Craig Callahan - Unloved Bull Markets

Здесь есть возможность читать онлайн «Craig Callahan - Unloved Bull Markets» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Unloved Bull Markets

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

Unloved Bull Markets: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Unloved Bull Markets»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull Markets

Unloved Bull Markets

Unloved Bull Markets

Unloved Bull Markets — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Unloved Bull Markets», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

For decades I have been telling financial advisors and investors “rallies and bull markets don't issue invitations” and “rallies and bull markets don't look like rallies and bull markets” … until they are over. An old Wall Street saying is that “stocks climb a wall of worry.” We are in an imperfect world and there is always something to worry about. This book will help financial advisors and investors focus on the profitable climb instead of the worries.

There is a little bit of “I told you so” in this book, but just enough to emphasize a few points and help readers avoid missing the next bull market. Of course, to get the full benefit of the messages in this book, some readers are going to have to admit they were wrong about some things. It seems worth it, though, if that is what it takes to fully participate in the next bull market.

Acknowledgments

Indeesh Mukhopadhyay provided valuable editorial feedback in the early stages of writing this book. In the final stages, Andrea Weule helped pull it all together. Kevin Scott, director of marketing at ICON, was invaluable with all logistical aspects. I would like to thank all three of them.

When a financial advisor places their investors’ assets with ICON, I take it very personally. I would like to thank those advisors for the trust they have placed in me over the years.

I would like to thank my two sons for believing in my system, supporting me, and embracing the duties of being fiduciaries.

I offer special, huge thanks to my wife, Linda, for her love and support, especially during graduate school and the difficult start-up years of ICON.

About the Author

Craig Callahan earned his bachelor of science in psychology at The Ohio State University in 1973 and his doctorate in finance from Kent State University in 1979. He began his career as a finance professor at the University of Denver primarily teaching investments and securities analysis. He also did research for a Denver brokerage firm before cofounding the predecessor company to ICON Advisers in 1986. Dr. Callahan created ICON's valuation investment methodology, which is used by him and others for portfolio management. Since 2000, ICON has won seventeen Lipper Awards for being the number one mutual fund in various categories and time periods. Twice he was a finalist for Ernst & Young's entrepreneur of the year in the Rocky Mountain region. Dr. Callahan appears regularly as a guest on financial television and radio. He does presentations at financial advisor and broker dealer conferences multiple times a year.

Introduction

On March 9, 2009, the stock market hit bottom after a seventeen-month agonizing bear market. Six months earlier, Bear Sterns and Lehman Brothers, two prestigious investment banking firms on Wall Street, collapsed under the weight of subprime mortgages. General Motors was facing bankruptcy and seeking a government bailout. Unemployment was 8.7% and racing to 10%. GDP had been negative for two quarters, including a stunning negative 8.5% quarter-to-quarter drop during the fourth quarter of 2008. Out of that setting, the bull market began. From the low on March 9, 2009, through February19, 2020, the Standard & Poor's (S&P) 1500 Index gained 530.12%, meaning if an investor had the courage to invest $1.00 at the bottom and hold eleven years, $1.00 invested would have grown to $6.30. As impressive as that is, many investors did not participate. Rallies and bull markets are often disguised.

