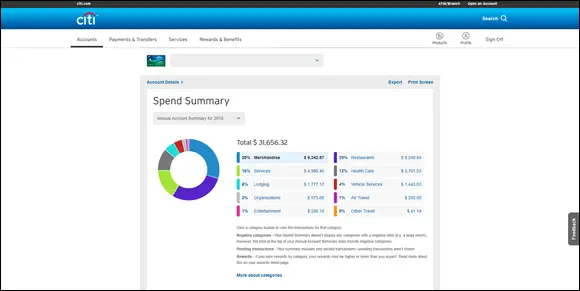

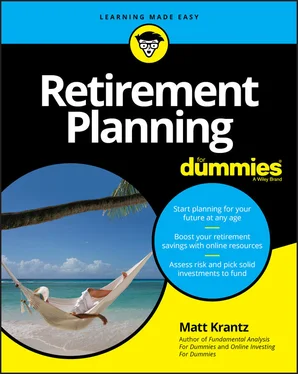

FIGURE 2-1:Like most banks and credit card companies, Citibank tracks your spending.

But you’re not done. Remember that you have other expenses that may not be picked up by the credit card issuer’s site. For instance, if your checking account is elsewhere, checks you write for property tax or insurance aren't included. Remember to include these additional expenses.

When looking at each of your expenses, picture where the expense fits in the major categories. Is it overhead or discretionary?

Some people hold their savings and credit cards at the same bank. If so, you can get summary spending information from the bank’s site. Others keep their checking and savings accounts and credit cards with different financial institutions. If that sounds like you, you’ll need to consult the online resources of both your bank and credit card company.

If you’re going this route to track your run rate, make your life easier by using only one credit card. Remember, if you pay off your credit card in full each month (which you should), you’re essentially getting a free monthly loan. Also, you get a more accurate and complete picture of your run rate.

Diving into the world of third-party apps and online tools

If you’re like most people, your smartphone is always at your side (or in your pocket). So it’s only natural to use this device to monitor your spending. Thanks to your smartphone’s capability to send you alerts, it can be a helpful tool in keeping you in close contact with your spending.

In this section, I describe some of the major providers of money-tracking app and websites. If you’re interested in a broader view of money-management apps — especially how they can be used to track your brokerage accounts, check out my Online Investing For Dummies, 10th Edition (Wiley).

The big daddy: Intuit’s Mint

When it comes to an all-encompassing website and app to track your spending, Mint ( www.mint.com ) is the one to beat. Mint is backed by the deep pockets of Intuit, a firm with many years of experience in financial technology.

Mint is free. Here's how to sign up:

1 Log in or create an ID.Go to www.mint.com and create an Intuit ID. If you already use TurboTax Online, you can use the same username and password.

2 Link accounts you want to track.Enter the username and password for your credit card accounts. Mint will then pull in your spending information from those accounts.

3 Go to the Trends tab.

4 Under the During option, select Last 12 Months.Mint summarizes your spending for the past year. You now have your run rate!

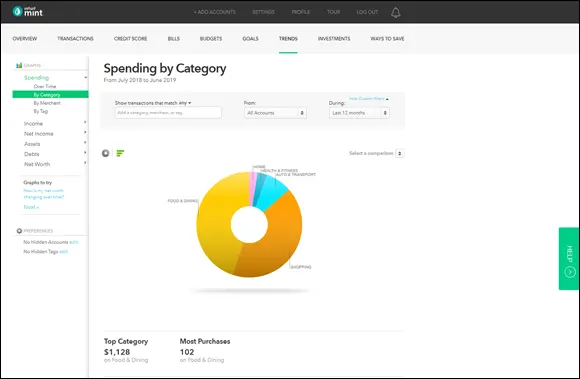

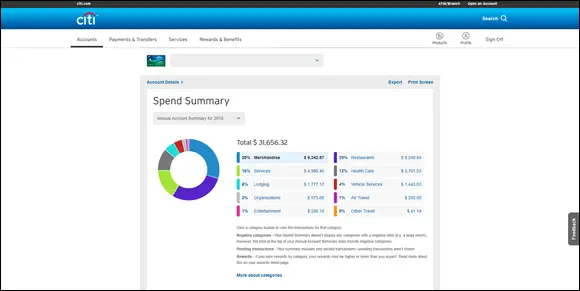

5 Check out your spending by category and your total spending. It’s particularly useful to look at spending by category, as shown in Figure 2-2. Knowing that you spend $100 a month at McDonald’s is good, but knowing that you spend $1,000 a month going out to eat is valuable information. Tracking your spending by category lets you spot trends, such as an out-of-control addiction buying collectibles or an entertainment budget that’s larger than your friends (maybe it’s time for them to pick up the restaurant tab sometimes).

Mint has a matching app that you can download for iOS or Android, so you can track your spending and run rate right from your smartphone.

If you're not comfortable sharing your personal information with Mint or you want more control over how to slice and dice your data, try Quicken.

FIGURE 2-2:Mint.com provides an easy, free way to see where your money is going.

Quicken is old school, but it's a good option for some people. The Deluxe version costs $50 yearly. Unlike Mint, Quicken stores your data on your computer instead of on a remote server (unless you choose to store it on Quicken’s online service) and doesn’t pitch financial products.

Quicken, like other software companies, moved to a subscription model. When you buy the software for $50, you get only a year of access. After a year, you can still read your data but some of the functions no longer work. Many users find this restriction a turnoff.

