By contrast, colleges that have more open enrollment, that take more risks on less prepared students are naturally going to have a lower graduation rate. But that doesn’t mean that some of those schools with less impressive graduation rates necessarily provide an inferior quality of education or an inability to graduate your child on time.

Don’t college grads make more money?

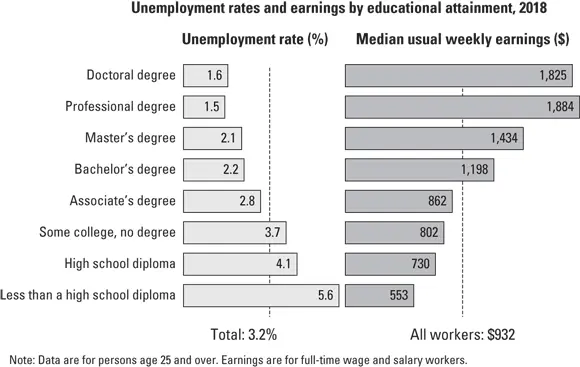

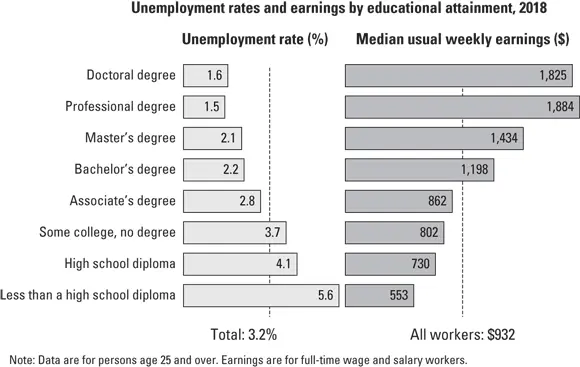

There are plenty of studies and analyses that show that those who have more education generally enjoy lower rates of unemployment and higher employment income. The graphic in Figure 1-1 clearly shows that those with higher levels of education reap considerably higher wages from work and lower unemployment rates.

Source: U.S. Bureau of Labor Statistics

FIGURE 1-1:What higher education means for earning higher wages and having lower unemployment.

There’s no question that education is a good thing and can develop your brain, critical thinking skills, interpersonal skills, etc. What jumps out at me from the graphic is that it looks like there’s value in completing high school, completing college if you’re going to attend and possibly considering an advanced degree. But that doesn’t mean that all education, or formal education, is worthwhile regardless of the cost. You should always consider the expected cost versus benefit or the return on the investment since attaining a college degree takes a good deal of time and money.

Another important point about Figure 1-1 — the “income premium” associated with college (compared with a high school degree) peaked in the year 2000 and declined about 10 percent over the next 15 years. College costs of course continued rising rapidly over this period further undermining the potential value of a college degree.

Parents and families should also be aware of the research report entitled, “Is College Still Worth It? The New Calculus of Falling Returns” by William R. Emmons, Ana H. Kent, and Lowell R. Ricketts, published by the Federal Reserve Bank of St. Louis Review, Fourth Quarter 2019. That report found:

“The college income premium is the extra income earned by a family whose head has a college degree over the income earned by an otherwise similar family whose head does not have a college degree. This premium remains positive but has declined for recent graduates. The college wealth premium (extra net worth) has declined more noticeably among all cohorts born after 1940. Among families whose head is White and born in the 1980s, the college wealth premium of a terminal four-year bachelor’s degree is at a historic low; among families whose head is any other race and ethnicity born in that decade, the premium is statistically indistinguishable from zero. Among families whose head is of any race or ethnicity born in the 1980s and holding a postgraduate degree, the wealth premium is also indistinguishable from zero. Our results suggest that college and postgraduate education may be failing some recent graduates as a financial investment.”

You can read this study at: https://files.stlouisfed.org/files/htdocs/publications/review/2019/10/15/is-college-still-worth-it-the-new-calculus-of-falling-returns.pdf .

