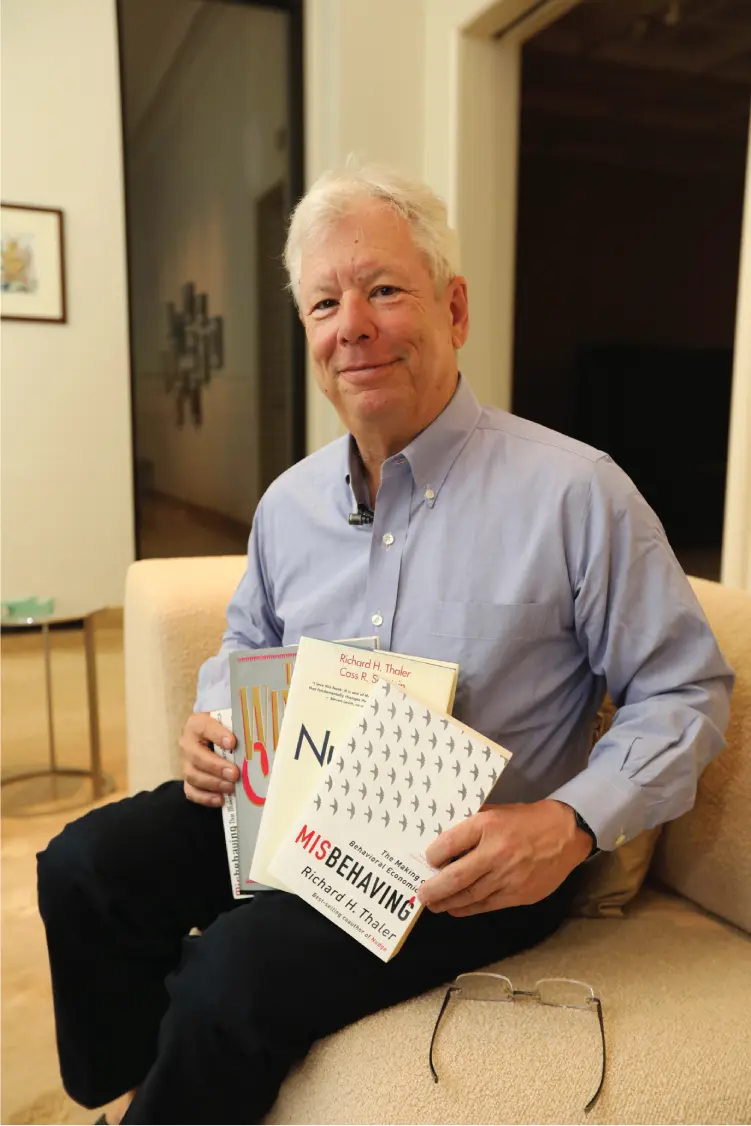

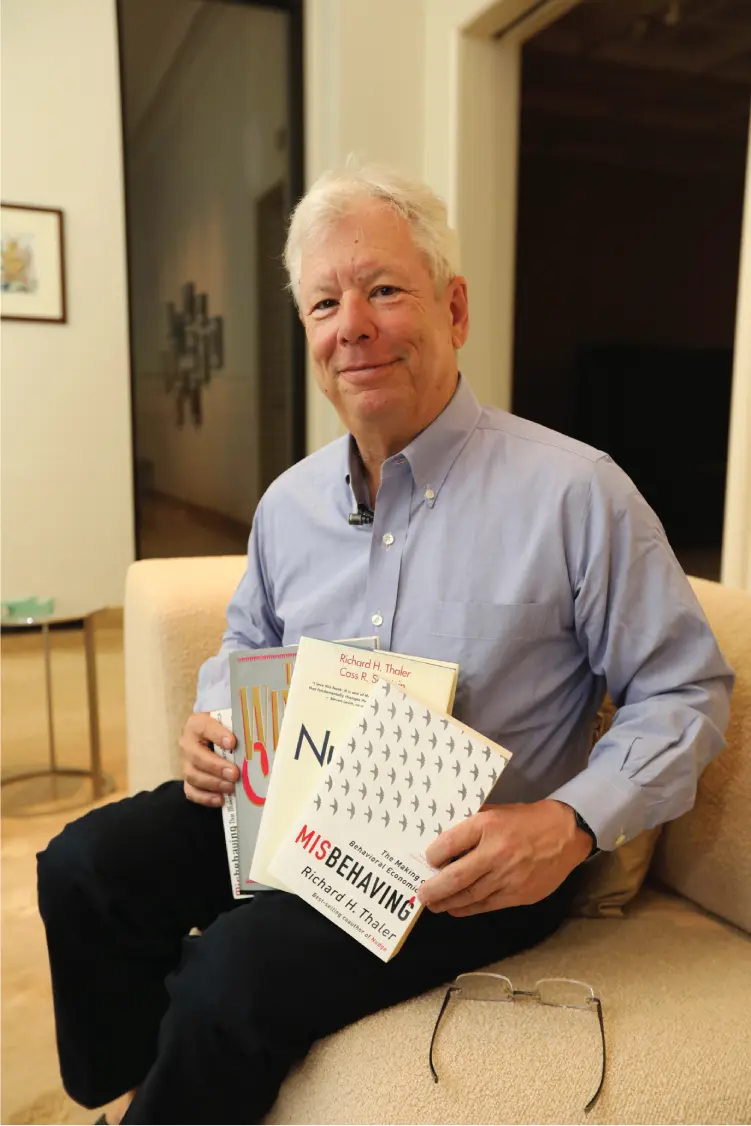

More recently, Professor Thaler, is the co-author (with Cass R. Sunstein) of the global best seller Nudge (2008) in which the concepts of behavioral economics are used to tackle many of society's major problems. In 2015 he published Misbehaving: The Making of Behavioral Economics . He has authored or edited four other books: Quasi-Rational Economics, The Winner's Curse: Paradoxes and Anomalies of Economic Life , and Advances in Behavioral Finance (editor) Volumes I and II. He has published numerous articles in prominent journals such as the American Economics Review , the Journal of Finance and the Journal of Political Economy .

