I cover this topic in more detail later, but now’s as good a time as any to think about your lifespan a bit. I keep the discussion optimistic by focusing on how long you’ll live (versus when you’ll die). In this section I provide my favorite tools to help you make this calculation.

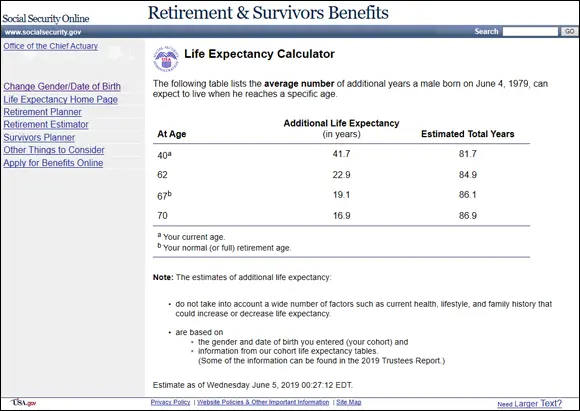

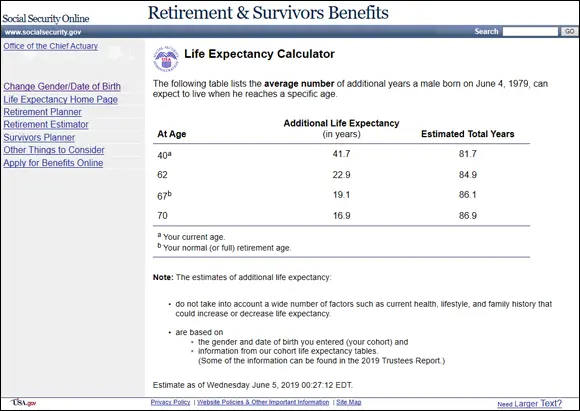

Social Security Administration’s Life Expectancy Calculator

The U.S. government has a good idea about how long you’ll live. After all, as the largest payer of income to older people, it’s in the government’s best interest to know this information.

The Social Security Administration’s Life Expectancy Calculator at www.ssa.gov/OACT/population/longevity.html looks at your gender and date of birth to estimate how long you'll live.

For example if you're a 40-year-old male in 2019, you would see a table like the one in Figure 1-1 after entering your gender and date of birth. You would be expected to live until 81.7, which means at 40 you'd be just about ready for a mid-life crisis. If you were healthy enough to make it to 67, the Social Security Administration would figure that you would make it to 86.

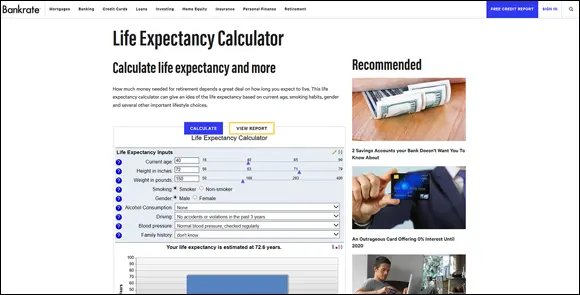

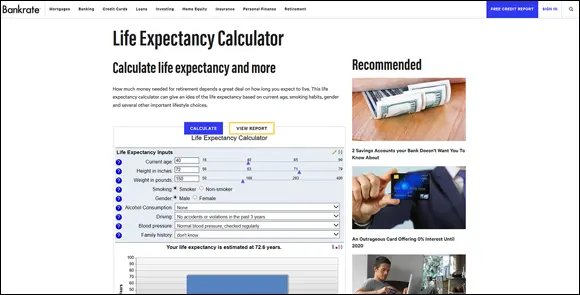

Bankrate’s Life Expectancy Calculator

You probably know that not all 40-year-olds will live exactly 81.7 years. Some lifestyle choices, such as smoking, have a bearing on how long you live. (Let’s forget about George Burns, the chain-smoking comedian who lived until 100.)

