We argue that we can make the market more understandable by dividing the bank market into three types of markets, i.e., the 3Cs – credit, capital, and casino-based banking. A fourth C could be on its way, i.e., Credit-trade-platforms like Alipay, Apple Pay, Google Pay, PayPal, WeChat Pay, etc. We have, however categorised the potential Fourth C under casino-based shadow banking. The over 2,400 cryptocurrencies that can be found today are like houses of cards and cannot be considered as “banking”.

In the first group of banks, i.e., credit-based banks, depositors are the key providers of money. The bank customers deposit “their wages” and other sources of income and the banks lend out the obtained financial resources. There are many different forms of credit-based banks ranging from small savings banks to large multinational commercial banks. The credit-based banks often specialise in a particular area, for example small local deposit banks. However, they can also be found as big and diversified global banks. These credit banks are often called traditional retail or deposit banks.

Also, the instruments of the financial institutions as well as competitive institutions have been evolving. Fast loan and payment providers from non-bank institutions have grown rapidly and transformed the traditional credit-based banks. PayPal, Alibaba, Amazon, Google and others have emerged in the “banking” market. Furthermore, today, few of Generation X, Y and Z (that is people born after the 1960’s) know what prudent banking is in practice, i.e., traditional banking with an honest touch. Another major transition relates to the changing mindset of the post-war generations. Therefore, it is important to consider what bank management really is? We are worried that too few realise that good and bad bank management means different things for different generations, as well as in different fields of banking, for example the objectives of banking are different if you are involved in traditional retail banking or in investment banking.

In the second group of banks, i.e., capital and asset-based banks, the major transition in bank management relates to the rise of capital markets around the world. There has never in our history been so much capital around as now! Bank managers today are selling capital-based products (instead of promoting savings accounts). As such, capital-based products are transforming the banks’ activities. Today it is common that customers save their capital in stock portfolios or funds administered by banks or other financial institutions. They are often technology-driven financial products with a high level of technical security issues. The capital markets, for example stock markets all over the world, have faced a remarkable increase in value over the last decades.

As Whitley (1999) notes, financial systems vary on a number of dimensions, however the critical feature deals with the process by which capital is made available and priced, through competition. However, in the current financial system, we can detect a number of disruptive payment platforms, cryptocurrencies and actors like Alipay, Apple Pay, Facebook Pay, Google Pay, PayPal WeChat Pay etc., that are transforming the traditional bank market.

The third group of banks, i.e., casino or shadow banks, relates to the internationalisation of customers, competitors, technology, financial institutions and central banks. The regulative burden and tax costs can be partly avoided by shadow banking based in tax-havens, or by creation of off-balance sheet entities. The objective of these non-regulated casino banks is often to maximise profit through avoidance of regulations and taxes. These banks are betting with their customers’ and their owners’ money on either value appreciation or depreciation of different financial products. The financial product range is huge and sometimes hard to fully grasp for a banker. Another fact is that the (too) big banks in the 3Cs markets are often too difficult for bankers to manage, because they have neither access to good data nor reliable enough facts! The fall of Lehman Brothers and the following collapse of the so-called shadow banking market in the USA during 2000–2007 is a good example of this third group of banking activity.

The Global Financial Crisis that followed led to the collapse of the financial system in Iceland, Ireland, Greece, etc. as well the collapse of the five largest investment banks in the USA. The problem today relates more to the excessive amount of money floating around in the world. One example of this is that the ECB in November 2019 again started “to print” 20 billion euros of new money per month with a negative interest rate, in addition to the already outstanding stock of QE (Quantitative Easing) money, which was initiated in November 2015 (ECB, 2019). In response to the coronavirus outbreak in early 2020, the ECB launched the pandemic emergency purchase programme (PEPP) of 1,350 billion euros. Similar QE programmes were launched by central banks all over the world. Under the ECB’s PEPP and the corporate sector purchase programme (CSPP), the maturity was raised up to thirty years and three hundred and sixty-four days (ECB, 2020).

Today, one can see that many banks are involved in all of the 3C banking groups, which makes the situation even more blurred and dangerous. Not only for the banks but also for the stability of the financial system.

Furthermore, national banking is facing a global digitalization dimension, where business and politics are mixing together to form a nuclear financial cocktail. The central banks in the EU and USA are greatly influencing the level of the short-term money markets rates of the world. One good example is found in the European Central Bank’s (ECB) decision to push the Euro Area interest rates into negative numbers, which cannot be seen as a normal situation. Negative market interest rates are not normal, they are anomalies that may be highly dangerous.

The most widely used market interest rate in the EU, i.e., the Euribor rate, has been negative since late 2014; in 2020 the ECB was signalling that it would continue to keep the steering rates negative. This means, in theory, that you as a customer have to pay for depositing euros into a bank. Negative market interest rates are a new phenomenon that bank managers have faced, in combination with a highly expansive monetary strategy from the ECB, the Fed and other central banks. During the last few years, payment platforms and different forms of blockchain technology have also enabled the creation of new currencies, such as cryptocurrencies. We argue that blockchain currencies, in combination with payment platforms, also create a serious threat to the banking system in the current global financial architecture.

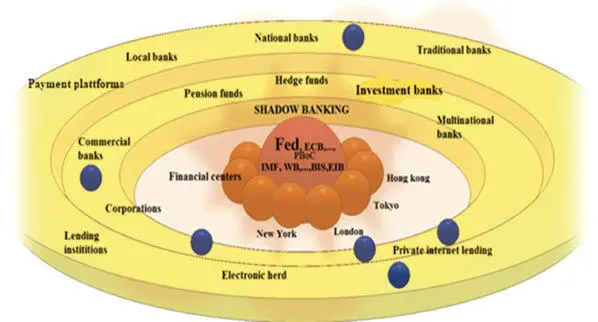

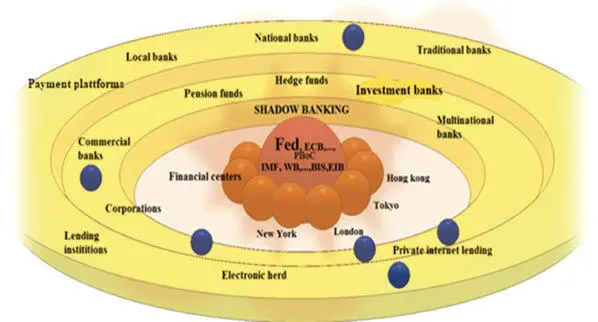

Metaphorically we describe the current global financial architecture as a nuclear core, with the Fed, the ECB and the other central banks in the nuclear centres, together with the Bretton Woods institutions. The nuclear core is surrounded by the major financial centres (Wall Street, London, Frankfurt, Tokyo, Shanghai, Hongkong, Paris, Stockholm, etc.), the electronic herd (hedge funds, investment banks, shadow ‘casino’ banks, blockchain currencies, etc.) The present global financial architecture is shown in Figure 1.

Figure 1. Nuclear Finance – The present global financial architecture

The figure above is inspired by Friedman (1999) and Tainio, Huolman and Pulkkinen (2001), who have also described the present global financial architecture as a nuclear core. The figure presents a financial world with the central banks as neutrons, spearheaded by the multinational banks and financial centres such as Wall street, London, Hong Kong, Shanghai, Tokyo, Frankfurt also in the core, surrounded by an electronic herd of ordinary banks, hedge funds, pension funds, investment banks, shadow banking etc. All of these financial institutions are connected by one of the most powerful as well as disruptive innovations of our times, the internet.

Читать дальше