Figure 1.4 Richard Thaler, PhD, 2017 Recipient of the Nobel Memorial Prize in Economic Sciences

Source: Anne Ryan/Chicago Booth

The following is an interesting and insightful excerpt from an interview Amazon.comconducted with Thaler and Sunstein. 4 I particularly like the reference to choice architecture.

Amazon.com:What do you mean by “nudge” and why do people sometimes need to be nudged?

Thaler and Sunstein:By a nudge we mean anything that influences our choices. A school cafeteria might try to nudge kids toward good diets by putting the healthiest foods at front. We think that it's time for institutions, including government, to become much more user-friendly by enlisting the science of choice to make life easier for people and by gentling nudging them in directions that will make their lives better.

Amazon.com:Can you describe a nudge that is now being used successfully?

Thaler and Sunstein:One example is the Save More Tomorrow program. Firms offer employees who are not saving very much the option of joining a program in which their saving rates are automatically increased whenever the employee gets a raise. This plan has more than tripled saving rates in some firms and is now offered by thousands of employers.

Amazon.com:What is “choice architecture” and how does it affect the average person's daily life?

Thaler and Sunstein:Choice architecture is the context in which you make your choice. Suppose you go into a cafeteria. What do you see first, the salad bar or the burger and fries stand? Where's the chocolate cake? Where's the fruit? These features influence what you will choose to eat, so the person who decides how to display the food is the choice architect of the cafeteria. All of our choices are similarly influenced by choice architects. The architecture includes rules deciding what happens if you do nothing; what's said and what isn't said; what you see and what you don't. Doctors, employers, credit card companies, banks, and even parents are choice architects.

We show that by carefully designing the choice architecture, we can make dramatic improvements in the decisions people make, without forcing anyone to do anything. For example, we can help people save more and invest better in their retirement plans, make better choices when picking a mortgage, save on their utility bills, and improve the environment simultaneously. Good choice architecture can even improve the process of getting a divorce—or (a happier thought) getting married in the first place!

Amazon.com:You point out that most people spend more time picking out a new TV or audio device than they do choosing their health plan or retirement investment strategy. Why do most people go into what you describe as “auto-pilot mode” even when it comes to making important long-term decisions?

Thaler and Sunstein:There are three factors at work. First, people procrastinate, especially when a decision is hard. And having too many choices can create an information overload. Research shows that in many situations people will just delay making a choice altogether if they can (say by not joining their 401(k) plan), or will just take the easy way out by selecting the default option, or the one that is being suggested by a pushy salesman.

Second, our world has gotten a lot more complicated. Thirty years ago most mortgages were of the 30-year fixed-rate variety, making them easy to compare. Now mortgages come in dozens of varieties, and even finance professors can have trouble figuring out which one is best. Since the cost of figuring out which one is best is so hard, an unscrupulous mortgage broker can easily push unsophisticated borrowers into taking a bad deal.

Third, although one might think that high stakes would make people pay more attention, instead it can just make people tense. In such situations some people react by curling into a ball and thinking, well, err, I'll do something else instead, like stare at the television or think about baseball. So, much of our lives is lived on auto-pilot, because weighing complicated decisions is not so easy, and sometimes not so fun. Nudges can help ensure that even when we're on auto-pilot, or unwilling to make a hard choice, the deck is stacked in our favor.

Another prolific contributor to behavioral finance is Meir Statman, PhD, of the Leavey School of Business, Santa Clara University (Figure 1.5).

Statman is the author of many significant works in the field of behavioral finance, including an early paper entitled “Behavioral Finance: Past Battles and Future Engagements,” 5 which is regarded as another classic in behavioral finance research. His research posed decisive questions: What are the cognitive errors and emotions that influence investors? What are investor aspirations? How can financial advisors and plan sponsors help investors? What is the nature of risk and regret? How do investors form portfolios? How important are tactical asset allocation and strategic asset allocation? What determines stock returns? What are the effects of sentiment? Statman produces insightful answers to all of these points. Professor Statman has won the William F. Sharpe Best Paper Award, a Bernstein Fabozzi/Jacobs Levy Outstanding Article Award, and two Graham and Dodd Awards of Excellence.

Figure 1.5 Meir Statman, PhD, Glenn Klimek Professor of Finance at the Leavey School of Business, Santa Clara University

Source: www.scu.edu

More recently, Professor Statman has written a book entitled What Investors Really Want . 6 According to Statman, what investors really want is three kinds of benefits from our investments: utilitarian, expressive, and emotional. Utilitarian benefits are those investment benefits that drop to the bottom line: what money can buy. Expressive benefits convey to us and to others an investor's values, tastes, and status. For example, Statman contends that hedge funds express status, and socially responsible funds express virtue. Emotional benefits of investments express how people feel. His examples are: insurance policies make people feel safe, lottery tickets and speculative stocks give hope, and stock trading gives people excitement.

Perhaps the greatest realization of behavioral finance as a unique academic and professional discipline is found in the work of Daniel Kahneman and Vernon Smith, who shared the very first behavioral finance–related Nobel Prize in Economic Sciences in 2002. The Nobel Prize organization honored Kahneman for “having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty.” Smith similarly “established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms,” garnering the recognition of the committee. 7

Читать дальше