Bankrate tries to capture that variability in its Life Expectancy Calculator at www.bankrate.com/calculators/retirement/life-age-expectancy-calculator.aspx . You enter not just your age and gender but also personal details: height, weight, whether or not you smoke and drink alcohol, and a little family history.

Let’s go back to our 40-year-old male. He’s 6-feet tall, weighs 150 pounds, doesn’t touch alcohol, but does smoke. With that added detail, his life expectancy is now estimated to be 72.6 years, as shown in Figure 1-2.

FIGURE 1-1:Social Security’s Life Expectancy Calculator helps you see how your lifespan compares with others.

FIGURE 1-2:Bankrate’s Life Expectancy Calculator factors in more details to help you figure out how long you’ll go.

Life expectancy calculators, like many calculators described in this book, provide estimates. Clearly, if you knew exactly how long you’d live, retirement planning would be a lot easier. Unpredictability is a key aspect that makes retirement planning — and life — an imprecise science.

Life expectancy calculators, like many calculators described in this book, provide estimates. Clearly, if you knew exactly how long you’d live, retirement planning would be a lot easier. Unpredictability is a key aspect that makes retirement planning — and life — an imprecise science.

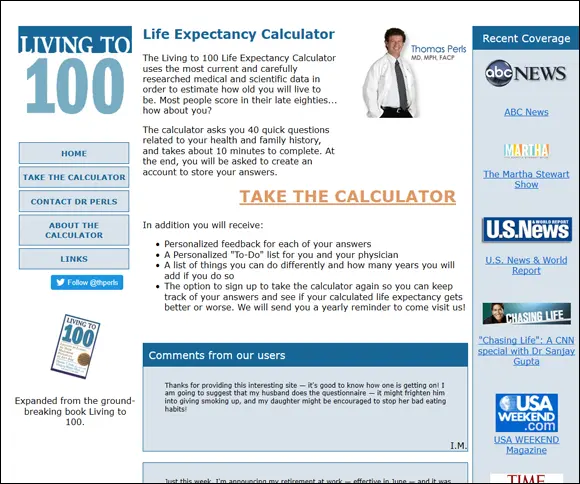

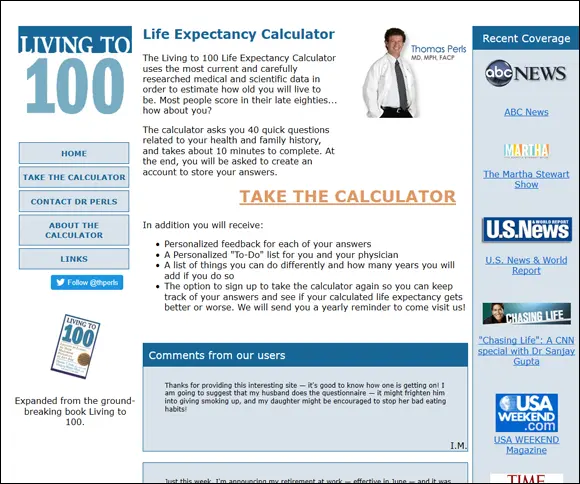

Living to 100 Life Expectancy Calculator

Your life expectancy is an important input in your retirement plan. It’s worthwhile to revisit this factor periodically and carefully. The Living to 100 Life Expectancy Calculator at http://www.livingto100.com brings rigor to this process.

The calculator, shown in Figure 1-3, asks a battery of questions covering everything from personal traits about your sleep patterns to lifestyle habits, nutrition, medical history, and family history. The calculator is free, but you need to set up an account with your email address.

FIGURE 1-3:Living to 100 Life Expectancy Calculator quizzes you with in-depth questions to estimate your lifespan.

Retirement Planning Beginnings: The Pension

As the U.S. industrialized, and farmers hung up their bib overalls and moved to work in factories, a major shift occurred in retirement planning. Workers would sign up with a company and pretty much assume they’d stay their entire careers. Over time, workers counted on their loyalty and decades of service to result in companies providing for them their entire lives — even after they retired.

