Michael Taillard - Corporate Finance For Dummies

Здесь есть возможность читать онлайн «Michael Taillard - Corporate Finance For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Corporate Finance For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4.5 / 5. Голосов: 2

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 100

- 1

- 2

- 3

- 4

- 5

Corporate Finance For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Corporate Finance For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Corporate Finance For Dummies,

Corporate Finance For Dummies,

Corporate Finance For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Corporate Finance For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Understanding Assets

Assets include the value of everything the company owns and everything the company is owed. Assets fall into two main categories:

Current assets: Current assets are those assets that a company expects to turn into cash within one year or, for inventories that take more than a year to turn into cash (such as buildings, vehicles, and other things that are usually expensive items), those assets a company expects to sell within one year.

Long-term assets: Long-term assets are those assets that will take more than one year to turn into cash or that are otherwise not intended to be sold yet (but can be sold, if necessary).

Note that a few assets don’t fall into either of these categories. That’s where the last two sections of the assets portion come into play — intangible assets and other assets. I discuss both later in this section.

Current assets

This section outlines the subsections of the current assets portion of the balance sheet from the most liquid to least liquid.

Cash and cash equivalents

Cash and cash equivalents are the most liquid assets a company has available. In other words, they’re the assets that the company can most easily turn into cash because, well, they’re already cash. Cash refers to the money a company has on hand, while cash equivalents refer to savings accounts and such, from which the company can withdrawal cash quite easily, although at times the bank can temporarily restrict access.

Marketable securities

The second most liquid asset that a company has available is everything that falls into the category of marketable securities, including banker’s acceptances, certificates of deposit (CDs), Treasury bills, and other types of financial products that have maturity dates but that companies can withdraw from or sell very easily if necessary.

Accounts receivable

The accounts receivable category includes the value of all money owed to a company within the next year. Note the important distinction between money that’s owed in the next year and money that’s likely to be paid. Unfortunately, sometimes people refuse to pay what they owe. In these cases, the receivable remains receivable until either the money is paid or the period in which the money is due passes.

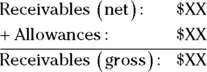

After the period passes, the company subtracts the value of the account owed from accounts receivable and transfers it to a subaccount called allowances. Allowances include the value of the money that’s still owed and past due but has yet to be written off as uncollectible (which is considered an expense). Usually, the accounts receivable entry looks something like this:

Inventories

The inventories category includes the value of all supplies that a company intends to use up during the process of making and selling something. Inventories include the raw materials used in production, the work-in-process products (partially completed products), end products ready for sale, and even basic office supplies and goods consumed in production (such as stationary used in offices, oil carried on delivery trucks for regular maintenance, and so on).

Income tax assets

Income tax assets include two forms of income taxes. The first is one that many people are familiar with: tax returns. When a company is set to receive money back on its taxes, that money becomes a short-term asset until the company receives it, at which point it becomes cash.

The other form of tax asset is the deferred tax, which occurs when a company has met the requirements to receive a tax benefit but has yet to receive it. For example, a company that experiences losses one year can file those losses the next year rather than the current year, so the value of its losses would be a deferred income tax asset that would decrease any income tax owed the next year.

Prepaid accounts

When a company pays for some expense in advance, the value of that prepayment becomes an asset (called a prepaid account ) for which the company will receive services in the future. Consider insurance as an example. If a company prepays its insurance for a full year, the full dollar amount paid will add to the value of the company’s prepaid accounts. Every month, the company decreases  of the value of that prepaid account (each month the company uses up one month’s worth of value). In other words, the company uses up its prepaid accounts as the service it paid for is provided.

of the value of that prepaid account (each month the company uses up one month’s worth of value). In other words, the company uses up its prepaid accounts as the service it paid for is provided.

Other current assets

The other current assets category is a rather common one to find on the balance sheet, but it means different things to different companies. Generally, it’s an all-inclusive category for any assets that are expected to turn into cash within a one-year period but that aren’t listed elsewhere on the balance sheet. Other current assets may include restricted cash, certain types of investments, collateral, and pretty much anything else you can think of.

Long-term assets

The long-term assets section includes three main categories — investments, property, plant, and equipment (PPE), and depreciation. I describe each of these in more detail in the following sections.

Investments

Long-term investments typically include equities and debt investments held by the company for financial gain, for gaining control over another company, or in funds such as pensions. It can also include facilities or equipment intended for lease or rent. In any case, all the investments in this section are meant to be held for more than one year.

Note: Sometimes a company lists its bond investments as notes receivables, which are reported sort of like accounts receivables, except with the expectations of receiving payments in the long term.

Property, plant, and equipment

The property, plant, and equipment (PPE) category includes nearly every major physical asset a company has that it will use for more than one year. Buildings, machinery, land, major furniture, computer equipment, company vehicles, and even construction-in-progress projects all qualify as PPE. Basically, if you can touch it and plan to use it for more than a single year, it contributes to the value of PPE.

Depreciation

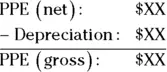

The long-term physical assets included in PPE don’t last forever. With age and usage, every long-term physical asset is subject to depreciation, or a decrease in value. Different companies measure depreciation in different ways (some of which I discuss later in this section), but regardless of the manner in which a company measures depreciation, the total shows up on the balance sheet as a subtraction from the total value of PPE. It looks something like this:

A company may choose to leave out the gross PPE line because it doesn’t contribute anything to the value of the total assets (and because you can calculate it easily, given the other information listed).

What follows are two of the most common methods for calculating depreciation.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Corporate Finance For Dummies»

Представляем Вашему вниманию похожие книги на «Corporate Finance For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Corporate Finance For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.