Capital budgeting

Capital budgeting is the commitment of funds now in order to receive a return in the future in the form of additional cash inflows or reduced cash outflows.

Capital budgeting decisions fall into two broad categories: screening and preference decisions. Screening decisions relate to whether a proposed service management initiative passes a predetermined hurdle, minimum return for example. Preference decisions, on the other hand, relate to choosing from among several competing alternatives. Selecting between an internal Service Improvement Plan (SIP) and a service sourcing programme is an example.

5.2.2.1 Screening decisions (NPV)

An investment typically occurs early while returns do not occur until some time later. Therefore the time value of money, or discounted cash flows, should be accounted for. There are two approaches to making capital budgeting decisions using discounted cash flows: Net Present Value (NPV) and Internal Rate of Return (IRR). NPV is preferred for screening decisions for reasons discussed later. IRR is preferred for preference decisions, as explained in the next section.

Under the NPV method, the programme ’s cash inflows are compared to the cash outflows. The difference, called net present value, determines whether or not the investment is suitable (Table 5.4). Whenever the net present value is negative, the investment is unlikely to be suitable.

If the NPV is:

Then the programme is:

Positive

Acceptable. It promises a return greater than the required rate of return

Zero

Acceptable. It promises a return equal to the required rate of return.

Negative

Unacceptable. It promises a return less than the required rate of return.

Table 5.4 NPV decisions

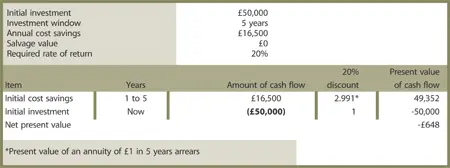

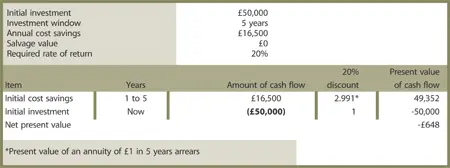

Case example 11: Net present value

A Type I provider for a small company in South America considers investing in a service management programme. The programme is estimated to cost £50,000. The programme is expected to reduce labour costs by £16,500 per year. The company requires a minimum pre-tax return of 20% on all investment programme s. A five-year window is used for investment return.

For simplicity, ignore inflation and taxes.

Should the investment be made?

(Answer given later in this section)

What is an organization’s discount rate? A company’s cost of capital is typically considered the minimum required rate of return. This is the average rate of return the company must pay to its long-term shareholders or creditors for use of their funds. Therefore, the cost of capital serves as a minimum screening device.

For service management programmes, the NPV method has several advantages over the IRR method:

NPV is generally easier to use

IRR may require searching for a discount rate resulting in an NPV of zero.

IRR assumes the rate of return is the rate of return on the programme, a questionable assumption for environment s with minimal service management programme experience

When NPV and IRR disagree on the attractiveness of the project , it is best to go with NPV. It makes the more realistic assumption about the rate of return.

There are other methods used for making capital budgeting decisions such as Pay-Back and Simple Rate of Return. Neither method is covered, as Pay-Back is not a true measure of the profitability of an investment while Simple Rate of Return does not consider the time value of money.

Case example 11 (solution): No

The answer may appear obvious since the savings (£82,500 = 5 years x £16,500) exceeds investment (£50,000). However, it is not enough that the cost reductions cover the investment. It must also yield a return of at least 20%.

To determine the suitability of the investment, the £16,500 annual savings should be discounted to its present value. Since the company uses a 20% minimum hurdle, this rate is used in the discounting process and is called the discount rate.

See Table 5.5. Deducting the present value of the required investment from the present value of the cost savings gives the net present value of -£648. According to the analysis, the company should not proceed.

Click on image above to view a larger version in a new browser window

Table 5.5 provides a simple but effective expression of an NPV screening analysis for Case example 11:

The projected cost saving is £18,000. This inflow is multiplied by 2.991 (the present value of £1 in 5 years. This factor can be found in the table in Appendix A).

The initial investment is subtracted from the savings, providing the net present value.

In a service management NPV, the focus remains on cash flows and not on accounting net income. Managers should look for the types of cash flows shown in Table 5.6.

Typical cash outflows

Initial investment in assets, including installation costs

Periodic outlays for maintenance

Training and consulting

Incremental operating costs

Increase in working capital

Typical cash inflows

Incremental revenues

Reduced costs

Salvage value from old assets, either from operational retirement or project end

Release of working capital

Table 5.6 Types of cash flow

Although it has an effect on taxes, depreciation is not deducted. Discounted cash flow methods automatically provide for return of the original investment, thereby making a deduction for depreciation unnecessary.

A simplifying assumption is made in that all cash flows other than the initial investment occur at the end of periods. This is somewhat unrealistic as cash flows typically occur throughout a period rather than just at its end.

Intangible Benefits

There are a number of techniques available when service management cash flows are uncertain. Some are very technical as they involve computer simulations and advanced skills in mathematics.

Process improvement and automation are common examples of difficult-to-estimate cash flows. The up-front and tangible costs are easy to estimate. The intangible benefits, such as lessened risk , greater reliability , quality and speed are much more difficult to estimate. They are very real in impact but nonetheless challenging in estimating cash flows. Fortunately, there is a simple procedure available.

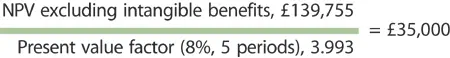

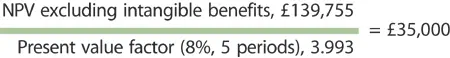

Take, for example, the organization seeking to purchase service management process -automation software. The organization has an 8% discount rate. The useful life of the software is set to five years. A prior NPV analysis of the tangible costs and benefits shows an NPV of -£139,755. If the intangible benefits are large enough, the NPV could go from negative to positive. To compute the benefit required (inflow), first find the Present Value Factor in Appendix A. A look in Column 8%, Row 5-period, reveals a factor of 3.993. Now perform the following calculation:

Click on image above to view a larger version in a new browser window

The result serves as a subjective guideline for estimation . If the intangible benefits are at least £35,000, then the NPV is acceptable. The process automation should be performed. If in the judgement of senior managers, the intangible benefits are not worth £35,000, then the process automation should not be performed.

Читать дальше