Given what you know about lifespans, you can see why it wasn’t a huge deal for companies to take care of employees for life. Let’s say an employee in a steel mill worked until age 65. Look back at Table 1-1and you’ll see that in the mid-1950s and the 1960s, he’d be expected to live only until 70. His company would have to provide retirement income for only five years.

Hence, the pension was born. In a pension plan, which is sometimes called a defined benefit plan, the employer commits to pay the pensioner a set amount of money each year after retirement. If employees stay with the company, they know how much income to expect.

During an employee’s working years, his or her employer would contribute to a fund. It was the company’s responsibility to not only add to the fund but also to prudently manage it with investments on the employees’ behalf. The company was required to hold and protect sufficient amounts of funds to pay pension proceeds. If the fund got low, typically because money was paid out faster than the fund grew, the company had to use part of its profits to refill the reserves. As you could imagine, investors weren't happy when this happened.

If you’ve recently joined the workforce, pension plans probably sound strange. But in the 1950s through the 1980s, most employees, especially those working for large companies, expected a pension. Pensions are still common for public employees but have largely vanished for everyone else. As of 2011, only 18 percent of private sector employees participated in a pension plan, according to the Bureau of Labor Statistics. That amount dropped to just 15 percent in 2017, according to an updated estimate from Pension Rights Center ( www.pensionrights.org/publications/statistic/how-many-american-workers-participate-workplace-retirement-plans ), and to 11 percent in 2018 according to the Employee Benefit Research Institute ( www.ebri.org/docs/default-source/ebri-press-release/pr-1244-retplansff-6jun19.pdf?sfvrsn=98a83f2f_4 ).

So how are you supposed to plan for retirement if you don’t have a pension plan? That’s where our story takes us next.

Changing Times: The 401(k)

Those of you who were around in 1978 probably recall the debut of the Garfield comic strip. Another big milestone in 1978 was the end of production of the Volkswagen Beetle. But something far more important for retirement planning happened that year: The 401(k) was born.

The 401(k) is practically synonymous with retirement planning now because this plan is the predominant way most people save for retirement, especially those relatively new to the workforce. This popular retirement plan has steadily replaced the pension plan.

Employer-sponsored defined contribution plans are typically called 401(k)s. But they have close cousins at different employers. Employees at nonprofits access 403(b) plans, government workers have 457(b) plans, and some schools have 401(a) plans. The letters and numbers are different, but the plans are essentially the same as 401(k)s in terms of taxation.

Employer-sponsored defined contribution plans are typically called 401(k)s. But they have close cousins at different employers. Employees at nonprofits access 403(b) plans, government workers have 457(b) plans, and some schools have 401(a) plans. The letters and numbers are different, but the plans are essentially the same as 401(k)s in terms of taxation.

As mentioned, pension plans are defined benefit plans. The plan sponsor, typically the employer, promises the retiree a certain monthly or annual income in retirement. In contrast, 401(k) plans are defined contribution plans. The only thing that’s set is how much will be contributed to the plan. Typically, employees make most of the contributions. Contributions for standard 401(k) plans are generally made by paycheck deductions using pre-tax dollars; I cover exceptions in Chapter 4. (When you contribute to a 401(k), you lower your tax bill.) Many employers then make additional contributions, usually a matching percentage of what the employee puts in.

Читать дальше

Life expectancy calculators, like many calculators described in this book, provide estimates. Clearly, if you knew exactly how long you’d live, retirement planning would be a lot easier. Unpredictability is a key aspect that makes retirement planning — and life — an imprecise science.

Life expectancy calculators, like many calculators described in this book, provide estimates. Clearly, if you knew exactly how long you’d live, retirement planning would be a lot easier. Unpredictability is a key aspect that makes retirement planning — and life — an imprecise science.