It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow. Henry Ford (1957).

We can say that bank management, and the complexities of banking, are different in local and shadow banks. Bank managers must remember that the strategy and operations should be appropriate for their banks. It is good to remember that customers are also different in different bank arenas, i.e., they are interested in different services.

Due to banking secrecy, little can be said publicly concerning the black box of financing decisions and performance of loans. A legal framework prevents bank managers from talking about clients and loan decisions. Consequently, a mystique is created, and an illusion of wise decision-making is born! One can “be made” to see things that are not there, i.e., short-term performance illusions or Halo Effects, which can be exploited!

If you see a bank that is performing well, you might think that it is efficient and professionally managed! In many cases it can be precisely the opposite! Lehman Brothers was considered a respectable and well-managed bank … before it failed! Nokia was for a long time the world market leader (40 percent of global markets in mobile phones 2007) and considered a giant that was very well-managed and innovative! Kjellman, Yang, Wu, and Park (2020) noted that then Nokia missed a turn regarding the future in the mobile phones business and almost failed. In 2015 Nokia and Microsoft had 0 percent of the global mobile and smartphone markets! These are examples of Halo Effects! You see and perceive something – like a great leader – that is not there!

Phil Rosenzweig (2007) is considered to be one of the great thinkers concerning the Halo Effect … and other business delusions that deceive managers! We see something that is “not there”. A good example of this is a great leader, who produces a great result for a short period of time. However, in the long run, such a leader may cause the bank to slide into the history books as another failed enterprise. Such delusions in banking are a great problem!

Traditionally, the cornerstone of the banking business is trust. Typically, banks in earlier times focused on strategies based on asset growth. Measured by the balance sheet, they strove to become ever larger. Big is often perceived as more trustworthy, and a manager of a bigger bank is perceived as being better than a manager of a small bank! In reality, this is often a Halo Effect! This is because small banks are generally safer for depositors than big banks! However, not many depositors look at things that way!

The trust of a bank is measured daily by the solvency and equity in the bank’s balance sheet. The financial highlights in a bank’s balance sheet are funding, lending, net interest income, operating result. Other important highlights in the balance sheet are the structure of the balance sheet, financial solidity, credit losses, bad loans and the number of offices and employees.

To fully understand the banking business and the advantages of the intermediation process, it is necessary to analyse what banks do and how they do it. The main function of banks is to collect funds (deposits) from units in surplus and lend funds (loans) to units in deficit. Deposits typically have the characteristics of being small-size, low-risk and high liquidity. Loans are of large-size, higher-risk and illiquid. Banks bridge the gap between the needs of lenders and borrowers by performing a transformation function which includes:

1 size-transformation,

2 maturity transformation, and

3 risk transformation.

Banks perform this size transformation function to exploit the economies of scale associated with the lending/borrowing function. As a result, they have access to a larger number of depositors than any individual borrower. Banks are said to be ‘borrowing short’ and ‘lending long’, and in this process they are said to ‘mismatch’ their assets and liabilities. This mismatch can create problems in terms of liquidity risk, which is the risk of not having enough liquid funds to meet one’s liabilities (see Casu et al., 2006: 7).

In recent decades, conglomeration has become a major trend in financial markets, emerging as a leading strategy of banks. This process has been driven by technological progress, the international consolidation of markets and the deregulation of geographical or product restrictions (see Casu et al., 2006: 449, 25). We think that in the management of shadow banks the conglomeration strategy is more typical than in the capital-based markets.

About the banking business

The business models of banks have changed after the Post-Crisis Age, in the 2010s. The banking industry has entered a period of slower growth than earlier. New regulation and a supervisory environment have been major driving forces in the future evolution of banks and their business models and strategies. We can see that new regulatory requirements have induced slower growth in banking, higher costs, and more banking fees. Low interest rates, in combination with regulation pressures have impacted differently on different banks, according to their business profiles (see Ayadi, Arbak & DeGroene, 2011).

Financial deregulation essentially consists of removing controls and rules that in the past have protected financial institutions, especially banks. However, in many cases deregulation is initiated less by a desire to benefit consumers than by a need to improve the competitive viability of the financial industry. The barriers between banks and non-bank financial institutions have disappeared, allowing, for example, for the rise of universal banking activity. One consequence of the process of deregulation has been the increased perceived risk within banking business. Banks can minimise the risk of individual loans by diversifying their investments, pooling risks, screening and monitoring borrowers and holding capital and reserves, as a buffer against unexpected losses.

The aim of banks is to cross-sell an array of products and services to meet customer needs and to generate more fee and commission income. People usually say that banking services are complex. After bank deregulations in the 1980s and 1990s, not to mention the clustering and reselling of subprime mortgages in the early twenty-first century, we note also that bank managers have done complex things in banking. In the history of banking, we have seen that many famous bank managers have taken a complex world and simplified it, for example what occurred at Wells Fargo, Handelsbanken and Kvevlax Savings Bank. Collins (2001: 96) argued that simple strategies are the best, even if strategies alone cannot explain success. However, we argue that in banking, bank managers used to make simple bank services too complex and that was a huge mistake! especially when they ran out of trust! New instruments and advanced calculation methods have been used to avoid risk, increased taxes, etc.

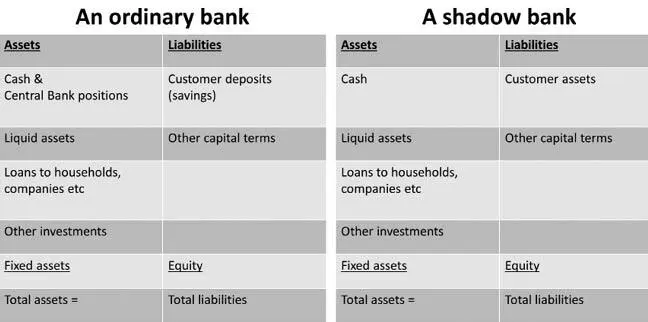

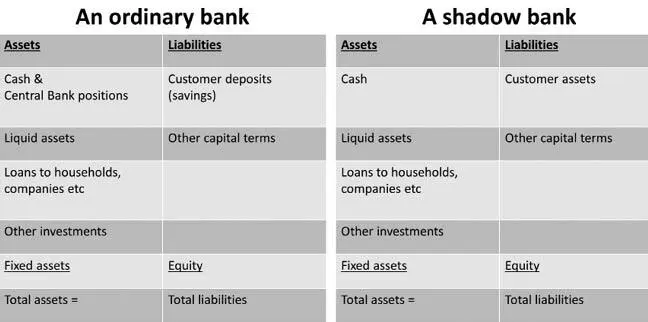

Bank managers conduct banking by using their banks’ balance sheets to try to enhance business in the banking market. The banks also provide asset management, pension savings, clearing services, insurance services and basic legal services. This can be done either by the bank itself or by a business partner. A manager must focus on the elements that drive firm performance, while recognising the fundamental uncertainty at the heart of the business world. The table below presents the central assets and liabilities in the balance sheet of a traditional bank, compared with that of a shadow bank.

Table 2.1. A simplified ordinary bank balance sheet compared with a shadow bank balance sheet

Traditionally, deposit customers have been very important for a bank manager, because deposits as well as lending services are cheap and long-standing for the bank.

Читать дальше