A number of steps need to be completed while generating a BIA. Some of the high-level activities are as follows:

1. Arrange resource s from the business and IT that will work together on the analysis

2. Identify all of the top candidate services for designation as critical, secondary and tertiary (you do not need to designate them at this point)

3. Identify the core analysis points for use in assessing risk and impact , such as:

Lost sales revenue

Fines

Failure risk

Lost productivity

Lost opportunity

Number of user s impacted

Visibility to shareholders, management etc.

Risk of service obsolescence

Harm to reputation among customers, shareholders and regulatory authorities

4. With the business , weight the identified elements of risk and impact

5. Score the candidate services against the weighted elements of risk and impact, and total their individual risk scores (you can utilize an FMEA for additional input here)

6. Generate a list of services in order of risk profile

7. Decide on a universal time period with which to standardize the translation of service outage to financial cost (1 minute, 1 hour, 1 day, etc.)

8. Calculate the financial impact of each service being analysed within the BIA using agreed methods, formulas and assumptions

9. Generate a list of services in order of financial impact

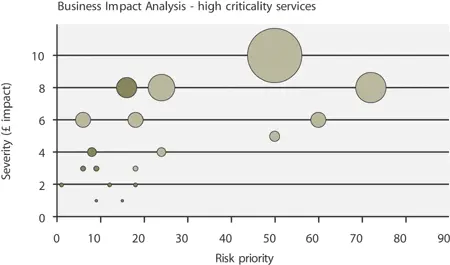

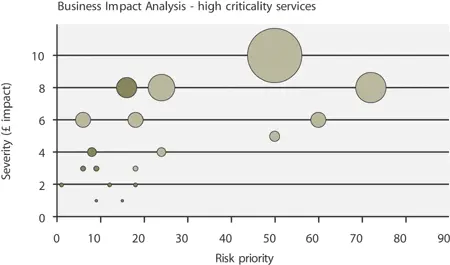

10. Utilize the risk and financial impact data generated to create charts that illustrate the company’s highest risk application s that also carry the greatest financial impact. A sample output from this analysis is shown in Figure 5.5.

Figure 5.5 Business Impact Analysis

Figure 5.5 displays services on a comparative scale using financial impact and risk priority (in this case the probability, detectability and impact of failure ) as points of analysis. For those companies that are inclined and capable, the use of Six Sigma methodologies can bring additional rigour to a BIA exercise, such as the example above, by enabling a structured approach to assessing Failure Modes and Effects (FMEA).

5.1.4 Key decisions for Financial Management

A number of concepts within the realm of Financial Management can have great impact on the development of service strategies. This section attempts to highlight some of those concepts so that the reader can determine how best to incorporate preferred alternatives into a formative strategy .

5.1.4.1 Cost recovery, value centre or accounting centre?

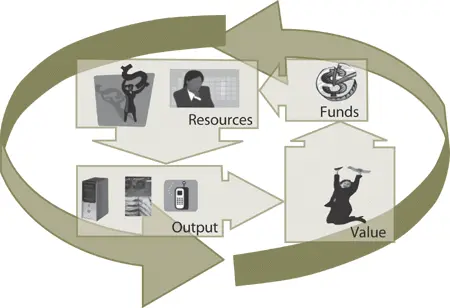

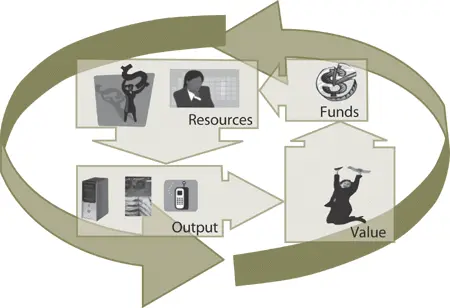

Whereas traditional accounting terminology refers to IT as a cost or profit centre , the real decision is not in the term used but in how funding will be replenished. Clarity around the operating model greatly contributes to understanding the requisite visibility of service provisioning costs, and funding is a good test of the business ’s confidence and perception of IT. Important questions should be answered when determining the premise under which the IT organization will replenish its funding for operations. The IT financial cycle starts with funding applied to resource s that create output. That output is identified as value by the customer, and this in turn induces the funding cycle to begin again (Figure 5.6).

Figure 5.6 The funding lifecycle

IT is typically referred to as a cost centre , with funding based only on replenishing actual costs expended to deliver service. Compare this to the value centre or profit centre model where IT funding rests on the actual costs plus a perceived value-added amount. The capture of this additional value above actual cost is not confined to external providers, as Type I providers also have a need to continually expand their offerings and fund the analysis of provisioning alternatives and service quality enhancements.

Corporate culture plays a large role in determining the operating model. Homogeneity of business products can impact corporate culture and how each organization prefers to see IT financial models. If all product lines are similar and use IT system s similarly and equitably, then the operating model may not require the complexities of a business with very diverse product lines where each line consumes IT Services differently from one another. Similarly, the complexities of business structure (i.e. a global conglomerate versus a single operating entity), and the geographic dispersion of an organization can also greatly effect business expectations.

Replenishment of funds requires a decision about when to fund. Will funding be done on an annual basis (based on a corporate cycle) or on a constant cycle of replenishment (rolling plan model, zero-based model, trigger-based)? If the decision is made for IT to self-fund, then a higher level of perceived value will be added to the cost of services, and funding will most likely occur on a constant cycle. A constant cycle of replenishment, like in a rolling plan, is based on mutually agreed services, and removes the constraints inflicted by an annual budget since any changes to funding are agreed first by both the consumer and the provider.

5.1.4.2 Chargeback: to charge or not to charge

A ‘chargeback’ model for IT can provide accountability and transparency. However, if the operating model currently provides for a more simplistic annual replenishment of funds, then charging is often not necessary to provide accountability or transparency. In this instance the desired visibility would instead come from the activities and outputs of planning , demand modelling , and Service Valuation . If IT is a self-funding organization, suggesting more complexity and maturity in financial mechanisms, then some form of charging would provide added accountability and visibility.

Visibility is brought about through identification of Service Portfolio s and catalogues, valuing those IT service s, and application of those values to demand or consumption models. Accountability refers to IT’s ability to deliver expected services as agreed with the business , and the business’s fulfilment of its obligations in funding those services. However, with no common ground as to what service or value the business is receiving, accountability just becomes a constant struggle to explain why perceived value varies from the funding. Therefore, charging, without taking into account the operating model, typically does not deliver desired levels of accountability and visibility.

Charging should be done to encourage behavioural changes related to steering demand for IT Service s. Charging must add value to the business and be in business terms, and it should have a degree of simplicity appropriate to the business culture . The most difficult and critical requirement of the model is its perceived fairness, which can be imparted if the model provides a level of predictability that the business typically desires, coupled with the mutual identification of services and service values.

Chargeback models vary based on the simplicity of the calculations and the ability for the business to understand them. Some sample chargeback models and components include:

Читать дальше