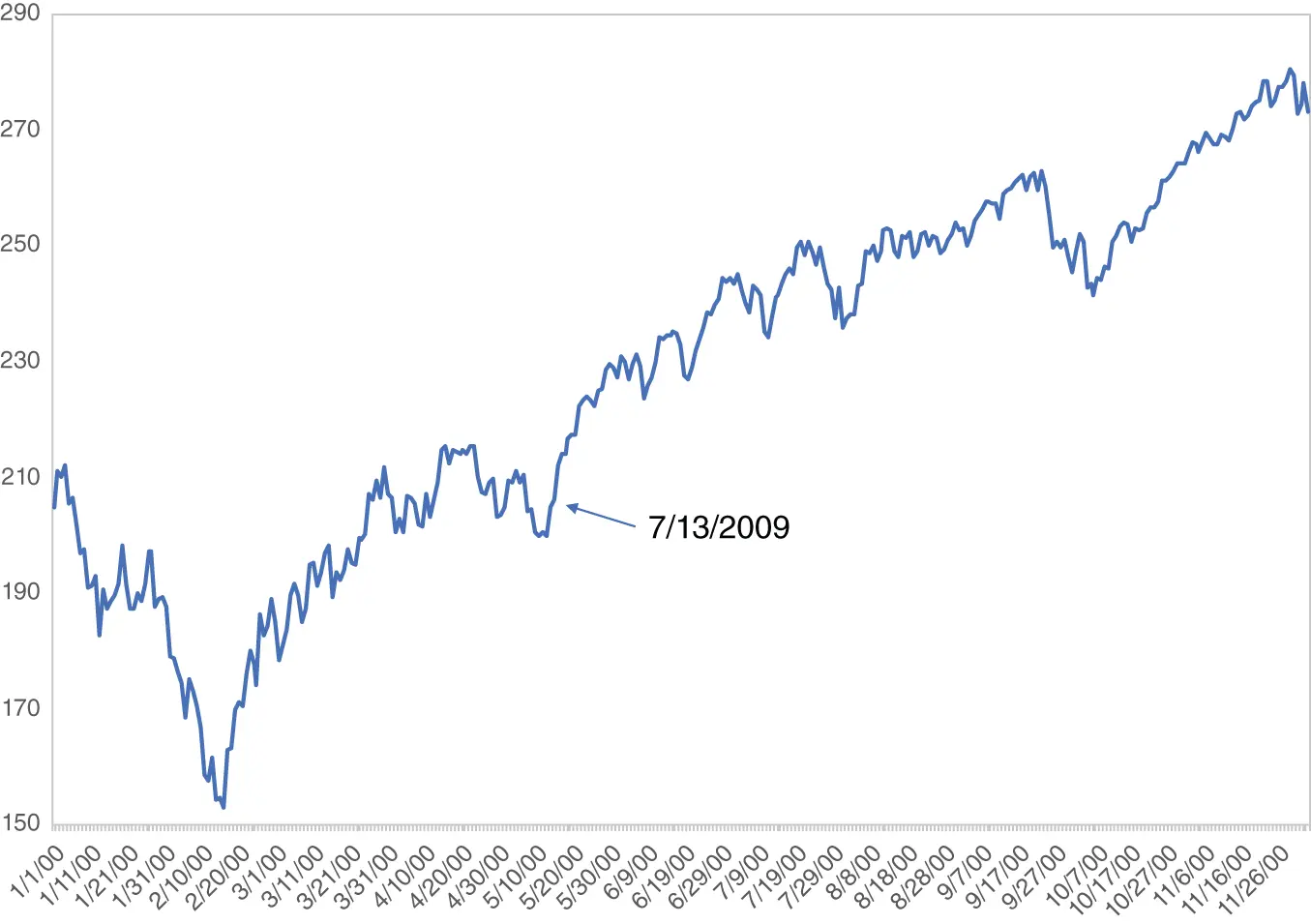

On Monday July 13, 2009, I was on CNBC TV “Squawk on the Street” with Erin Burnett; Matt Nesto, who was substituting for Mark Haines; and another guest, Dan Deighan of Deighan Financial Advisors. Figure Intro.1 shows the S&P 1500 Index from December 31, 2008, through April 30, 2010. The arrow points at July 13, 2009, the day of the interview. Just prior to the interview the rally took a brief pause late June and early July.

| Erin: | How do you position yourself? On the bullish side or the bearish side? Whether you go for a cataclysmic collapse or slow bleed? |

| Matt (after Mr. Deighan gave his bearish outlook): | Let's get Craig in before he blows a gasket. He's a bull! |

| Craig: | Yes, I am. It all starts with value. We measure the market right now to be well over 20% below fair value. The corporate bond rally is the best bond rally I have seen in decades and that is very supportive of higher stock prices. Many times we have seen the bond market just pull stocks along with it and I would expect it this time. So we think this is just a pause to the first leg of recovery and we expect the next leg will start soon. |

| Erin: | And where does that come from? What will be the catalyst for growth? |

| Craig: | We do not need a robust recovery. We just need the world not to be as terrible as was believed a few months ago. The market did overreact. People were talking depression back then. We are obviously not having one of those, so stocks are just trying to get back to fair value from a time period when people thought we were in a horrible [economic] setting. |

| Erin: | So you think stocks can go up without any catalyst from where we are now? |

| Craig (without hesitation): | Yes, we see them going higher. |

| Erin to Mr. Deighan: | And how low do you see them going? You're saying below the March bottom? |

| Mr. Deighan: | I see them going below last fall's low as much as 25% to 50% below that. |

| Erin: | 25% to 50% below? Well, that is a great depression scenario. |

| Mr. Deighan: | That's huge. |

| Erin: | Where do you see unemployment then? |

| Mr. Deighan: | I see unemployment getting to 12% to 13%. |

| Erin: | OK. So, I want a best trade from each of you. Let's start with you Craig. |

| Craig: | Coach … apparel, purses. The third best performing sector this year has been consumer discretionary. That would surprise many people, but this is an economic anticipation recovery rally and the consumer discretionaries are part of that. |

| Erin: | And you, Dan? |

| Dan: | I don't have one. I don't have any buys right now. I think I would sell anything that is based on discretionary spending. |

From July 13, 2009, through April 30, 2010, as seen in Figure Intro.1, the S&P 1500 moved higher gaining 35.32% and consumer discretionary was the best sector, gaining 56.98%. Coach was acquired by Tapestry so we can't find a price for it, but Tapestry gained 76.23% over that period. In Chapter 2, we will see that consumer discretionary was the second best performing sector over the eleven-year bull market.

Figure Intro.1 S&P 1500 Index, 12/31/2008–4/30/2010

That interview simply shows that one analyst was incorrectly bearish, but the first chapter will offer evidence that many investors did not participate in the bull market, as seen by investors redeeming from equity mutual funds rather than adding to positions to profit from the long-term market advance. Also, as evidence this bull market was “unloved,” investor sentiment was much more negative than in the previous two multiyear bull markets.

Those who have missed out try discrediting the bull market stating that it wasn't sensible or was due to gimmicks such as excessively easy monetary policy, bailouts, or corporate buybacks. This book will counter justifications by investors and advisors that this bull market wasn't sensible. The second chapter will show that the long bull market was sensible, had some behaviors and traits similar to previous bull markets, and, therefore, was fairly typical. In the subsequent chapters, the book will examine situations and conditions that bothered investors and could have caused investors to sell or, at least, sit on the sidelines. Looking back, this “wall of worry” was a darn big wall and so was the proportionate climb for stock prices. Let's see if there were lessons to be learned.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Unloved Bull Markets»

Представляем Вашему вниманию похожие книги на «Unloved Bull Markets» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Unloved Bull Markets» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.