SUCCESSFUL PEOPLE WHO NEVER GOT A COLLEGE DEGREE

You’ve surely heard of a number of “successful” people who accomplished significantly without a college degree. This would include folks like Michael Dell founder of Dell Computers, Steve Jobs founder of Apple, Bill Gates founder of Microsoft, John Mackey founder of Whole Foods Markets, Travis Kalanick founder of Uber, Larry Ellison founder of Oracle, performers Russell Simmons and Ellen DeGeneres, fashion designer Anna Wintour, and food guru Rachel Ray to name a few. These folks obviously are outliers in terms of their high level of professional success and associated financial earnings.

And there are plenty of lower profile people who have done quite well for themselves without a college degree including some plumbers, landscapers, dental hygienists, MRI technologists, commercial pilots, physical therapist assistants, respiratory therapists, air traffic controllers, transportation inspectors, diagnostic medical sonographers, electricians, construction managers, licensed practical nurses, web developers, elevator installers, radiation therapists, massage therapists, medical assistants, firemen and police officers. I chose to highlight some of these occupations because they are populated with relatively high numbers of people without a college degree.

Now, this is not in any way to suggest that the majority of people or your kids should bypass college! Each person’s situation is unique and different. But the point is that there are many paths to career success and some of those paths include going to college whereas others do not.

Clearly, there’s likely to be value in completing a college degree and getting a degree from a program with a good reputation and track record for graduates with that type of degree. Conversely, those who don’t complete their degree or who get a degree from a program with a subpar or mediocre track record will probably get a poor return on their invested education dollars.

In Part 3and especially in Chapter 8, I discuss the increasing numbers of shorter term and lower cost alternatives to traditional four-year colleges such as bootcamps, apprenticeships, trade schools, last mile programs, etc. The best of those programs have well-documented and impressive track records for the employment and compensation of their graduates.

In Part 3and especially in Chapter 8, I discuss the increasing numbers of shorter term and lower cost alternatives to traditional four-year colleges such as bootcamps, apprenticeships, trade schools, last mile programs, etc. The best of those programs have well-documented and impressive track records for the employment and compensation of their graduates.

Mushrooming student debt and its underlying causes

Why does college cost so darn much?

Don’t plenty of schools pack a few hundred students into a lecture hall? That can’t be too expensive, right?

Well, not so fast! Look at the course offerings at most schools and you will be surprised at how many courses they do offer and the fact that most don’t have a large number of students enrolled. Also, only $0.21 out of every college tuition dollar is actually spent on teaching.

So where are colleges and universities spending their money? On administrators, the number of whom has grown twice as fast as the number of students, on facilities and athletics, and schools prioritizing research over teaching.

Colleges and universities have increased tuition prices at twice the rate of inflation while jacking up room, board, and student fees at four times the rate of overall inflation. Ouch!

Student debt is a major problem for many college students. The total amount of student loans outstanding in the U.S. has surpassed $1.5 trillion, making it the second largest form of debt outstanding by consumers, exceeded only by mortgage debt. And, more than one million student loan borrowers default annually on their loans and only 57 percent are current on their payments.

According to LendEDU’s analysis of student loan debt figures at nearly 1,000 four-year private and public higher education institutions across the United States, the average graduating borrower received their diploma and left campus with $28,565 in student loan debt. That’s a pretty hefty number.

According to the National Association of Colleges and Employers (NACE), the average starting annual salary for college graduates is about $50,000. These averages can be deceiving and not super relevant to individual situations. For example, some college grads complete their degree with more debt than the amount of their starting annual salary. Conversely, some have little to no debt and a salary a good deal higher than average.

Читать дальше

In Part 3and especially in Chapter 8, I discuss the increasing numbers of shorter term and lower cost alternatives to traditional four-year colleges such as bootcamps, apprenticeships, trade schools, last mile programs, etc. The best of those programs have well-documented and impressive track records for the employment and compensation of their graduates.

In Part 3and especially in Chapter 8, I discuss the increasing numbers of shorter term and lower cost alternatives to traditional four-year colleges such as bootcamps, apprenticeships, trade schools, last mile programs, etc. The best of those programs have well-documented and impressive track records for the employment and compensation of their graduates.