Accounting is the first process that receives financial data for translation.

Change and Demand Management are the first steps in becoming aware of anticipated changes to IT.

Track 5 – Measure

To come full cycle through implementation, measures of success need to be provided on financial trends within funding, valuing and accounting .

It is also important to audit for any credibility gap between the value being received and price being paid as soon as possible. This can be done through providing:

Concise communication possibly via a balanced scorecard

Regular communication

Meaningful data

Making certain to always map to business strategy .

Auditing provides verification that processes are being followed. Since Financial Management is the owner of the data that translates and creates financial data, it is of obvious importance that audits be performed regularly.

5.2 Return on Investment

Return on Investment (ROI) is a concept for quantifying the value of an investment. Its use and meaning are not always precise. When dealing with financial officers, ROI most likely means ROIC (Return on Invested Capital), a measure of business performance . This is not the case here. In service management, ROI is used as a measure of the ability to use assets to generate additional value. In the simplest sense, it is the net profit of an investment divided by the net worth of the assets invested. The resulting percentage is applied to either additional top-line revenue or the elimination of bottom-line cost .

It is not unexpected that companies seek to apply the ROI in deciding to adopt service management . ROI is appealing because it is self-evident. The measure either meets or does not meet a numerical criterion. The challenge is when ROI calculations focus in the short term. The application of service management has different degrees of ROI, depending on business impact . Moreover, there are often difficulties in quantifying the complexities involved in implementations.

While a service can be directly linked and justified through specific business imperatives, few companies can readily identify the financial return for the specific aspects of service management. It is often an investment that companies must make in advance of any return. Service management by itself does not provide any of the tactical benefits that business managers typically budget for. One of the greatest challenges for those seeking funding for ITIL project s is identifying a specific business imperative that depends on service management. For these reasons, this section covers three areas:

Business case – a means to identify business imperatives that depend on service management

Pre-Programme ROI – techniques for quantitatively analysing an investment in service management

Post-Programme ROI – techniques for retroactively analysing an investment in service management.

5.2.1 Business case

A business case is a decision support and planning tool that project s the likely consequences of a business action. The consequences can take on qualitative and quantitative dimensions. A financial analysis, for example, is frequently central to a good business case.

Business case structure

A. Introduction

Presents the business objective s addressed by the service

B. Methods and assumptions

Defines the boundaries of the business case, such as time period, whose costs and whose benefits

C. Business impacts

The financial and non-financial business case results

D. Risk s and contingencies

The probability that alternative results will emerge.

E. Recommendations

Specific actions recommended.

Table 5.2 Sample business case structure

5.2.1.1 Business objectives

The structure of a business case varies from organization to organization. A generic form is given in Table 5.2. What they all have in common is a detailed analysis of business impact or benefits. Business impact is in turn linked to business objective s. A business objective is the reason for considering a service management initiative in the first place. Objective s should start broadly. For example:

The business objectives for commercial provider organizations are usually the objectives of the business itself, including financial and organizational performance .

The business objectives for not-for-profit organizations are usually the objective s for the constituents, population or membership served as well as financial and organizational performance.

Table 5.3 illustrates possible business objectives.

Operational

Financial

Strategic

Industry

Shorten development time

Improve return on asset s

Establish or enhance strategic positioning

Increase market share

Increase productivity

Avoid costs

Introduce competitive products

Improve market position

Increase capacity

Increase discretionary spending as a percentage of budget

Improve professionalism of organization

Increase repeat business

Increase reliability

Decrease non-discretionary spending

Improve customer satisfaction

Take market leadership

Minimize risk s

Increase revenues

Provide better quality

Recognized as producer of reliable or quality products or services

Improve resource utilization

Increase margins

Provide customized offerings

Recognized as low price leader

Improve efficiencies

Keep spending to within budget

Introduce new products or services

Recognized as compliant to industry standards

Table 5.3 Common business objectives

5.2.1.2 Business impact

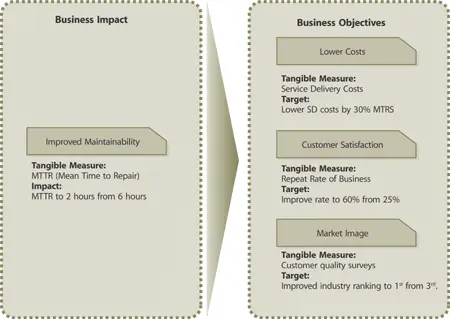

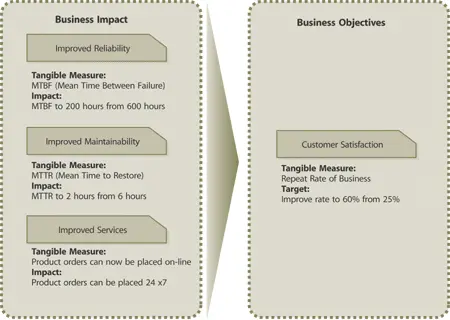

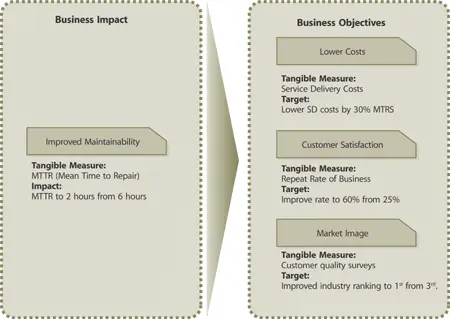

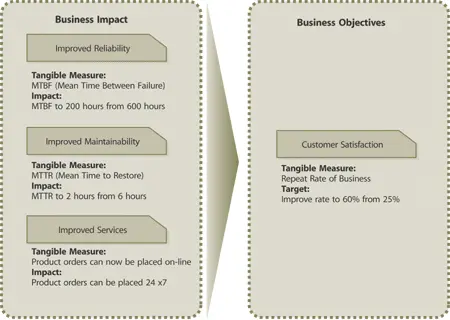

While most of a business case argument relies on cost analysis, there is much more to a service management initiative than financials. The scope of possible non-financial business impact s is summarized in this way: a business impact has no value unless it is linked to a business objective . There need not be a one-to-one relationship between business impact and business objective. Examples are given in Figures 5.7 and 5.8.

Figure 5.7 Single business impact can affect multiple business objectives

Figure 5.8 Multiple business impacts can affect a single business objective

It is easy for a business case to focus on financial analysis and neglect non-financial impacts. The end result is a business case that is not as convincing as it should be. By incorporating business impacts linked to business objectives, a business case is more compelling.

5.2.2 Pre-programme ROI

The term capital budgeting is used to describe how managers plan significant outlays on project s that have long-term implications. A service management initiative may sometimes require capital budgeting. It is the commitment of funds now in order to receive a return in the future in the form of additional cash inflows or reduced cash outflows (earnings or savings).

Читать дальше