cover Image: © Jobalou/Getty Images

4 Dedication To my parents, Hung Yip and Ching, and to Ben and Sarah Ming.

5 Preface to the 2 ndEdition REFERENCES

6 Preface WHO IS THIS BOOK FOR? WHAT KIND OF BACKGROUND DO YOU NEED? WHAT WILL YOU FIND IN THIS BOOK? REFERENCES

7 Acknowledgments

8 CHAPTER 1: The Whats, Whos, and Whys of Quantitative Trading WHO CAN BECOME A QUANTITATIVE TRADER? THE BUSINESS CASE FOR QUANTITATIVE TRADING THE WAY FORWARD

9 CHAPTER 2: Fishing for Ideas HOW TO IDENTIFY A STRATEGY THAT SUITS YOU A TASTE FOR PLAUSIBLE STRATEGIES AND THEIR PITFALLS SUMMARY REFERENCES

10 CHAPTER 3: Backtesting COMMON BACKTESTING PLATFORMS FINDING AND USING HISTORICAL DATABASES PERFORMANCE MEASUREMENT COMMON BACKTESTING PITFALLS TO AVOID TRANSACTION COSTS STRATEGY REFINEMENT SUMMARY REFERENCES NOTE

11 CHAPTER 4: Setting Up Your Business BUSINESS STRUCTURE: RETAIL OR PROPRIETARY? CHOOSING A BROKERAGE OR PROPRIETARY TRADING FIRM PHYSICAL INFRASTRUCTURE SUMMARY REFERENCES

12 CHAPTER 5: Execution Systems WHAT AN AUTOMATED TRADING SYSTEM CAN DO FOR YOU MINIMIZING TRANSACTION COSTS TESTING YOUR SYSTEM BY PAPER TRADING WHY DOES ACTUAL PERFORMANCE DIVERGE FROM EXPECTATIONS? SUMMARY

13 CHAPTER 6: Money and Risk Management OPTIMAL CAPITAL ALLOCATION AND LEVERAGE RISK MANAGEMENT PSYCHOLOGICAL PREPAREDNESS SUMMARY APPENDIX: A SIMPLE DERIVATION OF THE KELLY FORMULA WHEN RETURN DISTRIBUTION IS GAUSSIAN REFERENCES NOTES

14 CHAPTER 7: Special Topics in Quantitative Trading MEAN-REVERTING VERSUS MOMENTUM STRATEGIES REGIME CHANGE AND CONDITIONAL PARAMETER OPTIMIZATION STATIONARITY AND COINTEGRATION FACTOR MODELS WHAT IS YOUR EXIT STRATEGY? SEASONAL TRADING STRATEGIES HIGH-FREQUENCY TRADING STRATEGIES IS IT BETTER TO HAVE A HIGH-LEVERAGE VERSUS A HIGH-BETA PORTFOLIO? SUMMARY REFERENCES

15 CHAPTER 8: Conclusion NEXT STEPS REFERENCES

16 APPENDIX: A Quick Survey of MATLAB

17 Bibliography

18 About the Author

19 Index

20 End User License Agreement

1 Chapter 2 TABLE 2.1 Sources of Trading Ideas TABLE 2.2 How Capital Availability Affects Your Many Choices

2 Chapter 3TABLE 3.1 Historical Databases for Backtesting

3 Chapter 4TABLE 4.1 Retail versus Proprietary Trading

1 Chapter 2 FIGURE 2.1 Drawdown, maximum drawdown, and maximum drawdown duration.

2 Chapter 3FIGURE 3.1 Maximum drawdown and maximum drawdown duration for Example 3.4.

3 Chapter 5FIGURE 5.1 Semiautomated trading system.FIGURE 5.2 Fully automated trading system.

4 Chapter 7FIGURE 7.1 Cumulative returns of strategies based on Conditional vs. Uncondi...FIGURE 7.2 A stationary time series formed by the spread between GLD and GDX...FIGURE 7.3 A nonstationary time series formed by the spread between KO and P...FIGURE 7.4 Cointegration is not correlation. Stocks A and B are cointegrated...

1 Cover Page

2 Table of Contents

3 Begin Reading

1 ii

2 iii

3 iv

4 v

5 xi

6 xii

7 xiii

8 xiv

9 xv

10 xvi

11 xvii

12 xviii

13 xix

14 xxi

15 1

16 2

17 3

18 4

19 5

20 6

21 7

22 8

23 9

24 11

25 12

26 13

27 14

28 15

29 16

30 17

31 18

32 19

33 20

34 21

35 22

36 23

37 24

38 25

39 26

40 27

41 28

42 29

43 30

44 31

45 33

46 34

47 35

48 36

49 37

50 38

51 39

52 40

53 41

54 42

55 43

56 44

57 45

58 46

59 47

60 48

61 49

62 50

63 51

64 52

65 53

66 54

67 55

68 56

69 57

70 58

71 59

72 60

73 61

74 62

75 63

76 64

77 65

78 66

79 67

80 68

81 69

82 70

83 71

84 72

85 73

86 74

87 75

88 76

89 77

90 78

91 79

92 80

93 81

94 82

95 83

96 84

97 85

98 86

99 87

100 88

101 89

102 90

103 91

104 93

105 94

106 95

107 96

108 97

109 98

110 99

111 100

112 101

113 102

114 103

115 104

116 105

117 106

118 107

119 108

120 109

121 110

122 111

123 112

124 113

125 114

126 115

127 116

128 117

129 118

130 119

131 120

132 121

133 122

134 123

135 124

136 125

137 126

138 127

139 128

140 129

141 130

142 131

143 132

144 133

145 134

146 135

147 136

148 137

149 138

150 139

151 140

152 141

153 142

154 143

155 144

156 145

157 146

158 147

159 148

160 149

161 150

162 151

163 152

164 153

165 154

166 155

167 156

168 157

169 158

170 159

171 160

172 161

173 162

174 163

175 164

Читать дальше