Quicken, like other software companies, moved to a subscription model. When you buy the software for $50, you get only a year of access. After a year, you can still read your data but some of the functions no longer work. Many users find this restriction a turnoff.

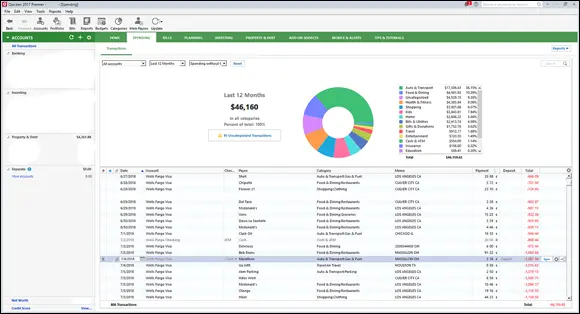

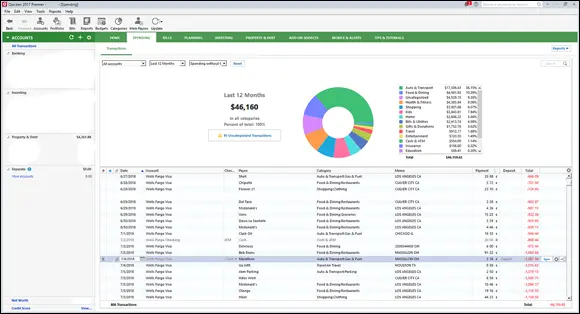

To find your run rate, go to the Spending tab. Quicken gives you precise control over time periods and types of spending. The 12-month view, shown in Figure 2-3, provides your run rate.

Using what you have: Microsoft Excel

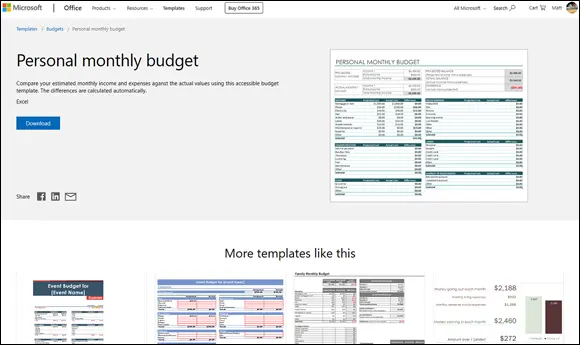

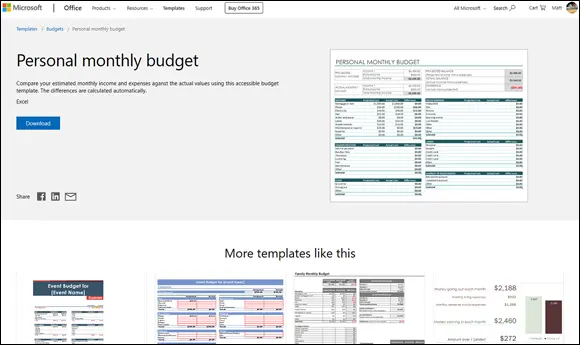

If you’re like most people, every computer or tablet in your house has Microsoft Office. It just so happens that Office’s Excel, shown in Figure 2-4, is good at tracking expenses. The benefit is that there’s no additional software to buy.

To download free spreadsheets to help you get started, go to Microsoft’s Excel template center at https://templates.office.com/ . Enter the term budget in the search box. One of my favorites is the personal monthly budget at https://templates.office.com/en-us/Personal-monthly-budget-TM04101071 .

FIGURE 2-3:You have to pay for Quicken, but it gives you lots of control.

FIGURE 2-4:Microsoft Excel puts you in control of your budget.

Using Excel to tabulate your run rate takes the most time and experience. If you’re not familiar with Excel or have little time to spend on this task, another approach will likely be better.

Using Excel to tabulate your run rate takes the most time and experience. If you’re not familiar with Excel or have little time to spend on this task, another approach will likely be better.

Checking out other money-tracking options

In addition to Mint, Quicken, and Excel, consider whether one of the following fits your lifestyle best:

Personal Capital: This powerful free app and website was built by former Quicken engineers to help you get set up more quickly (no software installation needed). Like Mint, Personal Capital, shown in Figure 2-5, requires you to enter the username and password of each of your financial accounts. The site then pulls in your financial transaction data and helps you see where your money is going. The app also features robust tools to manage your retirement account. More on that later, in Chapter 9. For now, just know that Personal Capital will look at all your spending and calculate your run rate. FIGURE 2-5:Personal Capital helps you see where your money is going. Personal Capital is a financial advisory firm. After you sign up for the online budgeting service, you will be contacted by a salesperson who will try to sell you a financial advisory service.

YNAB: An app and website that helps you control your spending, not just track it, YNAB (you need a budget) connects to your bank accounts and downloads your financial transactions. It’s up to you to put them into categories. You can manually enter transactions, too. YNAB wins fans but at a cost of $6.99 a month. If you sign up for a year subscription and cancel before the year is up, your refund is prorated. And there’s a month-long free trial. But paying money to save money seems a little counterintuitive.

Читать дальше

Quicken, like other software companies, moved to a subscription model. When you buy the software for $50, you get only a year of access. After a year, you can still read your data but some of the functions no longer work. Many users find this restriction a turnoff.

Quicken, like other software companies, moved to a subscription model. When you buy the software for $50, you get only a year of access. After a year, you can still read your data but some of the functions no longer work. Many users find this restriction a turnoff.